US stocks rallied for the second consecutive day on Wednesday, December 22, helping the indices close higher after a South African government report said Omicron is weaker than the Delta variant.

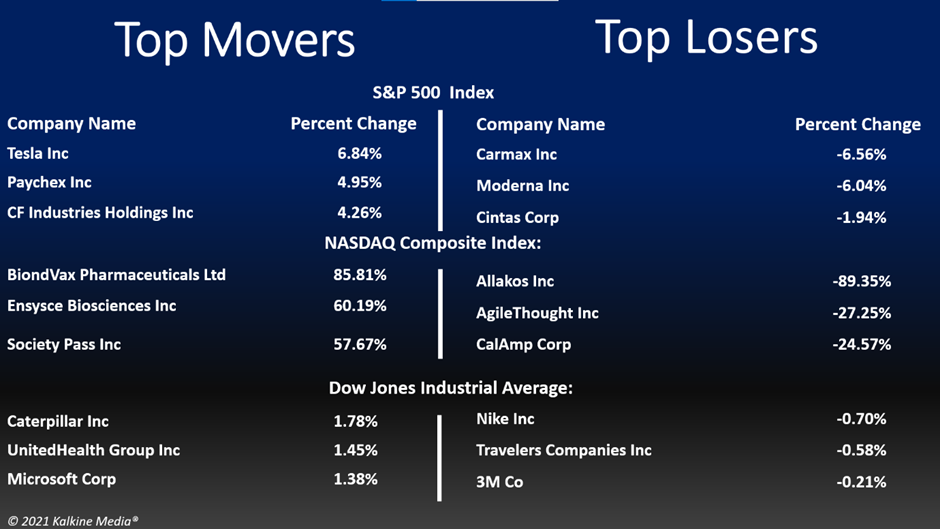

The S&P 500 was up 1.02% to 4,696.56. The Dow Jones rose 0.74% to 35,753.89. The NASDAQ Composite Index rose 1.18% to 15,521.89, and the small-cap Russell 2000 gained 0.86% to 2,221.90.

Traders welcomed the positive report from the South African researchers on Omicron.

South Africa's National Institute for Communicable Diseases said on Wednesday that the hospitalization risk from the Omicron variant is 70% to 80% less than the Delta strain.

Meanwhile, the US administration plans to distribute 500 million free at-home Covid-19 test kits to American households and deploy military doctors and nurses to fight the Omicron threat.

Technology, consumer discretionary, and healthcare segments were the top movers on the S&P 500 index. All the 11 segments of the index stayed in the positive territory.

Shares of Tesla, Inc. (TSLA) rose 6.44% a day after CEO Elon Musk said he reached the target of offloading 10% of his stake in the company.

The Pfizer, Inc. (PFE) stock was up 1.51% after the US Food and Drug Administration (FDA) approved its antiviral Covid-19 pill, making it the first at-home treatment for the disease.

Shares of Paychex, Inc. (PAYX) jumped 4.57% after strong Q2 results. Its revenue grew 13% YoY to US$1.1 billion, while its adjusted diluted earnings rose 25% YoY to US$0.91 per share.

In the consumer discretionary sector, Starbucks Corporation (SBUX) increased by 1.10%, General Motors Company (GM) rose 2.32%, and Ford Motor Company (F) rose 2.19%. Marriott International (MAR) and Yum! Brands, Inc. (YUM) ticked up 2.84% and 1.04%, respectively.

In healthcare stocks, UnitedHealth Group Incorporated (UNH) gained 1.27%, Novo Nordisk A/S (NVO) rose 3.15%, and Abbott Laboratories (ABT) jumped 2.17%. AbbVie Inc. (ABBV) and Danaher Corporation (DHR) advanced 1.55% and 1.20%, respectively.

In technology stocks, Microsoft Corporation (MSFT) rose 1.22%, Taiwan Semiconductor Manufacturing Company Limited (TSM) gained 3.04%, and Accenture plc (ACN) rose 1.91%. Oracle Corp (ORCL) and Advanced Micro Devices, Inc. (AMD) fell 1.73% and 1.05%, respectively.

Also Read: Top stocks under US$1,000 to explore in 2022

Also Read: Justworks IPO: Why investors exuded confidence in HR tech startup?

Also Read: Why BiondVax Pharmaceuticals (BVXV) stock rallied today?

Futures & Commodities

Gold futures were up 0.93% to US$1,805.40 per ounce. Silver increased by 1.39% to US$22.843 per ounce, while copper rose 1.09% to US$4.3933.Brent oil futures increased by 2.04% to US$75.47 per barrel and WTI crude was up 2.53% to US$72.92.

Also Read: Why Red Cat Holdings (RCAT) stocks jumped Wednesday?

Bond Market

The 30-year Treasury bond yields was down 2.28% to 1.854, while the 10-year bond yields fell 2.04% to 1.457.US Dollar Futures Index decreased by 0.48% to US$96.030.