Highlights:

- PayPal Holdings posted total assets of US$ 76,435 million in Q3 2022.

- Intuitive Surgical's non-GAAP net income in Q3 2022 was US$ 429 million.

- Adobe reported Q4 2022 revenue of US$ 4.53 billion.

The Nasdaq 100 stocks are usually tied to growth. However, in a volatile market, anything can happen. The sentiments in the US equity market are still tepid, as the Fed Reserve recently quipped that the economy is quite resilient to handle more rate hikes. If this happens, the situation this year might remain unchanged in the stock market.

Here, we look at three Nasdaq-100 stocks and how they handled market conditions in the latest quarters:

PayPal Holdings, Inc. (NASDAQ:PYPL)

PayPal Holdings is a US MNC, a fintech company that deals in online payment, including online money transfers. The digital payment behemoth reported total assets of US$ 76,435 million in the third quarter of 2022 compared to US$ 75,803 million as on December 31, 2021.

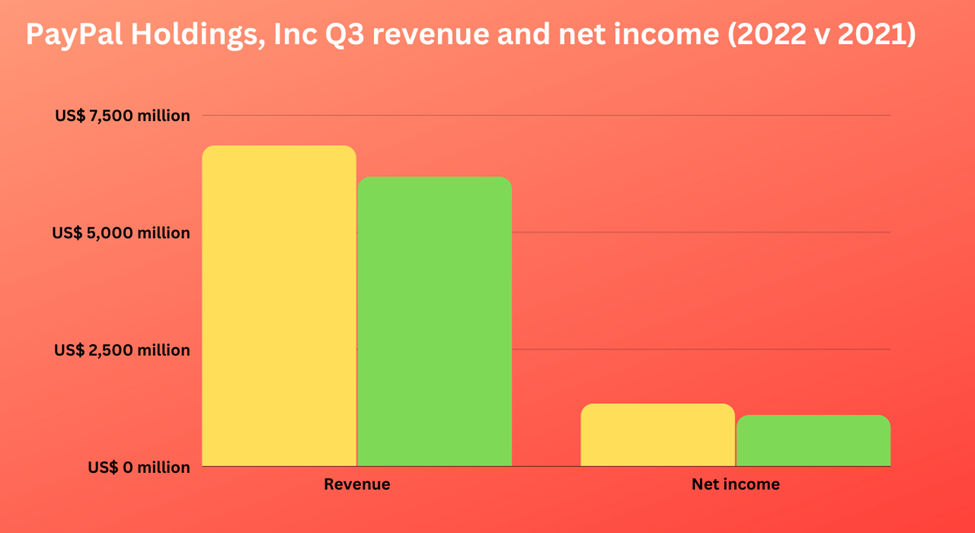

In the three months that ended September 30, PayPal registered net revenue of US$ 6,846 million versus US$ 6,182 million in the same period a year ago. PayPal says that its revenue comes from two segments: transaction revenue and revenue from other value-added services.

The net income of the company in the reported quarter in 2022 was US$ 1,330 million against US$ 1,087 million in the year-ago quarter. The PYPL stock returned more than 2.26 per cent YTD.

Intuitive Surgical Inc. (NASDAQ:ISRG)

Intuitive Surgical is into developing, manufacturing, and selling a robotic system for assisting minimally invasive surgery. The company also sells related instruments, disposable accessories, and warranty services for the system. It has an EPS of 3.78 and a P/E ratio of 71.10.

In the third quarter of 2022 revenue of Intuitive Surgical was US$ 1.55 billion, which was a jump of 11 per cent compared to US$ 1.4 billion in the corresponding quarter of 2021.

Intuitive Surgical said its Q3 2022 non-GAAP net income was US$ 429 million, or US$ 1.19 per diluted share compared to US$ 435 million, or US$ 1.19 per diluted share, in Q3 2021.

The company posted cash, cash equivalents, and investments of US$ 7.39 billion in the third quarter of 2022.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Adobe Inc. (NASDAQ:ADBE)

Adobe has three segments in its business: digital content, marketing solutions for digital sales, and publishing of legacy products. The digital software provider company has an EPS of 10.10 with a P/E ratio of 32.50.

Adobe posted Q4 2022 revenue of US$ 4.53 billion, up 10 per cent year-over-year or 14 per cent in constant currency. The diluted EPS of the company in the reported quarter was US$ 2.53 on a GAAP basis and US$ 3.6 on a non-GAAP basis.

In the fourth quarter of 2022, Adobe reported a GAAP operating income of US$ 1.51 billion. On the other hand, its GAAP net income was US$ 1.18 billion in Q4 2022. The ADBE stock has risen over 1.85 per cent over the past month.

Bottom line:

As an investor, do thorough research before taking any decision. Moreover, stay updated with the latest market trends and adopt strategies accordingly.

_01_09_2023_10_41_18_579714.jpg)