Benchmark US indices closed higher on Wednesday, October 6, as stocks recovered following a weak start to the trading day and bullish sentiments rose after lawmakers sealed a debt-ceiling deal.

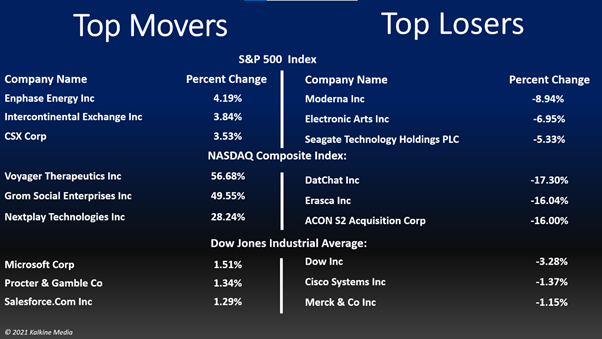

The S&P 500 was up 0.41% to 4,363.55. The Dow Jones rose 0.30% to 34,416.99. The NASDAQ Composite rose 0.47% to 14,501.91, and the small-cap Russell 2000 was down 0.60% to 2,214.96.

Investors welcomed a key debt deal between Democratic and Republican lawmakers that prevented a potential government default. But still, rising oil and gas prices that could increase inflationary pressure, weighed on investors’ minds. As a result, retail traders kept away from risky bets.

Utility, technology, and consumer segments were the top performers on the S&P 500. Energy and basic materials sectors trailed. Seven of the 11 index segments stayed in the positive territory.

Acuity Brands, Inc. (AYI) stock surged 11.34% in intraday trading after reporting quarterly results on Wednesday. Its net income was US$98.1 million on revenue of US$992.7 million in Q4 FY21.

Palantir Technologies Inc. (PLTR) stock rose 2.56% after it bagged an US$823 million contract from the US Army. Voyager Therapeutics, Inc. (VYGR) stock jumped over 54% after announcing a US$630 million licensing deal with Pfizer Inc. (PFE).

In the utility sector, NextEra Energy, Inc. (NEE) stock rose 1.62%, Duke Energy Corporation (DUK) stock rose 1.04%, and Dominion Energy, Inc. (D) stock gained 1.29%. American Electric Power Company, Inc. (AEP) and WEC Energy Group, Inc. (WEC) advanced 1.10% and 1.28%, respectively.

In the consumer staples sector, PepsiCo, Inc. (PEP) stock surged 1.90%, Mondelez International, Inc. (MDLZ) rose 1.58%, and The Hershey Company (HSY) stock rose 2.00%. Church & Dwight Company, Inc. (CHD) and The Clorox Company (CLX) ticked up 1.48% and 1.16%, respectively.

In energy stocks, Exxon Mobil Corporation (XOM) declined 1.85%, EOG Resources, Inc. (EOG) fell 1.08%, and Schlumberger N.V. (SLB) fell 1.77%. In addition, Kinder Morgan, Inc. (KMI) and Occidental Petroleum Corporation (OXY) fell 1.12% and 1.91%, respectively.

Also Read: Three hot growth stocks under US$1400 for income investors

Image description: Utility, technology, and consumer stocks were the top performers on S&P 500.

Also Read: Five technology trends defining the US market

Also Read: Palantir (PLTR) stocks climb after US$823Mn army contract

Futures & Commodities

Gold futures were up 0.17% to US$1,763.85 per ounce. Silver increased by 0.24% to US$22.663 per ounce, while copper fell 0.43% to US$4.1745.

Brent oil futures decreased by 2.12% to US$80.81 per barrel and WTI crude was down 2.42% to US$77.02.

Bond Market

The 30-year Treasury bond yields was down 0.73% to 2.085, while the 10-year bond yields fell 0.22% to 1.528.

US Dollar Futures Index increased by 0.47% to US$94.222.