Highlights:

- Hewlett Packard (NYSE:HP) recorded a revenue of US$ 6,713 million.

- In the quarter ended June 30, 2022, Apple posted a revenue of US$ 28 billion.

- Brighthouse Financial has a market cap of US$3.25 billion.

The US economy is likely heading towards a recession due to some macroeconomic factors. Rising inflation, continuous interest rate hikes by the US Federal Reserve, and plunging stocks have made investors jittery.

The S&P 500 tanked over 20 per cent so far in 2022, and Wall Street ended the first half of a year most dismally after 1970. With bankable and strong-performing companies hitting the low this year, picking stocks for investors has become difficult.

Here, we are exploring 10 US stocks from different sectors and their performances so far:

-

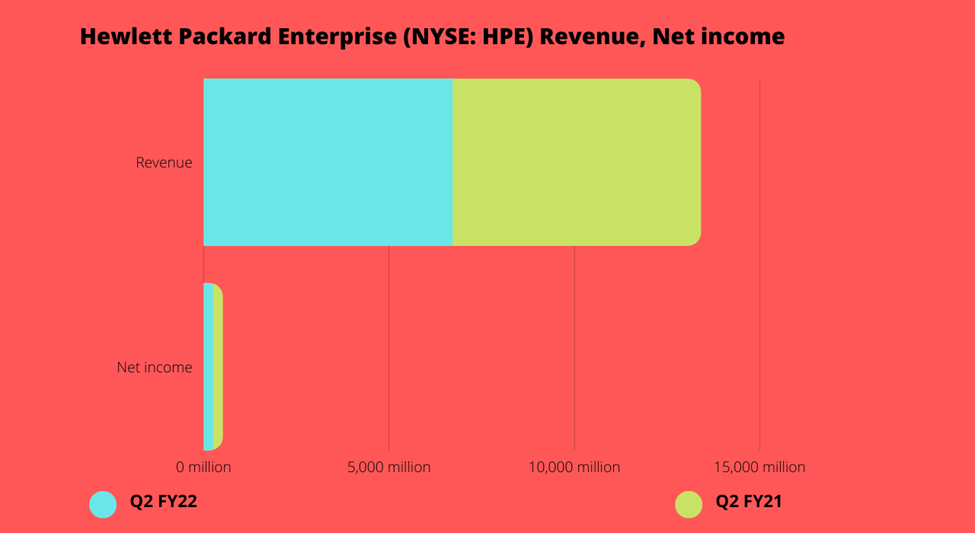

Hewlett Packard Enterprise (NYSE:HPE)

Hewlett Packard is a leading technology company with a market capitalization of US$ 18.29 billion. The IT infrastructure products and services company has a dividend yield of 3.41 per cent.

In the quarter ended April 2022, HP recorded a revenue of US$ 6,713 million. Its revenue in the corresponding quarter a year ago was US$ 6,700 million.

In a year when tech stocks saw their biggest rout, HP clocked a net income of US$ 250 million in Q2 FY22, compared to US$ 259 million in the corresponding quarter in 2021.

-

Dell Technologies Inc. (NYSE:DELL)

Information technology vendor Dell Technologies reported a 16 per cent jump in its revenue at US$ 26,116 million for the quarter ended April 2022, relative to the year-ago quarter.

The US$ 11.9 billion market-cap company has a dividend yield of 2.966 per cent. Its quarterly dividend was US$ 0.33 per unit.

Meanwhile, DELL stock fell 22 per cent this year. Over the last month, DELL surged over five per cent.

-

Apple Inc. (Nasdaq:AAPL)

Technology giant Apple Inc.’s stock jumped over 11 per cent year-over-year (YoY). It fell over 10 per cent year-to-date. Apple Inc. reported a revenue of US$ 28 billion in its third quarter, which ended in June 2022.

Apple Inc. has a dividend yield of 0.57 per cent. Its one-year forward price-to-earnings (P/E) is 26.43.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

-

Amazon.com, Inc. (Nasdaq:AMZN)

Amazon reported net sales of US$ 121.2 billion in Q2 FY2022, a seven per cent increase from US$ 113.1 billion in the previous year’s corresponding quarter.

Amazon registered a net loss of US$ 2 billion in Q2 FY22. Its operating income fell to US$ 3.3 billion in the second quarter of fiscal 2022 versus US$ 7.7 billion in the second quarter of 2021.

The US$ 1.37 trillion company has begun order deliveries to US customers on the custom-made Rivian electric delivery vehicles (EDVs).

-

Herbalife Nutrition Ltd. (NYSE:HLF)

Multinational nutrition company Herbalife has a market cap of US$ 2.7 billion. In the quarter ended March 2022, Herbalife reported net sales of US$ 1.3 billion.

HLF stock fell over 41 per cent this year. It plunged over 51 per cent YoY. Herbalife is slated to release its Q2 FY22 results on Tuesday, August 2, 2022, after market close.

-

Bunge Limited (NYSE:BG)

Bunge Limited is a US multinational agribusiness company with its headquarters in St. Louis, Missouri. Bunge has a market cap of US$ 14 billion.

In its second-quarter earnings of fiscal 2022, Bunge Limited reported net sales of US$ 12,747 million in its core agribusiness segment. Its net sales in the corresponding quarter of the previous year were US$ 21,444 million.

Bunge posted a gross profit of US$ 316 million in the second quarter of fiscal 2022, which is over a 75 per cent drop from the year-ago quarter’s gross profit of US$ 1,295 million. Bunge has an annual dividend rate of US$ 2.5, and the next dividend payable date is September 2, 2022. BG stock jumped over 20 per cent in the last year.

-

APA Corporation (Nasdaq:APA)

Based in Houston, APA Corporation is involved in hydrocarbon exploration with operations in Egypt, Surinam, and the North Sea, apart from the US. APA Corporation has a price-to-earnings (P/E) ratio of 5.31 and a forward one-year P/E of 3.75.

In the quarter ended March 31, 2022, APA posted a net income of US$ 1.9 billion or US$5.43 per diluted share. The company reported a free cash flow of US$ 891 million in the first quarter of fiscal 2022. APA Corporation also paid off US$ 213 million as bonds in the first quarter of the current fiscal that ended in March.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

-

Brighthouse Financial, Inc. (Nasdaq:BHF)

Brighthouse Financial offers annuity products and life insurance. It has a market cap of US$ 3.25 billion.

BHF stock fell over 23 per cent year-to-date (YTD). In the quarter ended March 31, 2022, Brighthouse reported a revenue of US$ 2,740 million compared to US$ 1,325 in the year-ago quarter. Brighthouse will likely report its quarterly results for the fiscal year ended June 2022 on Monday, August 8, 2022.

-

Vertex Pharmaceuticals Inc. (Nasdaq:VRTX)

Biotechnology company Vertex Pharmaceuticals operates on a global level and has a market cap of US$ 71.7 billion. Vertex stock has a price-to-earnings ratio of 29.52 and has risen over 26 per cent this year.

In the quarter ended March 31, 2022, Vertex reported a revenue of US$ 2,097.5 million, which is a 1.2 per cent YoY increase from US$ 1,793 million in the same period in 2021. It reported an operating income of US$ 1,033 million in the first quarter of fiscal 2022.

-

Azenta Inc. (Nasdaq:AZTA)

Formerly known as Brooks Automation, Azenta provides life science sample exploration and management solutions. Azenta Inc. has a market cap of US$5.1 billion. The company’s share volume on July 29, 2022, was 519,680.

In the second quarter of fiscal 2022, Azenta reported a revenue of US$ 145.5 million compared to US$ 129.5 in the year-ago quarter.

Bottom line:

Investing during market volatility is trickier, and this year has been particularly challenging for investors. Most of companies, irrespective of their sectors have witnessed selloffs. Investors must apply utmost caution in picking their stocks.