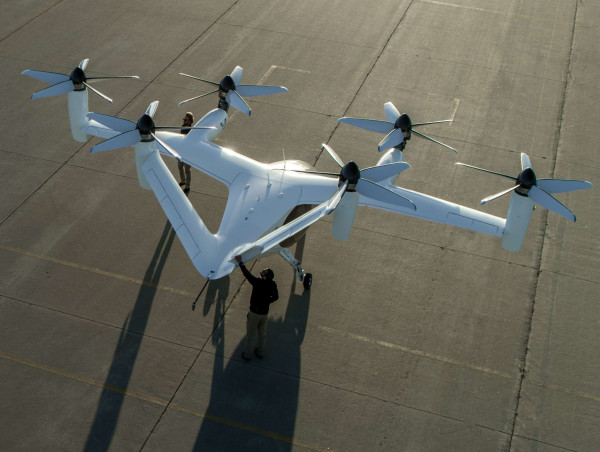

Toyota Motors (NYSE: TM) announced on Wednesday its plan to invest an additional $500 million in Joby Aviation Inc. (NYSE: JOBY), signaling its continued commitment to the electric vertical takeoff and landing (eVTOL) aircraft sector.

Shares of Joby Aviation surged by 25% following the news. This investment will support the certification and commercial production of Joby’s electric air taxis, a crucial step toward making urban air mobility a reality.

Toyota had previously invested $394 million in Joby Aviation as part of its strategic partnership.

The new funds will be distributed in two phases, with the first portion released by the end of this year and the remainder in 2025.

Despite this positive development, Joby Aviation stock remains down over 20% from its year-to-date high in mid-July.

Why has Toyota invested in Joby Aviation?

eVTOLs are still facing regulatory challenges, but they are widely regarded as the next frontier in urban air transportation.

Joby Aviation is fully committed to gaining certification and commercializing its electric air taxis.

Toyota shares this vision, as highlighted by Ted Ogawa, CEO of Toyota Motor North America, who stated, “We share Joby’s view that sustainable flight will be central to alleviating today’s persistent mobility challenges.”

Toyota is Joby Aviation’s largest external shareholder and also supplies key components, including parts for the powertrain.

This investment marks a significant move by legacy automakers into the electric air taxi space, a trend that was reinforced by Stellantis’ recent $55 million investment in Archer Aviation, another eVTOL company.

Is it too late to invest in Joby Aviation stock?

Joby Aviation is not only manufacturing eVTOLs but also aims to operate them as a part of its aerial ride-hailing service.

This vertical integration strategy allows the company to control the customer experience, which could lead to stronger pricing power and profitability over time.

The California-based company also plans to provide transportation services to government agencies, including the US Air Force.

Given the resilience of government contracts, this could provide a stable revenue stream, especially amid potential economic downturns.

While the costs of vertical integration are higher, Joby Aviation’s long-term potential remains attractive to investors.

The company has enough cash reserves to fund its operations for another 2.5 years, and its market cap is more than three times that of peer Archer Aviation. Institutional ownership stands at over 40%, signaling strong interest in the company’s prospects.

Wall Street analysts maintain a consensus “overweight” rating on Joby Aviation, with an average price target of $8.25, indicating a potential 35% upside from current levels.

The post Should you buy Joby Aviation stock after Toyota's $500 million investment? appeared first on Invezz