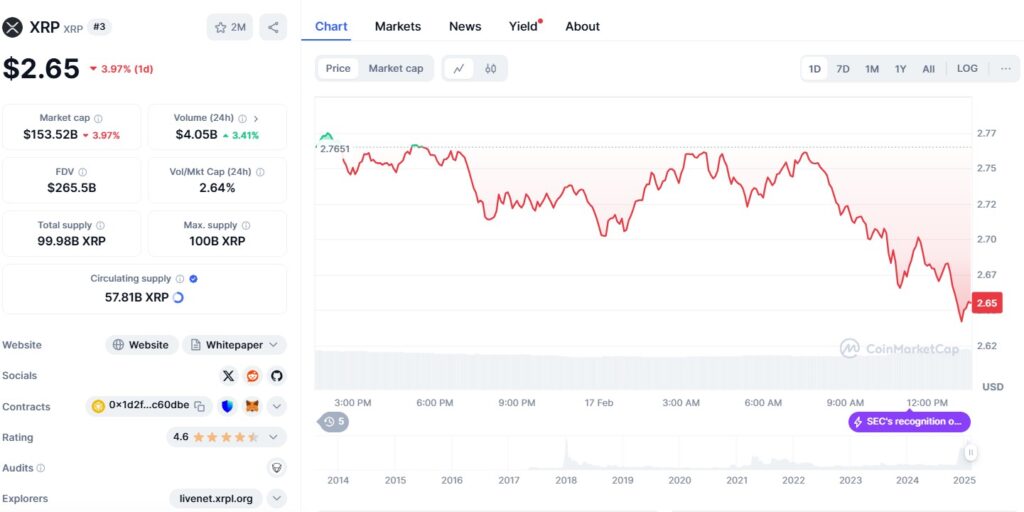

XRP’s price has slipped 4% in the past 24 hours, falling below the crucial support level of $2.65.

Source: CoinMarketCap

This downturn has sparked concerns about further declines, especially after the cryptocurrency recently surged past $2.80, raising hopes of a potential rally toward $3.

Despite this short-term weakness, analysts remain divided on whether the digital asset will recover or face prolonged consolidation.

Technical indicators and market metrics provide conflicting signals about XRP’s trajectory.

While some analysts foresee a near-term rally, others warn that breaching key support levels could lead to further downside.

Amid this uncertainty, long-term projections for XRP remain ambitious, with market experts suggesting a potential surge to $8 and even $27 in the coming years.

XRP key technical signals

Several technical indicators are pointing towards a possible rebound in XRP’s price.

One key metric is the 21-week exponential moving average (EMA), which has historically acted as a strong support level.

Even during the latest market downturn, XRP has managed to hold above this level, suggesting resilience in the current price range.

Crypto analyst EGRAG CRYPTO has highlighted the importance of Fibonacci retracement levels, noting that XRP is currently consolidating between the 0.888 and 1.0 Fib levels, ranging from $2.25 to $3.30.

This consolidation pattern is often seen before a breakout, making the next few weeks critical for determining XRP’s direction.

A significant price intersection is expected on March 10, 2025, based on Fibonacci projections.

If market conditions align, XRP could see a major upswing to $8, which would represent a threefold increase from current levels.

Projections suggest further gains, with potential price targets of $13 by September 2025 and $27 by June 2026.

Short-term resistance

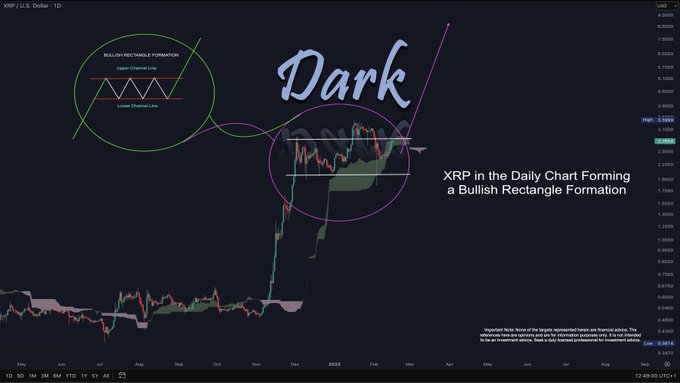

In the short term, XRP must reclaim key resistance levels to confirm bullish momentum.

Analyst Dark Defender suggests that XRP’s ability to break past $2.77 could pave the way for a move toward $3.

Hello all. #XRP is trying to claim the $2.7740 level. If successful, then $3 will be in play. Breaking this channel heralds 2 Digits levels first! Enjoy your Sunday! #XRPCommunity #XRPArmy, #Ripple

If this level is reclaimed, a breakout towards $3.35 could be in play, driven by a classic “cup and handle” formation in the price charts.

Market sentiment remains mixed, with some traders positioning for a breakout while others remain cautious due to lingering macroeconomic uncertainties.

XRP’s futures open interest has also declined by 6% to $4.07 billion, down from a recent high of $4.2 billion, indicating that leveraged traders are reducing exposure amid volatile conditions.

XRP vs Ethereum

Despite XRP’s recent price decline, some analysts believe it has the potential to surpass Ethereum in performance.

Over the last 18 months, XRP has recorded a price increase of 564%, compared to Ethereum’s 80% gains in the same period.

This outperformance has fueled speculation that XRP could narrow the gap with Ethereum in market dominance.

The broader outlook for XRP remains tied to regulatory developments.

Market speculation around a potential resolution in the Ripple vs. SEC case has contributed to increased volatility.

A favorable outcome, particularly under the next US SEC chair, could trigger significant price appreciation.

Anticipation over a possible XRP ETF in the US has further strengthened investor interest.

Institutional adoption through an ETF could provide the cryptocurrency with a fresh influx of capital, driving price momentum in the long term.

The post XRP falls below key $2.65 support: can it still hit $8? appeared first on Invezz