Highlights

- Lithium Americas has faced significant stock declines due to a discounted public offering and weak lithium market conditions.

- The long-term demand for lithium remains strong, driven by the global shift toward clean energy and EV production, positioning the company for future growth.

- Backed by major financial support from the U.S. government and General Motors, Lithium Americas is advancing its Thacker Pass project, a key asset for domestic lithium supply.

Lithium Americas Corp., a company in the mining sector specializing in lithium exploration and development, has experienced significant pressure in the past six months, with its shares dropping by 62.8%. This substantial decline far exceeds the broader mining industry’s performance, which only fell by 2.9% over the same period. The sharp drop in LAC's share price follows its public offering of 55 million shares at a steep discount, combined with a soft lithium market characterized by declining prices and weaker demand.

Lithium Americas Corp. (NYSE: LAC) 's current trading price represents a substantial discount compared to its 52-week high, reflecting the overall challenges in the lithium sector. Technical indicators show that LAC has been consistently trading below its 50-day simple moving average since late August 2024, signaling a sustained bearish trend.

Long-Term Prospects Despite Near-Term Challenges

While current market conditions present difficulties for LAC, the long-term outlook for lithium remains robust. Lithium is a crucial mineral in the global shift toward clean energy, particularly in the production of electric vehicles (EVs) and energy storage systems. Demand for lithium is projected to rise over the coming years as governments and industries across the globe push for greener alternatives to fossil fuels. As the adoption of EVs and renewable energy storage solutions accelerates, lithium is expected to play a vital role in these growing sectors.

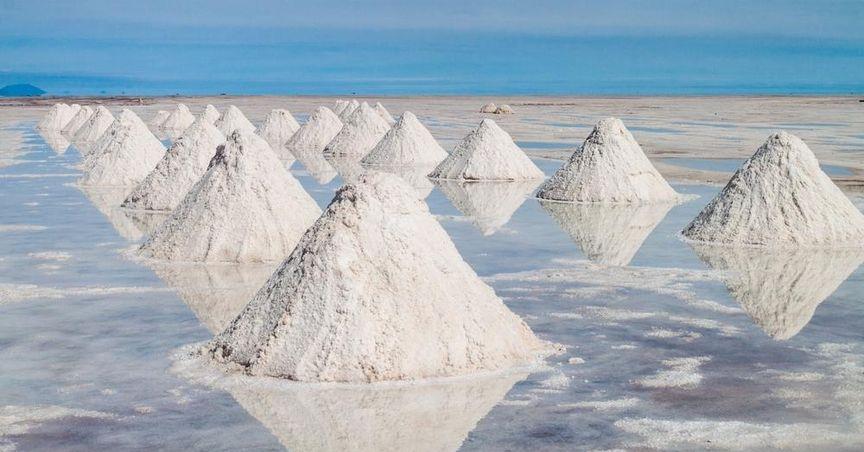

Lithium Americas is strategically positioned to benefit from this long-term demand through its key asset, the Thacker Pass project in Nevada. Thacker Pass holds the largest known measured and indicated lithium resource in North America, and the company is focused on advancing the project toward production. Phase 1 of Thacker Pass is expected to produce 40,000 tons of battery-grade lithium carbonate annually, with plans for a second phase that would double that capacity.

This project is critical for the U.S. push to establish a domestic lithium supply chain, reducing reliance on foreign sources. The U.S. government’s emphasis on national security and the development of EV infrastructure has led to strong support for projects like Thacker Pass. Once operational, Thacker Pass could supply lithium for approximately 800,000 EVs per year.

Strong Financial Backing for Thacker Pass Development

Lithium Americas has secured significant financial backing to advance Thacker Pass. The company received a conditional commitment for a $2.26 billion loan from the U.S. Department of Energy (DOE) under the Advanced Technology Vehicles Manufacturing Loan Program. This loan will finance the construction of the processing facilities at Thacker Pass, with closing expected in the second half of 2024. Additionally, General Motors (NYSE: GM) has committed to a $650 million equity investment in Lithium Americas to support the development of the project.

These financial commitments are expected to cover a substantial portion of the costs for Phase 1 construction. Major construction is anticipated to begin in late 2024, with mechanical completion targeted for 2027 and full production capacity projected by 2028.