US stocks closed lower on Friday, April 8, dragged down by technology, consumer-cyclicals, and industrial segments after a lacklustre session clouded by mixed signals on growth and inflation.

The S&P 500 fell 0.27% to 4488.28. The Dow Jones rose 0.40% to 34721.12. The NASDAQ Composite fell 1.34% to 13711.00, and the small-cap Russell 2000 dropped 0.76% to 1994.56

Traders weighed the worsening situation in Ukraine even as the European countries moved to reduce their dependency on Russian oil. The EU country representatives were expected to coordinate talks with major gas and LNG suppliers to deflect a potential supply disruption.

On Friday, the Food and Agriculture Organization (FAO) said food prices surged to record highs in March, raising serious concerns about global food security.

The cost of food items such as cereals rose by 17%, while vegetable oil prices jumped 23%. The UN agency warned of a further increase in food prices due to the Russia-Ukraine conflict. Both countries are major global suppliers of wheat, corn, barley, and sunflower oil.

The 10-year Treasury notes rose for the sixth straight day to 2.708% from 2.658% the previous day as selloff in the bond market continued after Fed’s aggressive stance on inflation.

Sectoral Performance

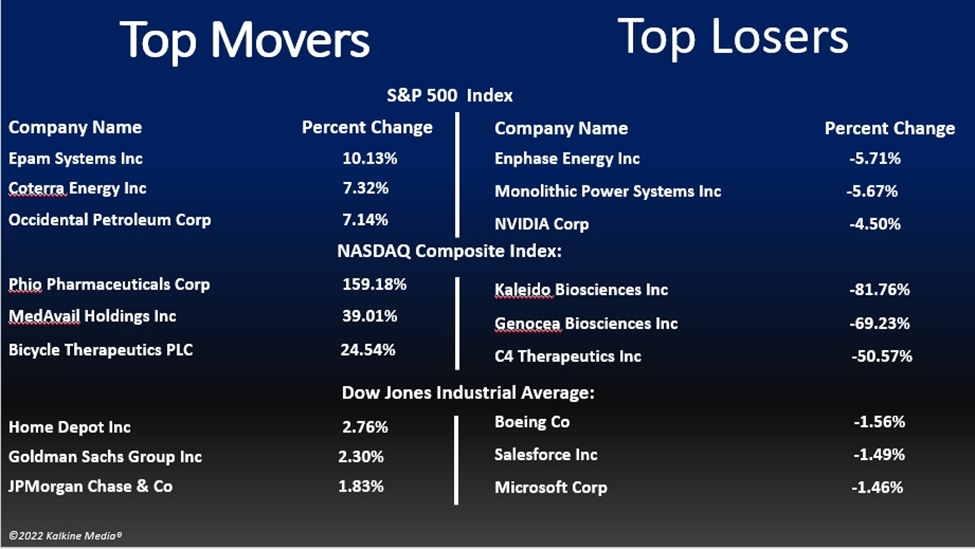

Energy, financials, consumer non-cyclicals, healthcare, basic materials, real estate, and utilities were the top movers on the S&P 500 index. Industrials, consumer cyclicals, and technology, were the bottom movers. Seven out of 10 segments of the index closed in the green.

In energy stocks, Exxon Mobil Corporation (XOM) rose 2.10%, Chevron Corporation (CVX) gained 1.69%, and Shell plc (SHEL) was up 1.21%.

In financial stocks, Berkshire Hathaway (BRK-B) rose by 1.90%, and Visa Inc. (V) gained 0.38%.

In consumer non-cyclicals, Walmart Inc. (WMT) surged 0.56%, The Procter & Gamble Company (PG) rose 0.78%, and The Coca-Cola Company (KO) was up 0.61%.

In technology stocks, Apple Inc. (AAPL) fell 1.19%, Microsoft Corporation (MSFT) closed 1.46% lower, and NVIDIA Corporation (NVDA) declined 4.50%.

The cryptocurrency market was down 2.40% to US$1.95 trillion at around 4:30 pm ET on Friday. Bitcoin (BTC) was down 2.67% to US$42,463.62 in the last 24 hours.

Also Read: Flipkart ups IPO valuation to US$70 billion, plans 2023 US listing

Also Read: Why is MXC (MXC) token up more than 100% year-to-date?

Also Read: Five student loan stocks to watch in April: DFS to SLM

Futures & Commodities

Gold futures were up 0.55% to US$1,948.40 per ounce. Silver climbed 0.70% to US$24.907 per ounce, while copper rose 0.59% to US$4.7270.

Brent oil futures went up 1.76% to US$102.35 per barrel and WTI crude climbed 1.88% to US$97.84 a barrel.

Bond Market

The 30-year Treasury bond yields gained 1.20% to 2.721, while the 10-year bond yields rose 2.02% to 2.708.

US Dollar Index Futures were up 0.03% to US$99.790.