Highlights:

- Definition of OPD: OPD (Opening Price Differential) is a tape symbol indicating the first trade of the day for a security after a delayed opening or in cases where the stock has undergone a significant price movement compared to the previous day's closing price.

- Purpose and Usage: OPD helps investors and traders identify securities with delayed openings or substantial overnight price changes, offering insights into market trends and potential volatility.

- Impact on Market Participants: Understanding OPD is crucial for market participants, as it signals possible trading opportunities, market reactions to news events, and shifts in investor sentiment.

In stock markets, various symbols and notations help traders and investors track security movements and understand market behavior. One such notation is OPD, which stands for Opening Price Differential. This tape symbol signifies the first transaction of a stock after a delayed opening or when a security’s opening price significantly differs from the previous day’s closing price.

The OPD symbol serves as an important indicator for investors looking to gauge early market activity, especially in cases where external factors such as earnings announcements, economic data releases, or geopolitical events have influenced market sentiment overnight. Understanding OPD can provide valuable insights into how a stock is likely to trade during the day and whether volatility is expected.

What Does OPD Indicate?

The OPD tape symbol is primarily used in two scenarios:

- Delayed Opening:

- Sometimes, a stock does not begin trading at the usual market opening time due to factors such as an imbalance of buy and sell orders, regulatory concerns, or pending news disclosures. The OPD notation marks the first executed trade once the stock starts trading.

- Significant Price Movement:

- When a security's opening price exhibits a substantial difference from its previous closing price—either due to positive or negative news—OPD highlights this discrepancy. This may be caused by factors such as earnings surprises, mergers, market-wide events, or sudden investor sentiment changes.

In both cases, the OPD symbol helps market participants quickly recognize that the stock had an unusual start to the trading session.

Importance of OPD for Market Participants

OPD plays a crucial role in helping different market participants, including traders, investors, and analysts, make informed decisions based on early market signals.

- Identifying Volatility and Trends

When OPD is displayed for a stock, it often indicates heightened volatility. Traders can use this information to identify short-term trading opportunities, as stocks with delayed openings or substantial price gaps may offer profit potential through quick movements.

- Gauging Market Sentiment

A significant gap between the previous close and the current opening price can signal a shift in investor sentiment. A positive OPD could indicate bullish sentiment driven by strong fundamentals, while a negative OPD might reflect bearish outlooks due to disappointing news.

- Strategy Development for Institutional Investors

Institutional investors and portfolio managers track OPD to adjust their trading strategies, especially if they hold large positions in securities that have shown opening differentials. Understanding whether an OPD signifies a short-term reaction or a longer-term trend helps in making strategic buy or sell decisions.

Causes of OPD in Securities Trading

Several factors can contribute to the occurrence of an OPD event in a security. These include:

- Corporate Announcements

Earnings reports, mergers and acquisitions, dividend announcements, and management changes can all lead to a significant opening price change, triggering an OPD notation.

- Macroeconomic Events

Changes in interest rates, inflation reports, employment data, and other economic indicators can cause substantial overnight price changes, resulting in an OPD.

- Global Market Developments

Events in international markets, such as geopolitical tensions, commodity price fluctuations, or economic crises, can influence domestic markets and cause stocks to open with a significant price difference.

- After-Hours and Pre-Market Trading

Activities during extended trading hours can create price gaps when the market officially opens, leading to an OPD if the security's price deviates significantly from its prior close.

How Investors Can Respond to OPD Events

Investors and traders can respond to OPD notations in several ways depending on their investment strategies and risk tolerance.

- Day Trading Strategies

For short-term traders, an OPD event can signal an opportunity to capitalize on rapid price movements. They often look for volume and momentum patterns to enter and exit trades quickly.

- Long-Term Investment Adjustments

Long-term investors may use OPD events as a chance to re-evaluate their holdings. If an OPD is caused by fundamental changes, investors might consider adjusting their portfolio to align with the new market outlook.

- Hedging Techniques

Institutional investors may use OPD data to implement hedging strategies, such as options or futures contracts, to protect their portfolios from potential downside risk.

Challenges and Risks Associated with OPD

Despite its usefulness, OPD can present several challenges and risks for traders and investors:

- Market Overreaction

In some cases, OPD-driven price movements may be exaggerated due to emotional reactions or speculative trading, leading to temporary mispricing of securities.

- Lack of Liquidity

Stocks experiencing an OPD may face liquidity issues, especially if the opening price gap causes investors to hesitate before buying or selling, leading to wide bid-ask spreads.

- False Signals

An OPD might sometimes occur without any fundamental reason, making it crucial for traders to verify the cause before making investment decisions.

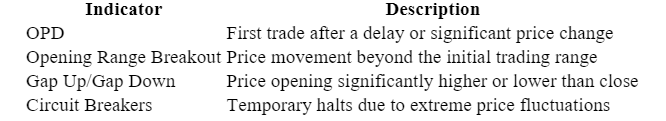

Key Differences Between OPD and Other Market Indicators

It’s important to distinguish OPD from other market indicators and events, such as:

Understanding these differences helps investors interpret market signals more accurately and make informed decisions.

Conclusion

The OPD (Opening Price Differential) tape symbol is an essential tool for traders and investors, providing insight into delayed openings and significant overnight price changes. Whether due to corporate news, market-wide events, or investor sentiment shifts, OPD helps market participants assess volatility, develop trading strategies, and make informed investment decisions.

However, like any market indicator, OPD should be used in conjunction with other analytical tools to avoid potential risks associated with overreaction or misinterpretation. For investors who closely monitor price movements, understanding OPD can offer valuable opportunities in the dynamic world of financial markets.

_01_22_2025_06_10_46_001806.jpg)