Benchmark US indices fell on Thursday, January 13, over the increased jobless claims and inflation worries. The technology stocks plummeted while investors remained alert about any update on monetary policy tightening by Federal Reserve.

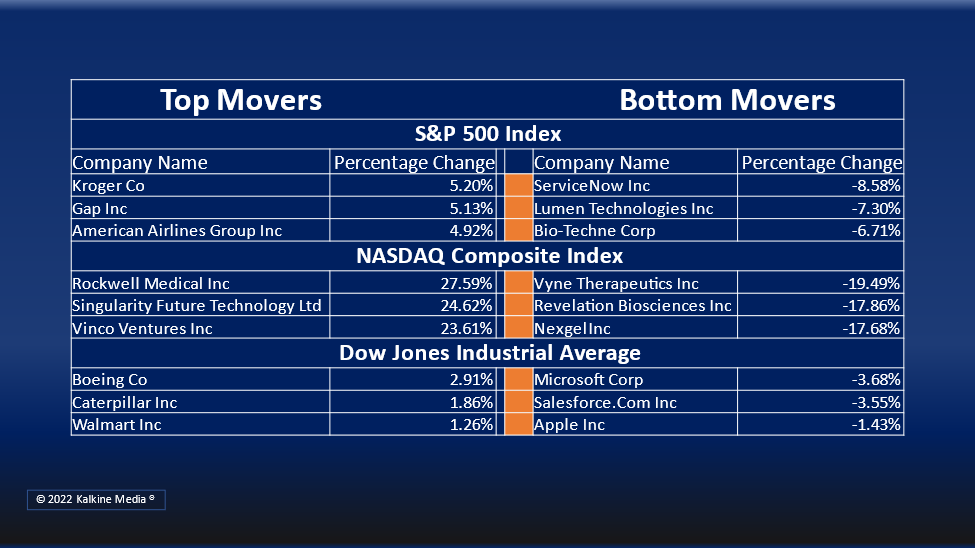

The S&P 500 fell 1.42% to 4,659.10. The Dow Jones decreased 0.49% to 36,113.95. The NASDAQ Composite was down 2.51% to 14,806.81, and the small-cap Russell 2000 was down 0.68% to 2,161.25.

Federal Reserve governor Lael Brainard pledged in the hearing for her nomination on Thursday to help keep inflation under control. She is the White House’s nominee for Federal Reserve’s vice-chair.

Meanwhile, the jobless claim increased to a seasonally adjusted 230,000 for the week ended January 08. It was more than the economists expected and the highest since mid-November.

Separately, the producer price index (PPI) increased 0.2% in December after rising 0.8% in the prior month and 9.7% in twelve months through December, said the Labor Department on Thursday. This reflects the reducing cost of goods and easing the supply chain.

Large technology stock drifted, whereas airlines stock surged today. Delta Air Lines, Inc. (DAL) stock surged more than 3% intraday in spite of booking quarterly loss in the fourth quarter; however, the results were better than analysts expected.

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) stock rose more than 6.5% in intraday trading after reporting better than expected fourth-quarter results. Its revenue increased 24.1% YoY at US$15.74 billion in the fourth quarter.

KB Home (KBH) stock increased over 15% in the intraday session after posting strong quarter and full-year earnings.

Two sectors out of all 11 sectors of the S&P 500 closed in the green on Thursday. Utilities and Consumer Staples sectors gained the most whilst Information Technology, Consumer Discretionary, and Healthcare sectors were the laggards.

In the Utility sector, Duke Energy Corporation (DUK) stock surged 0.47%, Southern Company (SO) rose 0.60%, and Dominion Energy (D) increased by 0.38%. Exelon Corporation (EXC) rose 0.88%, and American Electric Power Company Inc. (AEP) increased by 1.05%.

In the Consumer Staples sector, Walmart Inc. (WMT) surged 1.32%, Coca-Cola Company (KO) jumped 0.40%, and Pepsico Inc. (PEP) increased by 0.01%. Philip Morris International Inc (PM) and Modelez International Inc. (MDLZ) rose 0.43% and 0.24%, respectively.

In the Information Technology sector, Apple Inc. (AAPL) plunged 1.23%, Microsoft Corp. (MSFT) stock declined 3.05%, and Nvidia Corporation (NVDA) fell 4.34%. Adobe Inc. (ADBE) decreased by 2.18%, and Broadcom Inc. (AVGO) fell by 3.55%.

The global cryptocurrency market was down 2.48%, at a market capitalization of US$2.03 trillion, as per coinmarketcap.com at 4:00 pm ET, Thursday. Bitcoin (BTC) price fell to US$42,731.87 with a 2.56% decline in the last 24 hours.

Also Read: Why is BTCS Inc’s stock rocketing? E-commerce firm adds this crypto

Also Read: Why is iSpecimen Inc’s stock trending? ISPC spikes 13% in premarket

Also Read: 5 best US fintech stocks to consider in 2022

Futures & Commodities

Gold futures declined 0.33% to US$1,821.25 per ounce. Silver futures decreased by 0.41% to US$23.113 per ounce, while copper fell 1.34% to US$4.5150.

Brent oil futures decreased by 0.96% to US$83.86 per barrel and WTI crude futures were down 1.40% to US$81.48.

Bond Market

The 30-year Treasury bond yields decreased 1.31% to 2.045, while the 10-year bond yields were down 1.52% to 1.699.

US Dollar Futures Index declined 0.08% at US$94.825.