Summary

- The S&P 500 includes companies that are industry leaders and have a strong hold on the economic and financial well-being of the US.

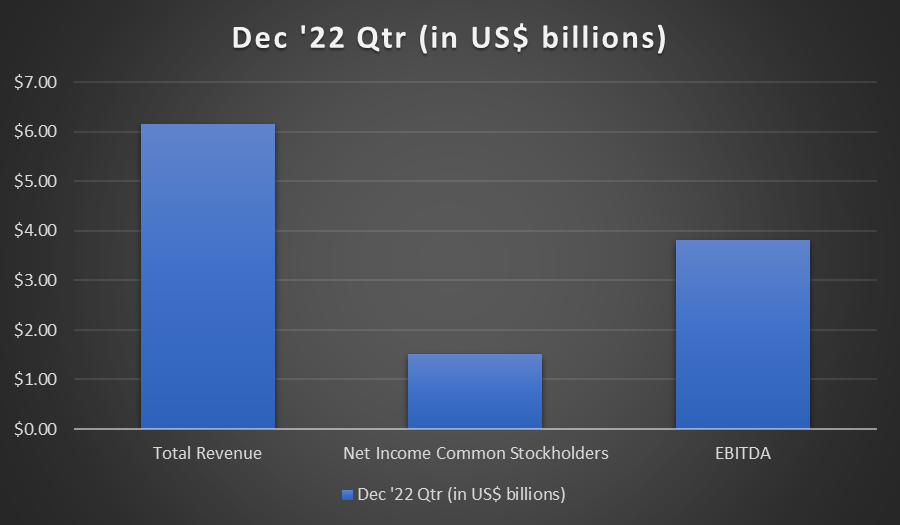

- NextEra is a utility company with a total revenue of US$ 6.164 billion during the December 2022 quarter.

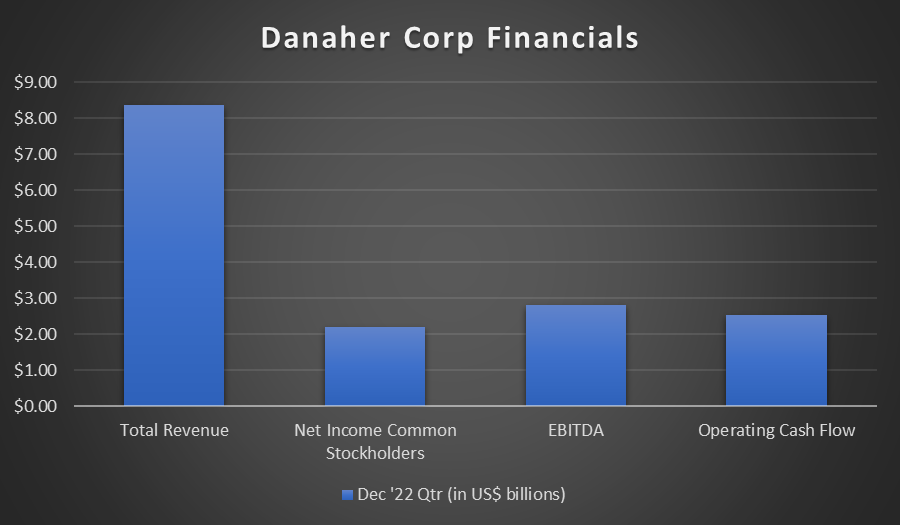

- Danaher is a manufacturing company that reported a total revenue of US$ 8.369 billion during the December 2022 quarter.

Stocks in the S&P 500 include some of the top US companies which are mostly industry leaders. These companies are largely reflective of the economic state of the United States. The S&P 500 index is an important stock index in the market and is often used to gauge economic and financial soundness.

There are certain requirements that companies must fulfil to become a part of the S&P 500. These requirements range from achieving a given market capitalization to having a certain level of liquidity.

ALSO READ: DVN & CVX: Two energy stocks to watch in 2023

Some top companies that are a part of the S&P 500 include Apple, Microsoft, Amazon, and Berkshire Hathaway. On that note, let us examine two S&P 500 stocks and how they have performed:

NextEra Energy Inc.

NextEra is one of the leading capital investors in infrastructure. The company’s subsidiary Florida Power & Light Company, is the largest power utility in Florida. FP&L constitutes 70% of NextEra’s total operating earnings.

Apart from this subsidiary, NextEra also has a renewable energy segment engaged in power generation throughout the US and Canada. This segment is known as NextEra Energy Sources and has a generation capacity of over 25 GW, including natural gas, solar, nuclear and wind.

© 2023 Krish Capital Pty. Ltd.

During the December 2022 quarter, NextEra Energy reported a total revenue of US$ 6.164 billion. The net income to common stockholders was US$ 1.52 billion, while the EBITDA was reported at US$ 3.82 billion during the December 2022 quarter.

NextEra Energy offers a quarterly dividend of US$ 0.468.

ALSO READ: BAC & BRK.A: Should you watch these US financial stocks in 2023?

Danaher Corp.

Danaher is a manufacturing company that focuses on producing scientific instruments and consumables. The company has three segments: life sciences, diagnostics, and environmental and applied solutions.

Through a sequence of mergers and acquisitions, Danaher became a manufacturing-focused business as opposed to its initial operations as a real estate firm. The company has announced plans to strip its environmental and applied solutions segment, turning it into a life sciences and diagnostics focused operation.

© 2023 Krish Capital Pty. Ltd.

The company reported a total revenue of US$ 8.369 billion during the December 2022 quarter. The net income to common stockholders was reported to be US$ 2.21 billion, and the EBITDA was US$ 2.822 billion during the same quarter.

Danaher offers a quarterly dividend of US$ 0.27.