Oil is headed for its biggest weekly gains since the middle of January as supply disruptions and rising demand supported sentiments.

A weaker US dollar also boosted demand for the commodity.

A weaker dollar makes commodities priced in the greenback cheaper for overseas buyers.

Oil’s gains this week come despite losses on Friday.

Benchmark contracts fell on Friday on uncertainty over trade flows and US tariffs.

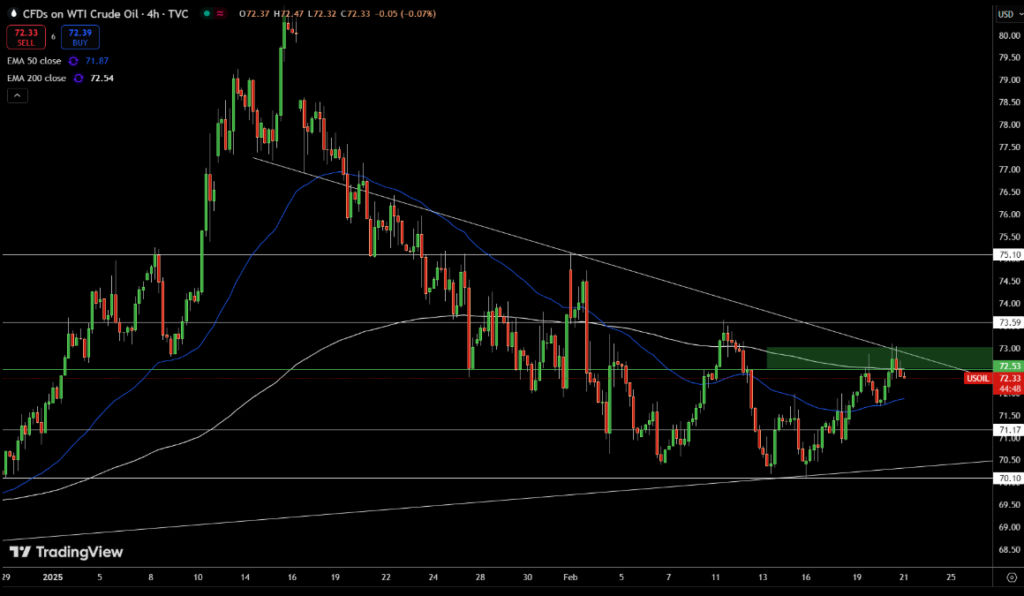

At the time of writing, the price of West Texas Intermediate crude oil was at $71.86 per barrel, down 0.8%.

Brent crude oil on the Intercontinental Exchange was 0.8% lower at $75.87 a barrel.

Sharp gains this week

Both Brent and WTI crude oil prices have experienced a significant upswing this week, with each gaining approximately 2%.

This marks the most substantial weekly increase for both benchmarks since the beginning of January.

For Brent crude, this positive movement signifies a second consecutive week of gains, following a period of three weeks of decline.

Conversely, WTI crude is poised to achieve its first week of gains after enduring four consecutive weeks of losses.

This recent price surge suggests a potential shift in market sentiment and could indicate a possible recovery in the oil market.

However, it remains to be seen whether this upward trend will continue in the coming weeks, as various factors, including geopolitical developments, global economic conditions, and supply-demand dynamics, continue to influence oil prices.

David Morrison, senior market analyst at Trade Nation said:

The overall picture looks more positive than it has done for a month or so. It’s possible that oil may have found an intermediate bottom, having dropped 12% from its recent high in mid-January.

Supply disruptions

A Ukrainian drone attack on a pumping station caused a 30-40% reduction in oil flows through the Caspian Pipeline Consortium (CPC) on Tuesday, according to Russia.

The CPC is a major export route for crude oil from Kazakhstan.

Despite the damage to this key export route, industry sources revealed to Reuters on Thursday that Kazakhstan has been pumping record-high oil volumes.

The exact mechanism by which Kazakhstan achieved this feat remains unclear.

Meanwhile, gasoline and distillate inventories in the US fell last week, according to the Energy Information Administration.

“The market responded to declining stockpiles as refinery maintenance limited processing capacity, supporting expectations of robust demand,” Arslan Ali, analyst at FXempire, said in a report.

Possible resumption of Iraq’s exports

However, the Iraqi oil minister announced on Monday that oil exports will soon resume from the semi-autonomous Kurdish province in Northern Iraq, which could mean additional oil will be entering the market shortly.

At the Munich Security Conference at the weekend, the Prime Minister of the Kurdish Provincial Government spoke of the resumption of exports by the end of March, according to a Commerzbank AG report.

Oil supplies via a pipeline to the Turkish Mediterranean port of Ceyhan have been interrupted for almost two years due to a dispute over marketing rights and the ruling of an arbitration court in this matter.

“The resumption of oil shipments would increase Iraq’s oil supply by around 300 thousand barrels per day ceteris paribus and lead to another problem,” Carsten Fritsch, commodity analyst at Commerzbank, said.

Iraq’s commitment to the OPEC+ agreement, which limits its oil production to 4 million barrels per day, is the reason for this.

Fritsch said:

Hence, Iraq has no leeway to increase oil production if it does not want to violate its production ceiling.

Moreover, some market chatter pointed to the Organization of the Petroleum Exporting Countries and allies extending their production cuts of oil beyond March at its upcoming meeting.

This would be bullish to oil prices if the cartel postpones its plan to gradually unwind the 2.2 million barrels per day of voluntary output cuts.

The group had already extended these cuts multiple times last year.

The post Oil prices set for biggest weekly gain since January: what’s driving the rally? appeared first on Invezz