Energy stocks have done well this week as the rising geopolitical risks in the Middle East pushed crude oil prices to their highest point in weeks. Brent, the international benchmark, rose for six consecutive days, reaching a high of $78.12, its highest point since August 30th.

The West Texas Intermediate (WTI) also bounced back to $74.21, up by over over 13% from its lowest level in September. Most oil and gas companies have soared, with the Vanguard Energy ETF (VDE) rising to $128, its highest level since August.

Exxon, the biggest energy company in the US, rose to a record high of $123.18 this week, rising by over 400% from its lowest point in 2020. Similarly, Chevron shares jumped to $150, rising by more than 260% from its 2020 high.

These companies have done well because higher prices mean more profits in the coming months.

However, there is still a risk that the ongoing oil price increase will be brief since Saudi Arabia has hinted that it will start focusing on market share gains. If this happens, oil could resume the downward trend.

Therefore, master limited partnerships might offer the best risk-reward in the coming months. For example, The Williams Companies (WMB) has soared by more than 43% while ONEOK (OKE) has surged by 40% in the same period. The two have soared by 176% and 87% in the last five years.

Read more: RTX stock price is firing on all cylinders: is it a good buy?

The Williams Companies | WMB

The Williams Companies is one of the biggest MLP companies in the industry with over $9 billion in annual revenue and a valuation of over $58 billion.

It is a company that runs some of the biggest oil and natural gas assets in the US, with over 33,000 miles of pipelines and 35 natural gas processing facilities. It serves over 700 clients.

Williams has done well even as the price of natural gas has dropped sharply in the past few years. Data by TradingView shows that it has fallen by 70% from its highest level in 2022. And as we wrote last week, natural gas has formed an inverse head and shoulders pattern, pointing to more upside in the near term.

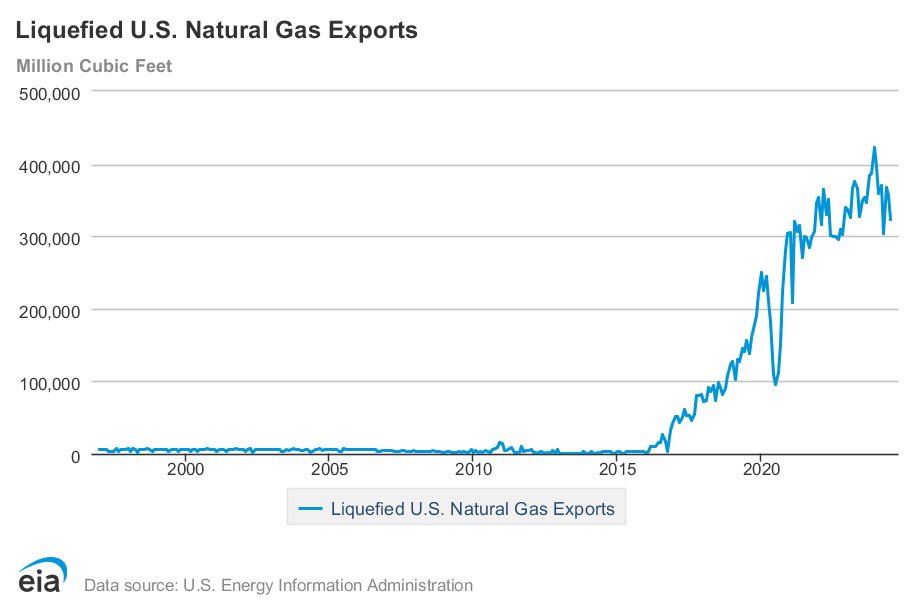

It has benefited from the rising US natural gas exports now thar Russia has slowed its deliveries to Europe. For example, the US LNG exports have soared by over 50% in the past few years, as shown below.

The Williams Companies has also become a highly profitable company in the industry, with its net income jumping from $850 million in 2019 to over $3.1 billion last year.

Its recent financial results showed that its net income was $401 million while its adjusted EBITDA was over $1.6 billion.

Analysts are optimistic that the Williams Companies has more upside to go, with those at Citigroup, Barclays, UBS, and Scotiabank having a bullish rating.

Technically, the stock has remained in a bullish trend after bottoming at $6.51 in 2020. It has remained above the 50-week and 100-week moving averages while the MACD and the Money Flow Index (MFI) has continued rising.

Therefore, the path of the least resistance for the stock is bullish, with the next point to watch being at $60.

ONEOK | OKE

ONEOK is another top energy stock that has done better than most mainstream names. It has risen by over 40% this year, continuing the gains that started in 2020 when the stock bottomed at $8.98, and reached $94 today.

ONEOK is an MLP company that operates 50,000 miles of pipeline that transports crude oil, natural gas, natural gas liquids, and refined products. It has a presence in key areas like gathering, processing, storage, and transporting.

ONEOK’s growth has happened both organically and through acqusitions. For example, it acquired Magellan, another MLP for $14.1 billion in 2023. This buyout brought in thousands of pipelines and terminals.

The most recent ONEOK news was that it was raising $7 billion in senior notes. $1.5 billion of these notes will be 3-years with a coupon rate of 4.25% while the longest duration ones will be $800 million senior notes yielding 5.85%.

The company will use these funds to acquire EnLink Midstream from Global Infrastructure Partners. It will also use the cash to buy Medallion Midstream.

The most recent financial results showed that ONEOK’s net income was $780 million, a big incraese from the $468 million it made last year. Its operating income rose from $737 million to $1.22 billion.

The ONEOK stock has remained above the 50-week and 100-week moving averages, meaning that bulls are in control. Similarly, the Relative Strength Index (RSI) and other oscillators have all pointing upwards.

Therefore, the stock will likely continue rising as bulls target the next key resistance point at $100.

OKE chart by TradingView

The post I’d avoid Exxon, Chevron stocks and buy OKE and WMB instead appeared first on Invezz