The S&P 500 index and Nasdaq Composite closed in the green, while Dow Jones marginally declined on Friday, February 4, after Amazon’s strong earnings and positive jobs report.

The S&P 500 rose 0.52% to 4,500.53. The Dow Jones fell 0.06% to 35,089.74. The NASDAQ Composite was up 1.58% to 14,098.01, and the small-cap Russell 2000 rose 0.57% to 2,002.36.

Investors took cues from the upbeat labor data and Amazon.com Inc’s (AMZN) strong fourth-quarter results the day before. US nonfarm payrolls increased by 467,000 in January, suggesting an improvement in the labor market. Labor Department’s latest report on Friday also showed that the US economy added 709,000 more jobs in November and December.

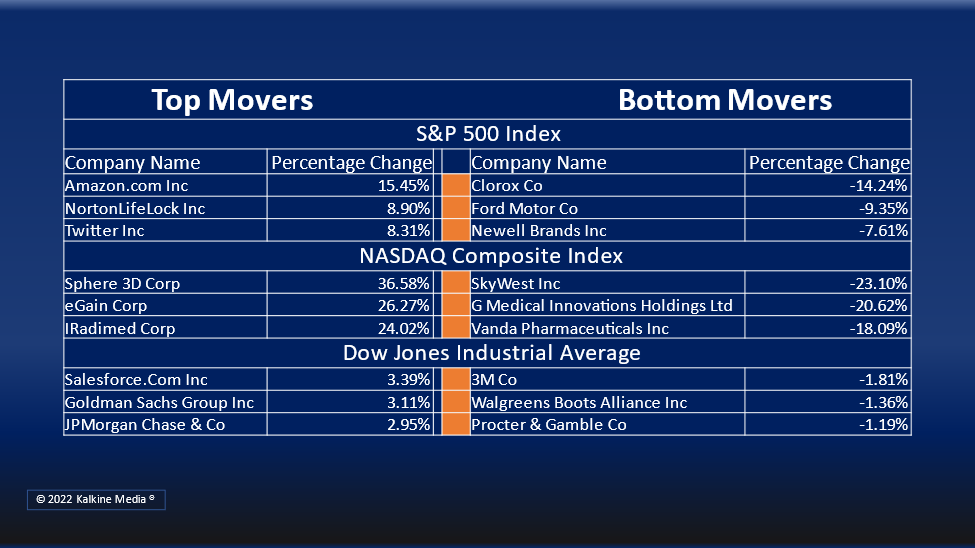

Shares of Amazon.com, Inc (AMZN) gained more than 15% in intraday trading after posting strong quarterly earnings. Its profit grew on cloud and advertising revenue in the quarter.

Five out of the 11 stock segments on the S&P 500 closed in the green on Friday. Consumer discretionary, financials and energy sectors advanced, while basic materials, consumer staples, and utility segments were the bottom movers.

Social media company Snap Inc. (SNAP) stock skyrocketed more than 62% on fourth-quarter results and better-than-expected outlook. It earned its first quarterly profit in the quarter.

Ford Motor Company (F) stock fell over 9% after its quarterly results missed estimates.

Pinterest, Inc. (PINS) stock gained 11.6% after reporting quarterly results on Thursday. The company posted its first annual net income on revenue of US$2.6 billion.

In the consumer discretionary sector, Tesla Inc. (TSLA) stock rose 4.04%, and Nike Inc. (NKE) gained 0.21%. McDonald’s Corporation (MCD) and Target Corporation (TGT) were up 0.03% and 0.80%, respectively.

In the financial sector, JP Morgan Chase & Co. (JPM) stock rose 3.02%, Bank of America Corporation (BAC) rose 4.40%, and Wells Fargo & Company (WFC) increased by 2.43%. Charles Schwab Corporation (SCHW) and Morgan Stanley (MS) were up 3.74% and 2.17%, respectively.

In the material sector, Linde Plc (LIN) stock fell 3.86%, Sherwin Williams Company (SHW) decreased by 1.83%, and Ecolab Inc. (ECL) declined 0.43%. Air Products and Chemicals Inc. (APD) plunged 5.71%, and Newmont Corporation (NEM) fell 1.07%.

The global cryptocurrency market surged 8.21% to US$1.85 trillion at 5:27 pm ET, as per coinmarketcap.com. Bitcoin (BTC) price rose 9.52% to US$40,501.42 in the last 24 hours.

Also Read: What is NFT? How to create and sell?

Also Read: Snap Inc (NYSE:SNAP) nixes iPhone privacy fears - answer to Meta woes?

Also Read: Is Meta Platforms’ (FB) US$250-bn loss biggest wipeout in US history?

Futures & Commodities

Gold futures surged 0.21% to US$1,807.95 per ounce. Silver futures increased by 0.42% to US$22.468 per ounce, while copper futures jumped 0.66% to US$4.5005.

Brent oil futures increased by 2.11% to US$93.03 per barrel and WTI crude futures were up by 2.05% to US$92.12.

Bond Market

The 30-year Treasury bond yields increased 3.63% to 2.223, while the 10-year bond yields were up 4.95% to 1.918.

US Dollar Futures Index advance 0.08% at US$95.457.