Highlights:

- Sunrun posted a Q3 2022 net earning assets of US$ 5.1 billion.

- Bloom Energy posted a record revenue of US$ 292.3 million in Q3 2022.

- Canadian Solar Inc has a market cap of US$ 2.35 billion.

The US is keen on ending its dependence on other nations for green energy, even as President Biden is working on leveraging the Defense Production Act (DPA). A few days back, the Biden administration announced its efforts to augment domestic electric heat pump manufacturing to achieve its goals of saving energy and enhancing energy security.

Efforts are on to maximize the DPA investment of US$250 million in heat pumps, funded through the President’s Inflation Reduction Act. It will reduce the country’s reliance on foreign nations for fossil fuels while bolstering national defense and energy security. It also aims to lower consumer energy costs, mitigate the climate crisis, and improve home efficiency.

The US energy ecosystem is dependent on fossil fuels, vulnerable to market upheavals. The onset of the pandemic, the Russian invasion of Ukraine, and supply chain woes have made it imperative for the federal administration to look for greener options. The primary objective is to help American families and businesses to benefit from US-made clean energy technologies.

Amid all these discussions, Kalkine Media explores four green energy stocks and analyzes their recent performances:

Sunrun Inc. (NASDAQ:RUN)

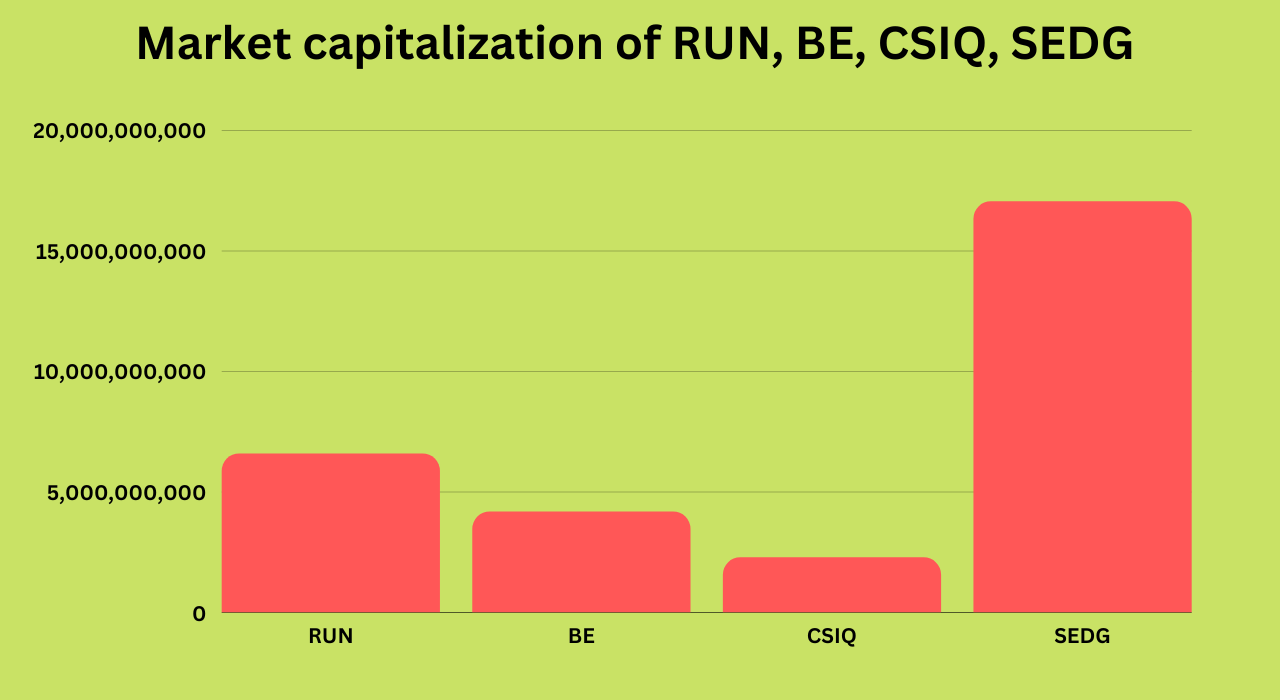

Sunrun develops, installs, and sells residential solar energy systems in the US. The solar systems are manufactured either directly by Sunrun or by its partners. The US$ 6.49 billion market cap company has earnings per share (EPS) of 0.29, while its price-to-earnings ratio (PE) stood at 104.80.

The net earning assets of Sunrun in Q3 2022 grew by US$ 465 million compared to the preceding quarter. It is currently US$ 5.1 billion, which includes US$ 956 million in total cash.

The company said its net subscriber value swelled significantly to US$ 13,259, beating guidance during the third quarter of 2022.

Sunrun added 35,760 customers in Q3 2022, sending its total customer base to 759,937, representing a 21 per cent year-over-year (YoY) growth.

The RUN stock plummeted over 46.7 per cent YoY, but also gained over 30 per cent in the last six months.

Bloom Energy Corporation (NYSE:BE)

Bloom Energy helps in on-site power generation with its manufactured energy servers (solid-oxide fuel cell systems). Its energy servers are fuel-flexible and can use natural gas, biogas, and hydrogen to help create round-the-clock electricity.

The US$ 4.06 billion market cap company Bloom Energy reported a record Q3 2022 revenue of US$ 292.3 million, a growth of 41.1 per cent versus US$ 207.2 million in the third quarter of the previous year.

The company registered a gross margin of 17.4 per cent in the third quarter of fiscal 2022, compared to a gross margin of 17.8 per cent in Q3 2021. Bloom Energy raised US$ 388.7 million in Q3 2022, offering its new class A common stock.

The stock of the energy company fell by over five per cent year-to-date. However, it climbed over 25 per cent over the past month.

Canadian Solar Inc. (NASDAQ:CSIQ)

Canadian Solar Inc is a Canada-based solar power company that provides solar power products, services, and system solutions. The company develops, designs, and manufactures solar ingots, cells, wafers, modules, and other solar products.

The US$ 2.35 billion market valuation company has a P/E ratio of 17.10, and its EPS was 2.12. The company reported its third quarter 2022 financial results on Tuesday, November 22, posting a 57 per cent growth in its revenue. The Q3 2022 revenue stood at US$ 1.93 billion, compared to US$ 1.23 billion in the year-ago quarter.

The company said that the 18.8 per cent gross margin supersedes the guidance range of 15 per cent to 16.5 per cent in the reported quarter.

There was a 62 per cent growth in solar module shipments to 6 GW in Q3 2022, compared to 3.7 GW in the same comparable period.

The CSIQ stock has surged over 17.4 per cent so far this year.

Kalkine Media® / Source: ©Kalkine Media®; © Canva via Canva.com

Kalkine Media® / Source: ©Kalkine Media®; © Canva via Canva.com

SolarEdge Technologies Inc. (NASDAQ:SEDG)

SolarEdge Technologies sells DC-optimized inverter systems used in solar photovoltaic installations. The company also designs and develops its inverter systems.

The US$ 16.9 billion company posted record revenues of US$ 836.7 million in the third quarter of 2022. It reported unprecedented revenue growth in its solar segment of US$ 788.6 million in Q3 2022. The GAAP net income of SolarEdge in the reported quarter was US$ 24.7 million.

Its GAAP operating income surged 134 per cent in Q3 2022 to US$ 84.4 million, compared to US$ 36 million in the previous quarter.

For the three months ended September 30, 2022, the company’s cash, cash equivalents, and other assets totaled US$ 937.6 million. The company’s cash flow from operating activities stood at US$ 5.6 million, down by US$ 77.4 million from the previous year’s quarter.

The SEDG stock surged over 6.71 per cent YTD.

Bottom line:

The US equity market has been through many upheavals since the beginning of this year. It was the worst first half of a year since the early seventies. As the world was limping back to normalcy from the pandemic, the Russian invasion of Ukraine pulled the plugs on all recovery. All these macroeconomic factors adversely impacted the US stock market, and Wall Street kept reeling under pressure throughout the year. Decade-high inflation and the Federal Reserve’s strict monetary policies have weighed heavy on investors’ sentiments.

In such a scenario, investing has become an uphill task. However, investors should think of long-term investments to wade through market volatility and bearish trends. Diversifying your portfolio can also help in protecting your investment. All you need as an investor is thorough market research and picking your stocks accordingly. The financials and the company’s performance should offer a cue to take any decision.