Asia-Pacific stocks performed strongly in 2024, with most major markets finishing the year in positive territory.

This was driven by central banks easing monetary policies and an AI boom, which particularly benefitted tech stocks.

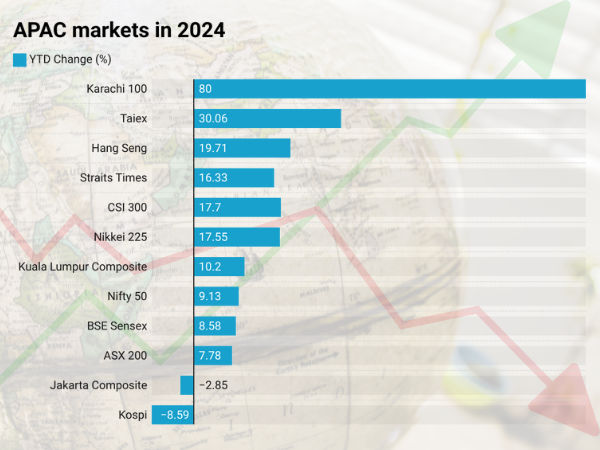

The winners and losers

The leader among the pack of major APAC markets was Taiwan’s Taiex.

The index led the gains in the region, up 30% as of December 25, while Hong Kong’s Hang Seng Index grabbed second place with a 19.71% increase.

Tech stocks were a major contributor to Taiex’s performance, with heavyweights such as Taiwan Semiconductor Manufacturing Company (TSMC), which soared 82.12%, and Apple supplier Foxconn (Hon Hai Precision Industry), which gained 77.51%.

Hong Kong’s Hang Seng, which was having a mostly quiet year, soared in the later part of the year starting late September.

The index hit a new all-time high of 23,241.74 in October but has since seen some moderation.

Just the next day after hitting the all-time high, the index crashed over 9%—its largest dip since 2008.

However, the biggest outlier was Pakistan’s Karachi 100, which soared around 80% this year.

The index had a steady growth in the first half of the year but picked up pace in the second half of 2024.

On the other hand, South Korea’s Kospi was the only major Asian market to end the year in negative territory, down 8.59%.

The country’s “Corporate Value-up program” failed to boost stocks, compounded by tariff concerns and political instability, including the ongoing uncertainty surrounding President Yoon Suk Yeol’s leadership.

India’s Nifty and Sensex also had a record-breaking year but lost momentum after September.

Nifty 50 hit a new record high of 26,277.35 in September, but since then has seen a correction due to the continued foreign fund outflows.

In the past three months, foreign institutional investors have sold off Indian equities worth over ₹2.64 lakh crore (around £24.7 billion).

What to expect from Asian markets in 2025

Looking ahead to 2025, geopolitical factors such as the presidency of Donald Trump and the state of China’s economy will weigh heavily on the outlook for Asian markets.

Uncertainty looms as experts predict turbulence in the second quarter due to the potential impact of Trump’s policies, slowing semiconductor cycles, and China’s overcapacity issues.

Nomura expects the Trump administration to ramp up tariffs, which could exacerbate inflation and slow investment growth, particularly in manufacturing and trade-dependent economies like those in Asia.

The monetary policy trajectory will also weigh on the market’s trajectory in the coming year.

With the Fed’s hawkish stance for the year, asian markets markets may find it difficult to continue the upward momentum.

Countries such as China, South Korea, Indonesia, and Australia, which are more exposed to foreign exchange risks, may implement easier monetary policies to support growth amidst higher tariffs.

Conversely, nations like Japan and Malaysia, which are experiencing stronger growth, higher inflation, and still accommodative monetary conditions, may hike interest rates.

The post This Asian stock index outperforms India's Nifty and Japan's Nikkei with 80% returns in 2024 appeared first on Invezz