Benchmark US indices drifted on Friday, December 17, after the market participants have evaluated the potential effect of the policy shifts by the world's largest central banks.

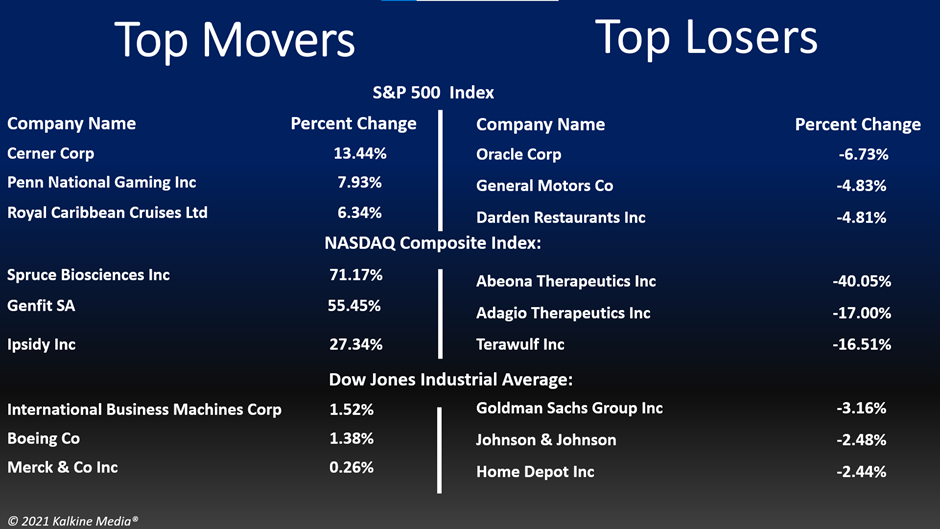

The S&P 500 was down 0.87% to 4,628.25. The Dow Jones Industrial Average decreased by 1.26% to 34,449.05. The NASDAQ Composite Index fell 0.04% to 15,174.26, and the small-cap Russell 2000 was up 1.24% to 2,178.87.

The market drifted on Friday, as the investors gauged the effect of higher interest rates in the future. The Federal Reserve had announced on Wednesday that the central bank intends to accelerate tapering of its asset-buying program. In addition, the central bank may raise its interest rate next year sooner than anticipated.

Even though the investors cheered the Fed's decision initially, considering the impact of the monetary policies in controlling inflation, but the fast-growing tech stocks have been pressured by the effect of higher interest rates.

In addition, worries over the Covid-19 Omicron variant still hovers on investors’ minds, affecting the trading sentiment of the market participants in recent times.

The real estate and consumer discretionary sector have topped the S&P 500 index on Friday. Eight of the 11 critical sectors of the S&P 500 index stayed in green, with the financial and energy sector as the bottom movers.

The stocks of Rivian Automotive, Inc. (RIVN) reached their lowest level since its IPO in the previous month, after reporting its third-quarter performance results on Thursday. The firm said that it may fall short of its production target this year. The RIVN stocks were down 8.89% in intraday trading on Friday.

The shares of Cerner Corporation (CERN) were up 12.96%, following a report that said that Oracle Corporation (ORCL) is in talks to acquire the firm in a deal that may value around US$30 billion. Meanwhile, the ORCL stocks tumbled 6.96%

The stocks of Spruce Biosciences, Inc. (SPRB) jumped 58.87% in the intraday session on Friday after Oppenheimer has covered the stocks with a bullish "outperform" rating with a price target of US$15.

In the real estate sector, Crown Castle International Corp. (CCI) rose 1.06%, SBA Communications Corporation (SBAC) increased by 2.38%, and Welltower Inc. (WELL) gained 1.22%. CoStar Group, Inc. (CSGP) and Extra Space Storage Inc. (EXR) advanced 1.30%.

In consumer discretionary stocks, Tesla, Inc. (TSLA) soared 2.41%, Booking Holdings Inc. (BKNG) surged 2.80%, and TJX Companies, Inc. (TJX) jumped 1.04%. Chipotle Mexican Grill, Inc. (CMG) and Hilton Worldwide Holdings Inc. (HLT) ticked up 1.25% and 1.60%, respectively

In the financial sector, Berkshire Hathaway Inc. (BRK-A) fell 2.42%, JPMorgan Chase & Co. (JPM) declined 2.05%, and Bank of America Corporation (BAC) plunged 2.07%. PayPal Holdings, Inc. (PYPL) and Wells Fargo & Company (WFC) plummeted 1.32% and 4.14%, respectively.

Also Read: Nauticus Robotics to go public with CleanTech Acquisition SPAC deal

Also Read: 5 best US oil & gas stocks that returned over 100% in 2021

Also Read: J&J, Sputnik & Sinopharm vaccines ineffective against Omicron: Study

Futures & Commodities

Gold futures were up 0.13% to US$1,800.55 per ounce. Silver decreased by 0.14% to US$22.453 per ounce, while copper fell 0.30% to US$4.2918.

Brent oil futures decreased by 2.08% to US$73.46 per barrel and WTI crude was down 2.10% to US$70.86.

Bond Market

The 30-year Treasury bond yields was down 2.06% to 1.823, while the 10-year bond yields fell 0.92% to 1.409.

US Dollar Futures Index increased by 0.57% to US$96.567.