Highlights:

- com Inc. posted net sales of US$ 127.1 billion in Q3 2022.

- MercadoLibre Inc.'s revenue in Q3 2022 was US$ 2.7 billion, up 60.6 per cent YoY.

- com Inc holds a dividend yield of 0.23 per cent.

The e-commerce sector was thriving, with sales growing 15 per cent annually before the pandemic. However, with the onset of the pandemic and followed by macroeconomic headwinds a year later, the sector has struggled. But, as we head into 2023, the sector would be expecting a change of fortune. Having said that, the way things have panned out recently, it would be advisable to take some precautions while taking critical investment decisions.

Kalkine Media® deeps dive into two US e-commerce stocks and their performances in the recent quarter:

Amazon.com Inc. (NASDAQ:AMZN)

Amazon.com, Inc. is a US multinational tech company sspecializingin e-commerce, cloud computing, digital streaming, online advertising, and artificial intelligence.

The e-commerce giant holds a dividend yield of 0.23 per cent and paid a dividend of US$ 0.20 per share. Amazon has an EPS of 1.09 and a P/E ratio of 78.

In the third quarter of fiscal 2022, Amazon’s net sales grew by 15 per cent to US$ 127.1 billion compared to US$ 110.8 billion in the corresponding quarter in 2021.

Sales in its North American segment surged 20 per cent year-over-year to US$ 78.8 billion.

Its most popular segment, AWS sales, jumped 27 YoY to US$ 20.5 billion in the reported quarter.

On the other hand, its net income decreased to US$ 2.9 billion in the third quarter, or US$ 0.28 per diluted share, compared with US$ 3.2 billion, or US$ 0.31 per diluted share, in the third quarter of 2021.

Source: ©Kalkine Media®; © Canva via Canva.com

MercadoLibre Inc. (NASDAQ:MELI)

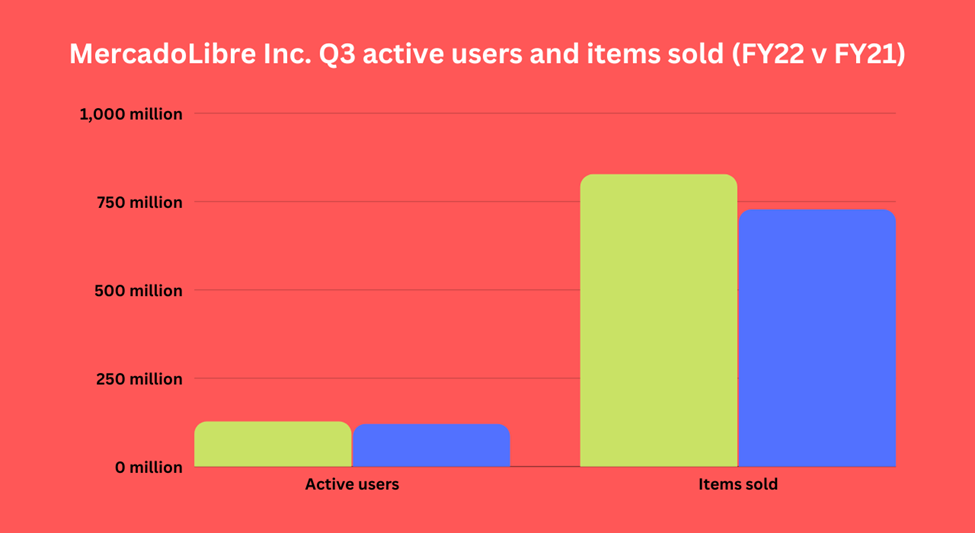

E-commerce giant in Latin America, MercadoLibre recorded over 140 million active users and one million sellers on its platform last year. It has an EPS of 5.36 and a P/E ratio of 167.90.

In the third quarter of 2022, MercadoLibre posted revenue of US$ 2.7 billion, which was up 60.6 per cent year-over-year. The company said its commerce business added US$ 1.5 billion in revenue, while the Fintech division contributed US$ 1.2 billion.

The operating income in the reported quarter touched US$ 296 million, a quarterly record. The cash generated from operations during Q3 2022 was US$ 724 million. Hence, its total cash at the end of the quarter was reported at US$ 275 million higher on a sequential basis. The number of unique active users at the end of the third quarter of 2022 was 127 million compared to 120 million in the year-ago quarter. The number of items the company successfully sold in the quarter was 826 million, against 727 million in the corresponding quarter in 2021.

Bottom line:

Although e-commerce is a popular sector, investors should tread carefully in the current scenario due to the extreme volatility in the market. As a result, several top stocks have struggled during the year. Therefore, it’s advisable to adopt a long-term strategy along with diversification to protect your investment in the short term.