Benchmark US indices closed mixed on Tuesday, December 28, dragged down by technology and healthcare stocks amid rising oil prices.

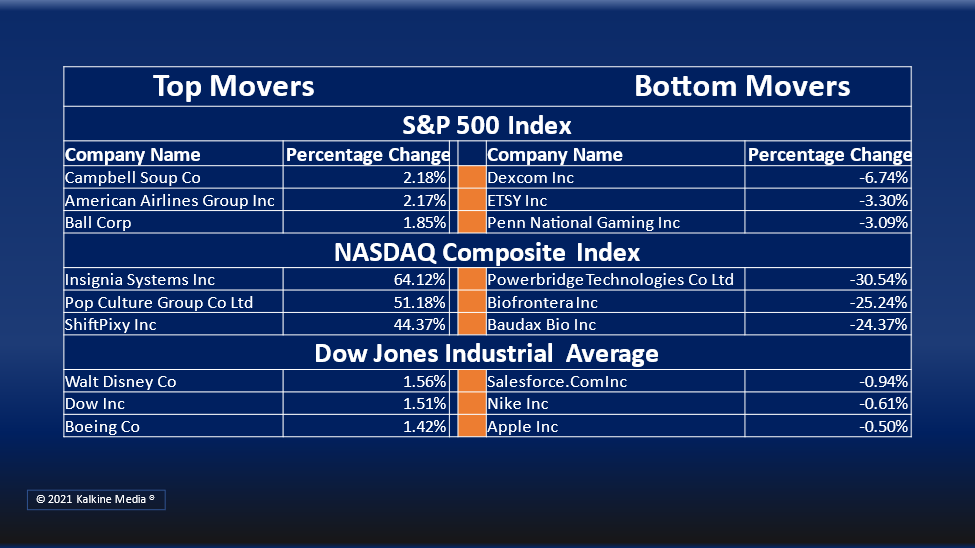

The S&P 500 fell 0.10% to 4,786.35. The Dow Jones rose 0.26% to 36,398.21. The NASDAQ Composite fell 0.56% to 15,781.72, and the small-cap Russell 2000 fell 0.47% to 2,250.51.

Traders sighed relief after the Centers for Disease Control and Prevention (CDC) reduced the isolation period to five days for asymptomatic people who tested positive for covid.

It also advised them to wear a mask when around other people. The federal health agency’s latest order indicated that the Omicron strain might be less severe.

Meanwhile, oil prices rose amid these developments. Brent futures increased by 0.70% to US$78.77 per barrel and WTI crude futures were up 0.64% to US$76.05.

Nine of the 11 segments of the S&P 500 closed in positive territory. Utilities, industrial and materials sectors gained the most. Technology and healthcare stocks were the bottom movers.

Shares of BioNTech SE (BNTX) fell more than 5.5%, while Moderna, Inc. (MRNA) was down over 3% in intraday trading.

Apple Inc’s (AAPL) valuation was close to hitting the historic US$3-trillion mark after the stock’s early gains, but it later declined around 0.54% in intraday trading. On Monday, it announced to close all 12 stores in New York City due to rising Omicron cases.

In other technology stocks, Microsoft Corp. (MSFT) stock declined 0.33%, Nvidia Corp (NVDA) fell 1.63%, Broadcom Inc. (AVGO) fell 0.85%, and Accenture Plc (CAN) declined 0.02%.

In airline stocks, United Airlines Holdings, Inc. (UAL) was up nearly 2%, and American Airlines Group Inc. (AAL) jumped more than 1.90% in intraday trading.

In the utility sector, Exelon Corporation (EXC) surged 1.22%, FirstEnergy Corp (FE) grew 1.17%, and American Water Works Company Inc. (AWK) rose 1.14%. Evergy Inc. (EVRG) and American Electric Power Company Inc. (AEP) increased by 1.10% and 1.09%, respectively.

In the industrial sector, Union Pacific Corporation (UNP) stock grew 0.67%, Honeywell International Inc. (HON) increased by 0.36%, and Raytheon Technologies Corporation (RTX) jumped 0.87%. Boeing Company (BA) grew 1.22%, and Caterpillar Inc. (CAT) rose 0.23%.

Meanwhile, the global cryptocurrency market was down 6.01%, dragging down its valuation to US$2.26 trillion, according to coinmarket.com. Bitcoin (BTC) fell 6.79% to around US$47,774.

Also Read: Yearender: Five S&P 500 stocks that gave over 100% return on equity

Also Read: Yearender: Top 5 healthcare stocks that grabbed limelight in 2021

Also Read: Yearender: Top EV stocks that continue to hog limelight

Futures & Commodities

Gold futures declined 0.09% to US$1,807.20 per ounce. Silver futures increased by 0.32% to US$23.062 per ounce, while copper declined 0.82% to US$4.4352.

Brent oil futures increased by 0.70% to US$78.77 per barrel and WTI crude futures were up 0.64% to US$76.05.

Bond Market

The 30-year Treasury bond yields increased 1.09% to 1.907, while the 10-year bond yields were up 0.22% to 1.484.

US Dollar Futures Index climbed 0.07% at US$96.153.