Wall Street extended its losses on Thursday, May 19, after a sharp fall in the previous session as investors weighed a possible global economic slowdown.

The S&P 500 was down 0.58% to 3,900.79. The Dow Jones fell 0.75% to 31,253.13. The NASDAQ Composite declined 0.26% to 11,388.50, and the small-cap Russell 2000 rose 0.08% to 1,776.22.

On Wednesday, Dow Jones and S&P 500 logged their worst one-day decline since the early phase of the pandemic after retail earnings painted a gloomy picture of the economy.

On the economic front, the number of unemployment benefits claims surged to a four-month high last week, indicating the demand for workers may be waning. The jobless claims rose by 21,000 to 218,000 last week, although the numbers still remain historically low.

The materials and consumer discretionary sector led gains in the S&P 500 index on Thursday. Six of the 11 sectors of the index stayed in the negative territory. The consumer staples and the information technology sectors were the bottom movers.

Kohl's Corporation (KSS) trimmed its fiscal 2022 profit forecast after it said its first-quarter earnings were hit by elevated inflation and sales plummeted in April. However, the KSS stock rose 4.03% from nearly an 11% drop in the previous session after the results.

Shares of BJ's Wholesale Club Holdings, Inc. (BJ) surged 8.63% in intraday trading after the company reported a 16% increase in its first-quarter revenue and the profit and same-store sales topped Wall Street estimates.

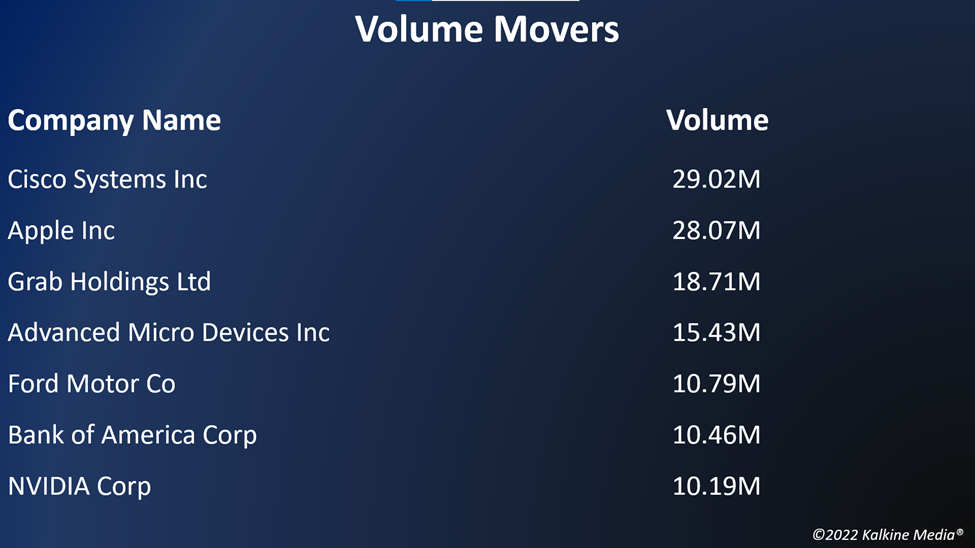

The Cisco Systems, Inc. (CSCO) stock tumbled 14.31% after it cut its revenue guidance for fiscal 2022. The company's exit from Russia and material shortages due to the pandemic lockdowns in China adversely impacted the quarterly performance.

In the basic material sector, BHP Group Limited (BHP) increased by 3.20%, Rio Tinto Group (RIO) rose 1.87%, and Vale S.A. (VALE) surged 3.78%. Freeport-McMoRan Inc. (FCX) and Newmont Corporation (NEM) advanced 3.82% and 3.48%, respectively.

In consumer staples stocks, The Procter & Gamble Company (PG) decreased by 2.33%, Walmart Inc. (WMT) fell 2.74%, and The Coca-Cola Company (KO) declined by 2.01%. PepsiCo, Inc. (PEP) and Philip Morris International Inc. (PM) plunged 1.50% and 5.28%, respectively.

In the consumer discretionary sector, Lowe's Companies, Inc. (LOW) surged 2.24%, Booking Holdings Inc. (BKNG) jumped 2.59%, and JD.com, Inc. (JD) soared 5.69%.

In the technology sector, Apple Inc. (AAPL) slipped 2.46%, Broadcom Inc. (AVGO) dropped 4.27%, and Oracle Corporation (ORCL) slumped 1.82%.

In the crypto space, Bitcoin (BTC) and Ethereum (ETH) increased by 3.03% and 1.58%, respectively. The global crypto market cap rose 1.54% to US$1.27 trillion at 4:15 pm ET on May 19.

Also Read: Why is Tron (TRX) crypto rising amid a market crash?

Also Read: 5 penny stocks to watch in June: PVL, SNRG, GOFF. CHKR & FDOC

Also Read: Crypto exchange FTX set to launch commission-free stock trading service

Futures & Commodities

Gold futures were up 1.30% to US$1,839.47 per ounce. Silver increased by 1.62% to US$21.894 per ounce, while copper rose 2.27% to US$4.2732.

Brent oil futures increased by 1.93% to US$111.22 per barrel and WTI crude was up 1.78% to US$108.95.

Also Read: Will Russian minister's comments on legalizing cryptos reenergize the market?

Bond Market

The 30-year Treasury bond yields were down 0.55% to 3.054, while the 10-year bond yields fell 1.38% to 2.844.

US Dollar Futures Index decreased by 0.91% to US$102.918.