Highlights:

- Silicon Lab earned a revenue of US$233.8 million in the first quarter of 2022.

- Avis Budget Group, Inc. (NASDAQ:CAR) posted a net income of US$527 million in Q1, 2022.

- CAR stock has plummeted by over nine per cent since the last month.

The US stock market is said to have concluded its worst first half-year in 2022 since 1970, having fallen over 20 per cent. In the wake of this decline, which was significantly contributed to by large tech and retail stocks, some investors can be jittery about mega-cap companies.

Such US investors can explore midcap stocks like Silicon Laboratories, Inc. (NASDAQ:SLAB) and Avis Budget Group Inc. (NASDAQ:CAR).

Let's explore the two NASDAQ-listed midcap stocks, SLAB and CAR, that can provide some growth in the long run.

Silicon Laboratories, Inc. (NASDAQ:SLAB)

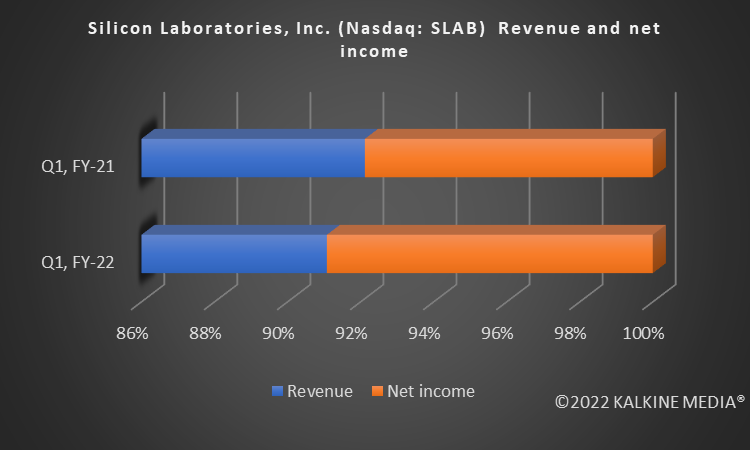

A global technology company that manufactures and designs semiconductors, software and other silicon devices, Silicon Laboratories earned a revenue of US$233.8 million in the first quarter of 2022 compared to US$157.8 million in Q1 2021.

Silicon Lab's net income for Q1 2022 was US$22.9 million, whereas it was US$13.5 million in the first quarter of the previous year.

Silicon Laboratories has a market cap of US$5.06 billion as a midcap stock and its earnings per share (EPS) stands at US$47.7.

SLAB stock has maintained a steady price over the last year with a 0.36 per cent rise to US$138.54 as of July 26, 2022. However, it has plunged over 32 per cent this year.

Avis Budget Group Inc. (NASDAQ: CAR)

The vehicle rental company, which is the US parent company of Avis Car Rental, Zipcar, Budget Car Rental, and Budget Truck Rental, noted a revenue growth of over 77 per cent year-over-year (YoY) to US$2.4 billion in Q1 2022.

Avis Budget Group earned a net income of US$527 million in the first quarter of 2022 and an adjusted EBITDA of US$810 million in the latest quarter.

The Parsippany-Troy Hills, New Jersey-headquartered company's stock has plunged over 26 per cent this year, and fallen over nine per cent over the last month.

Bottom line

Mid-cap stocks can provide some relief to investors looking for discounted options that are not likely to be as risky as smallcap or penny stocks.

Midcap players, which are known to belong to companies that have a market cap between US$2 billion and US$10 billion, generally have a greater growth possibility than large-cap giants. However, they can also be a riskier option in comparison.

_07_27_2022_11_36_23_126183.jpg)