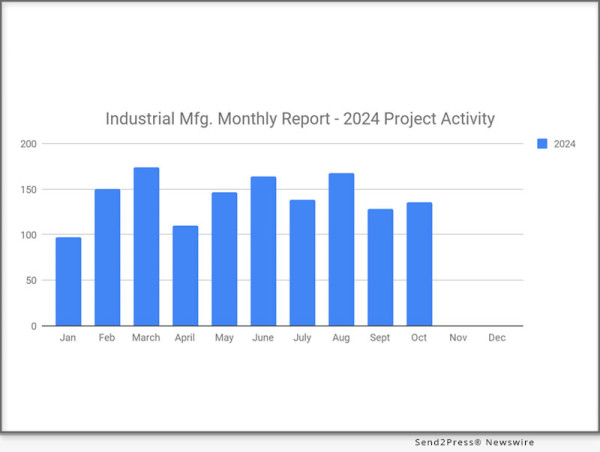

JACKSONVILLE BEACH, Fla., Nov. 7, 2024 (SEND2PRESS NEWSWIRE) — Industrial SalesLeads released its October 2024 report on planned capital project spending in the Industrial Manufacturing sector. The firm monitors planned industrial capital projects across North America, including facility expansions, new plant construction, and major equipment modernization initiatives. The latest research identified 136 new projects, an increase from 128 in September.

Image caption: Industrial Manufacturing Monthly Report 2024 October.

The following are selected highlights on new Industrial Manufacturing industry construction news.

Industrial Manufacturing – By Project Type

Manufacturing/Production Facilities – 118 New Projects

Distribution and Industrial Warehouse – 85 New Projects

Industrial Manufacturing – By Project Scope/Activity

New Construction – 47 New Projects

Expansion – 42 New Projects

Renovations/Equipment Upgrades – 56 New Projects

Plant Closings – 12 New Projects

Industrial Manufacturing – By Project Location (Top 10 States)

Pennsylvania – 10

Indiana – 9

North Carolina – 7

Ohio – 7

Ontario – 7

Tennessee – 7

Texas – 7

Illinois – 6

Washington – 6

Arizona – 5

LARGEST PLANNED PROJECT

During the month of October, our research team identified 19 new Industrial Manufacturing facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Eli Lilly and Company, who is planning to invest $4.5 billion for the construction of a processing, laboratory, and research campus in LEBANON, IN. They are currently seeking approval for the project.

TOP 10 TRACKED INDUSTRIAL MANUFACTURING PROJECTS

NORTH CAROLINA:

Pharmaceutical company is planning to invest $2 billion for the construction of a processing campus in WILSON, NC. Construction is expected to start in Spring 2025.

NEVADA:

Battery mfr. is planning to invest $1 billion for the construction of a 1.2 million sf manufacturing facility in RENO, NV. They are currently seeking approval for the project. Construction is expected to start in 2025.

PENNSYLVANIA:

Pharmaceutical company is planning to invest $800 million for the construction of 2 processing facilities on their campus in MARIETTA, PA. They are currently seeking approval for the project. Construction is expected to start in late 2024, with completion slated for late 2028.

MICHIGAN:

Semiconductor mfr. is planning to invest $325 million for the construction of a manufacturing facility on their manufacturing campus in HEMLOCK, MI. They are currently seeking approval for the project.

VIRGINIA:

Pharmaceutical company is planning to invest $200 million for the expansion of their processing facility at 2020 Avon Crt. in CHARLOTTESVILLE, VA. They have recently received approval for the project.

PENNSYLVANIA:

Generator mfr. is planning to invest $175 million for the construction of a 300,000 sf manufacturing facility in FINDLAY TWP., PA. They are currently seeking approval for the project. Construction is expected to start in 2025.

NORTH CAROLINA:

Consumer goods mfr. is planning to invest $146 million for the renovation and equipment upgrades on a processing facility at 4700 Sandoz Dr. in WILSON, NC. They are currently seeking approval for the project.

TEXAS:

Plastic recycling company is planning to invest $145 million for the construction of a processing and warehouse facility in HOOKS, TX. They are currently seeking approval for the project. Construction is expected to start in Summer 2025.

OREGON:

Wood product mfr. is planning to invest $120 million for the renovation and equipment upgrades on its manufacturing facility in SPRINGFIELD, OR. The project includes the construction of 2 manufacturing facilities at the site. Completion is slated for early 2026 and late 2026 respectively.

ALABAMA:

Automotive component mfr. is planning to invest $100 million for the renovation and equipment upgrades on a manufacturing facility in AUBURN, AL. They have recently received approval for the project.

LEARN MORE: https://www.salesleadsinc.com/industry/industrial-manufacturing/

About Industrial SalesLeads, Inc.

Since 1959, Industrial SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team.

Visit us at https://www.salesleadsinc.com/.

Each month, our team provides hundreds of industrial reports within a variety of industries, including:

- Industrial Manufacturing

- Plastics

- Food and Beverage

- Metals

- Power Generation

- Pulp Paper and Wood

- Oil and Gas

- Mining and Aggregates

- Chemical

- Research and Development

- Distribution and Supply Chain

- Pipelines

- Pharmaceutical

- Industrial Buildings

- Waste Water Treatment

- Data Centers

Learn more: https://www.salesleadsinc.com/solutions/industrial-project-reports/

News Source: Industrial SalesLeads Inc

To view the original post, visit: https://www.send2press.com/wire/strong-start-to-q3-with-136-new-industrial-manufacturing-planned-industrial-project/.

This press release was issued by Send2Press® Newswire on behalf of the news source, who is solely responsible for its accuracy. www.send2press.com.