Benchmark US indices closed the first day of the month on Monday, Nov 1, with a buoyant note as stocks saw gains across all industry groups on upbeat quarterly earnings and economic outlook.

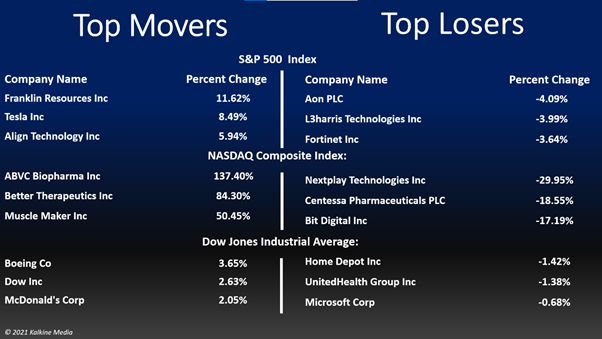

The S&P 500 was up 0.18% to 4,613.67. The Dow Jones rose 0.26% to 35,913.84. The NASDAQ Composite rose 0.63% to 15,595.92, and the small-cap Russell 2000 was up 2.65% to 2,358.12.

Traders began the month's first day trading on an upbeat note after solid quarterly results in the previous weeks. They will now eagerly wait for cues from Fed's two-day policy monthly meet starting on Nov 2. The central bank is likely to announce a timeline for withdrawing its US$120 billion monthly asset-buying programs, expected by mid-Nov.

Energy and basic materials stocks were the top movers on S&P 500 on Monday. Communication and technology stocks were the bottom movers. Five of the 11 stock segments of the index stayed in the positive territory. The index saw its best monthly performance in October in over a year.

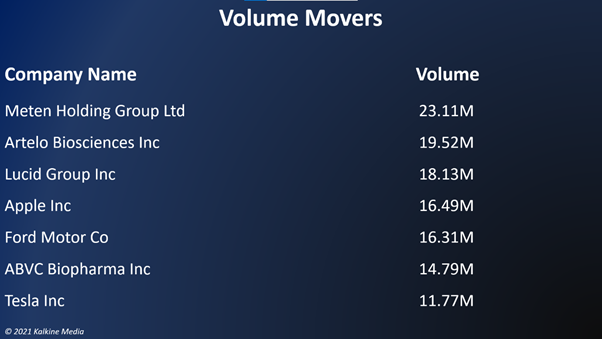

Tesla, Inc. (TSLA) and Meta Platforms (FB) were the top gainers on Nasdaq. TSLA rose 5.82% while continuing its last week's rally when it hit the US$1 trillion market cap for the first time. On the other hand, FB stock rose 1.65% after it renamed itself from Facebook last week.

XPeng, Inc. (XPEV) shares rose 1.82% a day after it reported its October vehicle delivery increased by 233% YoY to 10,138 vehicles, while its YTD deliveries jumped 289% YoY to 66,542 cars.

Global Market touches record highs on Monday

Shares of Harley-Davidson, Inc. (HOG) soared 8.70% in intraday trading after the US and EU reached a trade truce on steel and aluminum that will help reduce production costs. The EU also removed tariffs on other US products like whiskey, powerboats, etc.

Consumer product manufacturer Newell Brands' (NWL) stock was up 3.52% after analysts upgraded the shares to "overweight" from "neutral."

In the energy sector, Exxon Mobil Corporation (XOM) rose 2.20%, EOG Resources, Inc. (EOG) increased by 1.33%, and Schlumberger N.V. (SLB) gained 3.63%. In addition, Pioneer Natural Resources Company (PXD) and Kinder Morgan, Inc. (KMI) ticked up 1.50% and 1.88%, respectively.

In basic materials stocks, Linde PLC (LIN) jumped 1.50%, Freeport-McMoran, Inc. (FCX) gained 1.52%, and Dow Inc. (DOW) rose 3.11%. Dupont De Nemours, Inc. (DD) and LyondellBasell Industries NV (LYB) advanced 2.77% and 1.59%, respectively.

In the technology sector, Microsoft Corp. (MSFT) decreased by 0.98%, Adobe Inc. (ADBE) declined by 1.93%, and Oracle Corporation (ORCL) fell by 1.84%. Also, Accenture PLC (ACN) and Broadcom Inc. (AVGO) tumbled 1.30% and 1.17%, respectively.

Also Read: Top EV stocks to watch as White House mulls tax credit

Also Read: 11 hot stocks to watch this week

Also Read: Pacific Gas (PCG) posts Q3 losses; ON Corp’s (ON) profit jumps 93%

Futures & Commodities

Gold futures were up 0.61% to US$1,794.80 per ounce. Silver increased by 0.68% to US$24.113 per ounce, while copper rose 0.54% to US$4.3918.

Brent oil futures increased by 1.02% to US$84.57 per barrel and WTI crude was up 0.51% to US$84.00.

Bond Market

The 30-year Treasury bond yields was up 1.17% to 1.964, while the 10-year bond yields rose 0.32% to 1.561.

US Dollar Futures Index decreased by 0.26% to US$93.873.