Highlights:

- Cogent Biosciences, Inc. (NASDAQ:COGT) develops therapies for genetic diseases.

- The company went public on March 26, 2018.

- On Friday, it reported positive Phase 2 clinical trial data for ‘Bezuclastinib’.

Shares of Cogent Biosciences, Inc. (NASDAQ: COGT) jumped 101.81% to US$10.01 at 11:42 am ET on Friday after announcing positive Phase 2 APEX clinical trial data for ‘Bezuclastinib’.

The Cambridge, Massachusetts-based company is evaluating selective KIT D816V inhibitor ‘Bezuclastinib’ in advanced systemic mastocytosis (AdvSM) patients.

Also Read: CELU to CMPI: Explore top 5 biotech stocks with over 100% YTD return

The company presented the data on Friday at the European Hematology Association (EHA) Congress in Vienna, Austria.

Cogent develops precision therapies for genetically defined diseases. Its most advanced clinical program, Bezuclastinib (CGT9486), aims to prevent KIT D816V mutation in KIT exon 17.

Advanced systemic mastocytosis is a severe, debilitating hematologic disorder. The search for better treatment is continuing.

Also Read: MUSA to TH: Five consumer discretionary stocks to explore in June

Also Read: CTVA to CC: 5 chemicals stocks that returned over 20% gains in a year

Expected clinical updates

Andrew Robbins, Chief Executive Officer at Cogent, said, “Based on these results, we expect to accelerate our timelines and investment and look forward to providing another APEX clinical update by the end of 2022, and to presenting Summit clinical data in non-advanced systemic mastocytosis (NonAdvSM) patients in the first half of 2023.”

Daniel DeAngelo, Chief of the Leukemia Division at the Dana-Farber Cancer Institute and APEX clinical trial investigator, said in a press release, “If results like these can be shown in a larger set of patients with AdvSM, I believe bezuclastinib has the potential to help us take a big step forward in treating systemic mastocytosis patients.”

Also Read: Top healthcare stocks to explore in June: JNJ, LLY, ABBV, MRK & BMY

Cogent was founded in 2014. It currently employs around 70 individuals. It went public on March 26, 2018. Its current market capitalization is US$425.67 million. The stock traded in the range of US$11.06 to US$3.79.

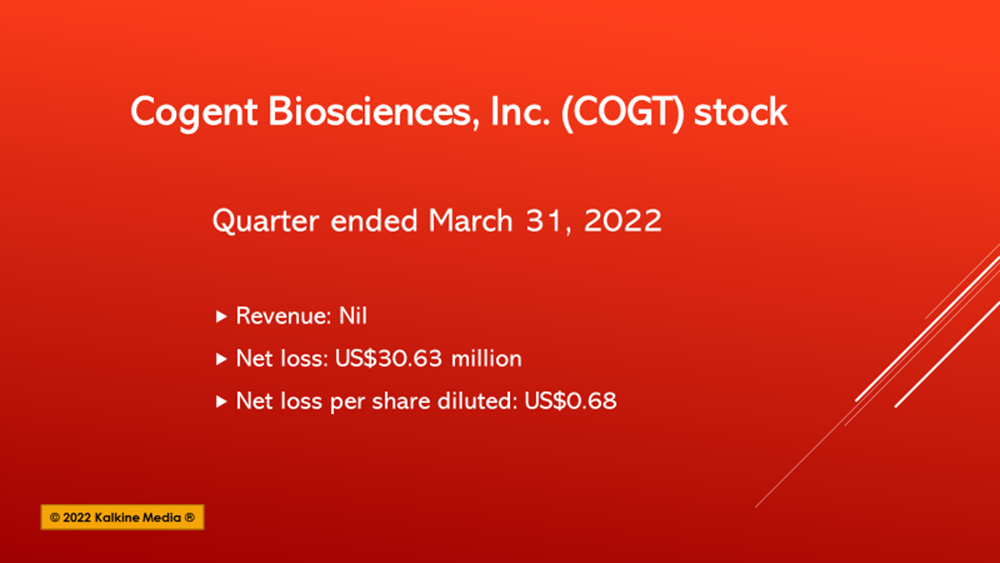

Financials:

The booked a net loss of US$30.63 million or US$0.68 per diluted share for the quarter ended March 31, 2022. It earned no revenue in the March quarter of 2022. The net loss in the same quarter in 2021 was US$11.73 million or US$0.34 per diluted share.

Also Read: Top 5 paper stocks to watch in Q2: ITP, MERC, PKG, GPK & WRK

Bottom line:

The COGT stock rose 14.55% to US$4.96 in the last five days to the closing on June 9 but was still trading 42.99% lower YTD.