Benchmark US indices inched higher on Monday, October 17, as the market participants seemed to have moved their focus into the ongoing third-quarter earnings season, amid a flurry of economic challenges weighing on sentiments.

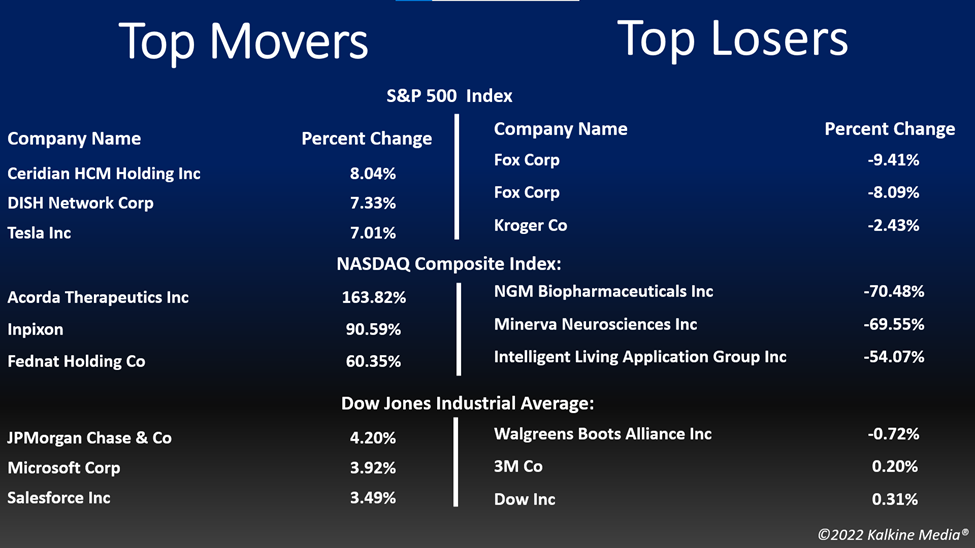

The S&P 500 rose 2.65 per cent to 3,677.95. The Dow Jones was up 1.86 per cent to 30,185.82. The NASDAQ Composite gained 3.43 per cent to 10,675.80, and the small-cap Russell 2000 rose 3.17 per cent to 1,735.75.

A flurry of hotter-than-anticipated economic data from last week had cemented bets that the Federal Reserve may stick to its aggressive plans in the coming time to bring down the stubbornly high inflation.

Despite the notable jump in the policy rates by the central bank in recent months, inflation has remained elevated. In September, the core inflation or core CPI surged to its highest level since 1982.

However, the higher rates seemed to have bolstered gains in the financial segment, while raising the investors' confidence that the corporate earnings might be better than previously anticipated.

On Monday, October 17, all 11 segments of the S&P 500 index stayed in the positive territory, with the consumer discretionary, real estate, and communication services sectors as the highest percentage gainers.

Shares of the online video gaming firm, Roblox Corporation (NYSE:RBLX) jumped more than 19 per cent in the intraday session on October 17, after the company released certain key metrics for the month of September 2022. Its metrics showed that it had attained robust engagement last month compared to the year-ago period.

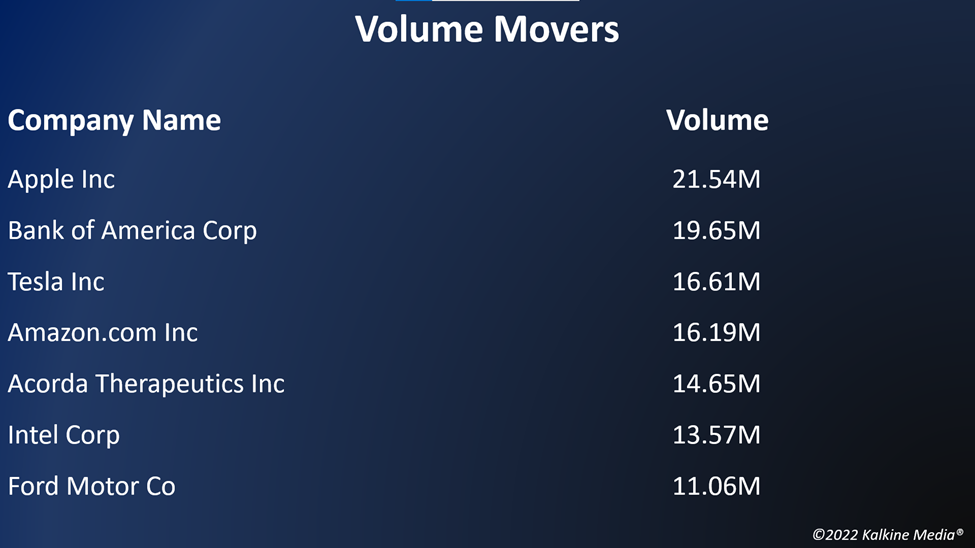

Bank of America Corporation (NYSE: BAC) surged more than six per cent in the intraday hours on Monday, after the financial services and investment banking firm reported its Q3 FY22 earnings results. The company's net interest income was boosted by the higher interest rates in the latest quarter.

In the consumer discretionary sector, Amazon.com, Inc. (AMZN) increased by 6.45 per cent, Tesla, Inc. (TSLA) rose 7.01 per cent, and The Home Depot, Inc. (HD) soared by 1.75 per cent. Toyota Motor Corporation (TM) and McDonald's Corporation (MCD) jumped 1.53 per cent and 1.37 per cent, respectively.

In real estate stocks, Prologis, Inc. (PLD) gained 5.76 per cent, American Tower Corporation (AMT) surged 3.61 per cent, and Crown Castle Inc. (CCI) added 4.17 per cent. Public Storage (PSA) and Equinix, Inc. (EQIX) were up 3.53 per cent and 4.26 per cent, respectively.

Futures & Commodities

Gold futures were up 0.35 per cent to US$1,654.70 per ounce. Silver increased by 2.72 per cent to US$18.562 per ounce, while copper fell 0.53 per cent to US$3.4055.

Brent oil futures increased by 0.14 per cent to US$91.76 per barrel and WTI crude was down 0.01 per cent to US$84.64.

Bond Market

The 30-year Treasury bond yields were up 1.22 per cent to 4.023, while the 10-year bond yields rose 0.26 per cent to 4.017.

US Dollar Futures Index decreased by 1.07 per cent to US$111.993.