Highlights

- Investment bank Cowen Inc. gave an "outperform" rating to Airbnb, Inc. (NASDAQ:ABNB).

- Wynn Resorts, Limited (NASDAQ:WYNN) bags best employer recognition from Las Vegas Review-Journal and Business Press.

- ABNB stock rose 3.96% in one month, while WYNN declined 14% in the last 30 days.

Airbnb, Inc. (NASDAQ:ABNB) stock was up 4%, and Wynn Resorts Limited (NASDAQ:WYNN) rose by more than 2% on Tuesday morning after positive news from the companies.

The ABNB stock traded at US$173.80, up 4.28%, while WYNN stock traded at US$90.95, up 2.21% at around 10:30 am ET from their previous closing price.

Let's explore some of the recent developments of these companies.

Also Read: As Halloween shopping gets underway, here’re five stocks to consider

Airbnb, Inc. (NASDAQ:ABNB)

Airbnb is a vacation rental company based in San Francisco, California. It operates an online marketplace for lodging services, mainly homestays for tourists.

The stock rallied after analysts at investment bank Cowen Inc. upgraded its rating to "outperform" from "market perform" while suggesting that Wall Street might be undervaluing its bookings growth in 2022.

Also Read: MARA & RIOT: Two crypto mining stocks catching attention

Airbnb has a market cap of US$103.64 billion and a forward P/E one year of -617.30. Its stock value increased by 3.96% in one month.

The highest and lowest prices of the stocks for the last 52 weeks were US$219.94 and US$121.50, respectively. Its trading volume was 2,046,310 on October 11.

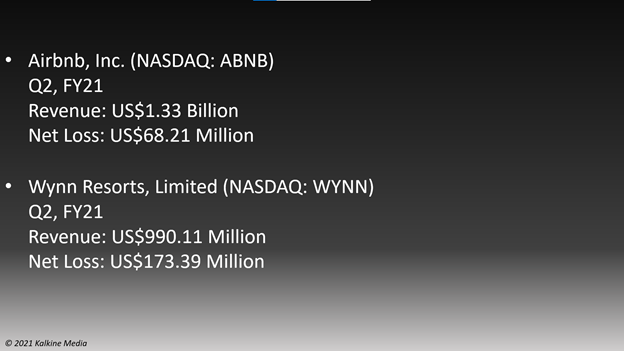

The company's revenue was US$1.33 billion in Q2, FY21, compared to US$334.77 million in the prior year's second quarter. It reported a net loss of US$68.21 million against a loss of US$575.58 million in Q2, FY20.

Also Read: US economists Card, Angrist and Imbens awarded 2021 Nobel Prize

Also Read: CLOV, ADMS stocks up on rating upgrade, purchase deal

Wynn Resorts, Limited (NASDAQ:WYNN)

Wynn Resorts owns and manages destination resorts, casinos, and other travel-related properties for tourist and leisure activities. It is based in Las Vegas, Nevada.

The Las Vegas Review-Journal and Business Press have named the firm one of Nevada's best employers on their list of Top Workplaces Nevada 2021. In addition, it has been recognized as the best resort on the Las Vegas Strip.

Also Read: IPOs to watch in October as race for stock listings continues

Wynn market cap is US$10.56 billion, and the forward P/E one year is -15.08. Its EPS is US$-13.31. The WYNN stock declined 14.01% in the last 30 days.

The 52-week highest and lowest stock prices were US$143.88 and US$67.70, respectively. Its share volume on October 11 was 8,301,548.

The total operating revenue of the company was US$990.11 million in Q2, FY21, compared to US$85.69 million in the year-ago quarter. It reported a net loss of US$173.39 million, compared to a loss of US$734.86 million in Q2, FY20.

Also Read: Top stocks, quarterly earnings to watch this week

Bottomline

The hotel-and-resorts industry was the worst hit during the pandemic. However, the sector is rapidly bouncing back to its pre-pandemic levels as the threat of Covid-19 declines due to increased vaccinations. In addition, the lifting of lockdown restrictions helped the sector in its recovery. The S&P Hotels, Resorts, and Cruise Lines index jumped 20.99% YTD while increasing 3.40% QTD, suggesting its steady growth this year.