Headlines

- Group 1 Automotive crosses key technical level

- Analyst activity and ratings reflect investor interest

- Recent performance highlights positive momentum

Group 1 Automotive Continues Positive Trend

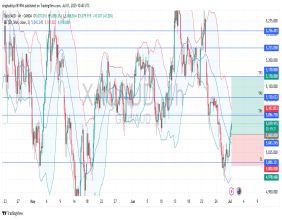

Shares of Group 1 Automotive, Inc. (NYSE:GPI) recently surpassed their 200-day moving average, signaling strong technical performance. This key indicator is often watched by traders to gauge long-term trends, and the stock's upward movement indicates investor confidence. Group 1 Automotive's latest trading price represents a notable rise, reinforcing the positive momentum the company is experiencing. The stock’s price action, coupled with a significant volume of shares traded, suggests that it has garnered attention from market participants.

Research Firms Show Increased Interest in Group 1 Automotive

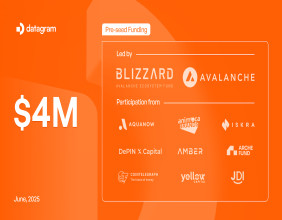

Several leading research firms have closely followed Group 1 Automotive's performance. Stephens initiated coverage on the company, assigning an equal weight rating and setting a price objective based on their evaluation.Jefferies Financial Group also initiated coverage, setting an optimistic outlook with a price target indicating potential for future growth. Meanwhile, JPMorgan Chase & Co. slightly increased their price target, reflecting their continued positive view of the company. Guggenheim also revised their price target upwards, signaling increasing confidence in Group 1 Automotive's prospects.

Strong Analyst Sentiment Supports Group 1 Automotive’s Outlook

The consensus view from analysts suggests a favorable outlook for Group 1 Automotive. While some analysts have issued hold ratings, others have expressed a more bullish sentiment, providing higher price targets for the company’s shares. The overall sentiment indicates that Group 1 Automotive remains a strong player in its industry, supported by both technical performance and positive evaluations from analysts. As a result, the stock continues to attract attention as it moves upward, drawing interest from investors who are focused on the company's potential.