Highlights:

- The coefficient of variation (CV) compares the risk to the return of an investment.

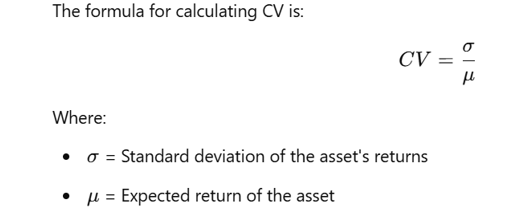

- It is expressed as the ratio of the standard deviation to the expected return.

- A higher CV indicates greater risk per unit of return, while a lower CV suggests less risk.

The Coefficient of Variation (CV) is a financial metric that plays a crucial role in assessing the risk associated with an investment relative to its expected return. This measure provides a standardized way of evaluating investments, making it particularly useful when comparing different assets or projects with varying returns and risk profiles.

At its core, the Coefficient of Variation defines risk in terms of the variability of an asset’s returns relative to its expected return. It is calculated by dividing the standard deviation of an asset’s returns by the expected return. Standard deviation measures the extent of variation or volatility in an asset’s returns, while the expected return is the average anticipated return over a given period.

The CV is expressed as a ratio and provides insight into how much volatility an investor must endure to achieve a certain level of return. A higher CV indicates that the asset is more volatile relative to the return it is expected to generate, suggesting a higher risk. Conversely, a lower CV indicates that the asset is less volatile, which implies that it is relatively less risky for the return expected.

The Coefficient of Variation is especially valuable in comparing investments of different risk profiles. For example, two assets may have the same expected return, but one might carry much higher volatility than the other. By calculating and comparing their CVs, investors can assess which asset provides a better risk-return tradeoff.

When assessing portfolios, the CV helps to understand the total risk of the portfolio compared to the expected return, aiding investors in making more informed decisions. It allows for a clearer perspective on which investments can potentially offer the best returns with the least amount of risk.

In practical application, the CV is commonly used in the analysis of stocks, mutual funds, bonds, and other investment vehicles. It enables investors to optimize their portfolio by choosing assets with the most favorable risk-return relationship.

While the CV is a powerful tool, it has its limitations. It assumes that risk is purely a function of volatility, ignoring other aspects of risk such as liquidity risk or systemic risk. Additionally, the CV might not be as useful when comparing investments with negative expected returns, as it may give misleading interpretations in such scenarios. Despite this, it remains an essential tool in investment analysis.

Conclusion: The Coefficient of Variation is an important metric for investors seeking to understand and compare the risk of different investment options. By comparing the volatility of returns to the expected return, it helps to gauge which investments provide the most attractive risk-adjusted return. However, like any metric, it is most effective when used in conjunction with other tools and considerations to form a complete picture of an investment's potential.