Highlights

- Rhumbline Advisers expanded its position in WESCO International, increasing its stake in the company.

- Institutional investors collectively hold over 93% of WESCO International’s stock, reflecting strong engagement.

- The company maintains steady financial metrics, with a dividend policy supporting shareholder returns.

WESCO International continues to attract institutional activity, with financial firms adjusting their holdings in the company. Recent disclosures highlight shifts in ownership, reflecting ongoing market engagement. With a presence in distribution, logistics, and supply chain solutions, WESCO International maintains steady financial performance, while its dividend policy and operational strategies reinforce its role in the industry.

Institutional Investment Activity

WESCO International (NYSE:WCC) has experienced active participation from financial institutions, with recent disclosures highlighting changes in ownership. Rhumbline Advisers increased its stake, bringing its total holdings to over 120,000 shares. Other financial entities have also adjusted their positions, with the New York State Teachers Retirement System expanding its stake, adding to its existing shares.

Additional activity was recorded from V Square Quantitative Management LLC, which significantly adjusted its holdings, reflecting broader market engagement. Van ECK Associates Corp also expanded its position, increasing the number of shares in its portfolio. The overall institutional ownership in WESCO International remains high, with more than 93% of shares held by financial entities.

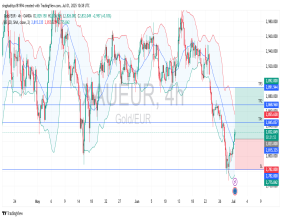

Stock Performance and Financial Position

WESCO International opened trading above $190 in a recent session, maintaining a market capitalization exceeding $9 billion. The company's price-to-earnings ratio is positioned within a competitive range, while its beta reflects market volatility.

Key financial indicators, including the debt-to-equity ratio and liquidity metrics, suggest a structured financial foundation. The company’s stock has fluctuated over the past year within a defined range, aligning with broader market conditions and industry trends.

Dividend Strategy and Market Engagement

WESCO International continues its dividend distribution, with a scheduled payout exceeding $0.40 per share. The annualized yield remains under 1%, reinforcing the company’s commitment to shareholder value.

Financial institutions have provided assessments on WESCO International’s market standing, with some adjusting their projections. Certain entities revised their evaluations upward, while others reassessed their positions. This variation reflects a range of perspectives on the company's financial trajectory.

Business Operations and Industry Role

WESCO International operates across multiple segments, providing electrical, communication, and broadband solutions. The company’s role in distribution and logistics spans regions, supporting business-to-business supply chain operations.

With an established presence in the market and consistent institutional participation, WESCO International remains engaged in its sector, balancing financial stability with operational expansion.