Highlights:

- PG&E Corporation (NYSE:PCG) will report its earnings results on October 27.

- Carnival Corporation (NYSE:CCL) noted a sequential revenue growth of 80 per cent in Q3 FY22.

- Warner Bros Discovery, Inc. (NASDAQ:WBD) will announce its Q3 FY22 earnings results on November 3.

The S&P 500 index generally indicates the overall health of the equity market, meaning the investors keep close track of the index's constituents for cues on the stock market.

The index is comprised of some major companies from different sectors, and some of them include PG&E Corporation (NYSE:PCG), Carnival Corporation (NYSE: CCL), Hewlett Packard Enterprise Company (NYSE: HPE), Warner Bros Discovery, Inc. (NASDAQ:WBD), and Huntington Bancshares Incorporated (NASDAQ:HBAN).

Given the stocks' lower trading prices and their significant position in their respective sectors, these stocks are sometimes explored by market participants with a limited budget. The trading prices of these stocks are under US$ 20.

Now, the recent hovering turmoils in the market have left or forced many investors to stay on the sideline. The volatility has made it hard for investors to put their bets into the market.

But, the historical performance of the market showed that after a bearish period, the market has often regained momentum.

The latest CPI data showed that despite the harsh efforts from the Federal Reserve and the global central banks, inflation has remained stubbornly high. This also gives more space to the Federal Reserve to stay on an aggressive track with its monetary plans.

So, let's take a look at some of these S&P 500 stocks and see how they have performed in recent days.

PG&E Corporation (NYSE:PCG)

The stock of the public utility company, PG&E Corp, closed at US$ 14.73 on Monday, October 24, noting an increase of 1.59 per cent from its previous close. The US$ 35.74 billion market cap natural gas and electric energy company primarily focuses on the transmission and delivering energy.

The company's stock, which claims to provide natural gas and electric service in northern and central California, rose over 24 per cent YoY and 19 per cent YTD. Last week, its price went up over four per cent through Friday, October 21.

The company is scheduled to report its Q3 FY22 earnings results this Thursday, October 27, at 11:00 am ET. Meanwhile, in Q2 FY22, the PG&E Corp's operating revenue was US$ 5.11 billion, against US$ 5.21 billion in Q2 FY21.

The net income per common diluted share of the utility firm was US$ 0.17 apiece in the quarter, against US$ 0.18 apiece in the preceding year's same quarter.

Carnival Corporation (NYSE:CCL)

The major cruise operating firm, Carnival Corporation, has had a rough trading session in recent months. The cruise line operator's stock fell over 59 per cent YTD and 63 per cent YoY. However, in the ongoing month, it added over 16 per cent through October 21.

Meanwhile, the US$10.62 billion market cap company's stock also touched its 52-week low of US$ 6.11 on October 11 this year, while on November 5 last year, the CCL stock noted its 52-week high of US$ 25.29.

According to the Q3 2022 earnings, the company's revenue was US$ 4.3 billion, against US$ 546 million in Q3 FY21, and its net loss per diluted share was US$ 0.65 apiece, against a loss of US$ 2.5 apiece in the year-ago quarter.

Its revenue also noted a significant increase of 80 per cent in Q3 FY22 from the prior quarter.

Hewlett Packard Enterprise Company (NYSE:HPE)

The Texas-based multinational information technology firm Hewlett Packard Enterprise's stock fell over 14 per cent YTD and 13 per cent YoY. The Spring, Texas-based firm dividend yield is 3.56 per cent.

The company said during its Q3 FY22 earnings release that its revenue rose one per cent YoY to US$ 7 billion, and its diluted EPS surged seven per cent YoY to US$ 0.31 apiece, and sequentially, it rose 63 per cent.

Hewlett Packard said its Q3 FY22 revenue improved than its earlier guidance.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Warner Bros Discovery, Inc. (NASDAQ:WBD)

The stock of the film production company Warner Bros Discovery fell over 42 per cent YTD and 46 per cent YoY. The US$ 32.65 billion market cap company closed at US$ 13.49 on October 21.

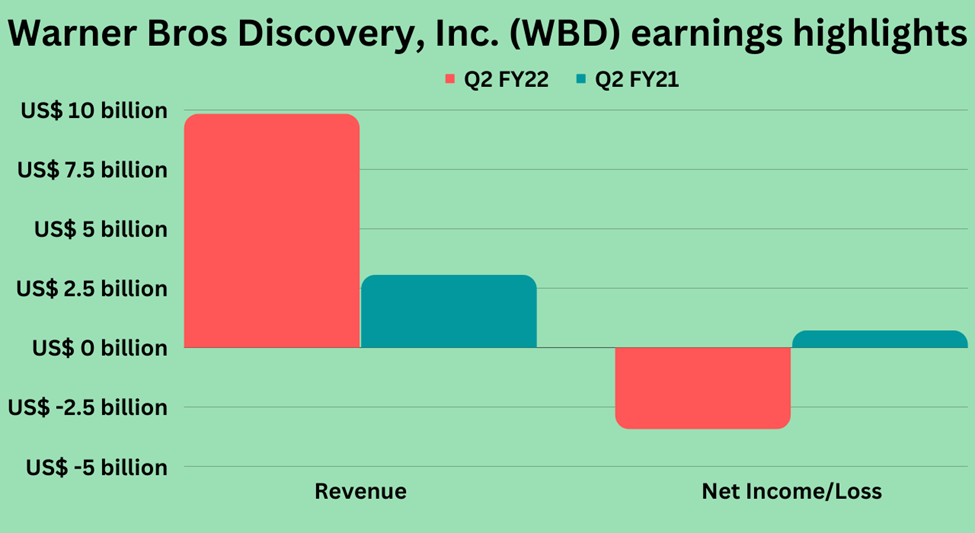

The film and entertainment studio company said on October 20 that it would be announcing its Q3 FY22 earnings results on November 3 at 4:30 pm ET. Meanwhile, in Q2 FY22, Warner Bros Discovery's revenue was US$ 9.82 billion, and its net loss totalled US$ 3.41 billion.

Huntington Bancshares Incorporated (NASDAQ:HBAN)

The stock of the financial services and commercial banking firm Huntington Bancshares fell over six per cent YTD and 13 per cent YoY. The company, with a dividend yield of 4.29 per cent, provides services like online banking, investment, mortgage, credit cards, and other related services.

In Q3 FY22, Huntington Bancshares' net interest income rose 21 per cent YoY and 11 per cent QoQ to US$ 1.41 billion, and its diluted EPS surged 70 per cent YoY and 11 per cent QoQ to US$ 0.39 per share.

Bottom line:

The core inflation in September hit its peak level in four decades, despite the continuous tightening of the Fed's monetary plans. Although some policymakers have turned a little dovish in recent days, indicating that the Federal Reserve might slow its rate-hike pace in the coming days.

For instance, Fed Vice Chairwoman Lael Brainard said in a speech last week that it is still unclear how the already higher rates, along with expected jumbo hikes in the coming days, would halt economic growth.

These actions relieved the investors, reflected by the strong gains in all three indices last week. In addition, the earnings season, with some big companies providing positive guidance, has also lifted the investors' spirit.

Earnings from this week would also be important among the investors, with some of the tech mammoths scheduled to announce their latest quarter earnings.

Looking at the performance of the S&P 500 index, it lost over 17 per cent YoY while dropping over 21 per cent in 2022, after the strong gains it attained last week. In the ongoing month through last Friday, October 21, the index has added over four per cent; in the last week, it soared more than two per cent.