SAN DIEGO, Calif., Feb. 6, 2025 (SEND2PRESS NEWSWIRE) — Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 0.12% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report for a deeper understanding of the latest market trends and dynamics.

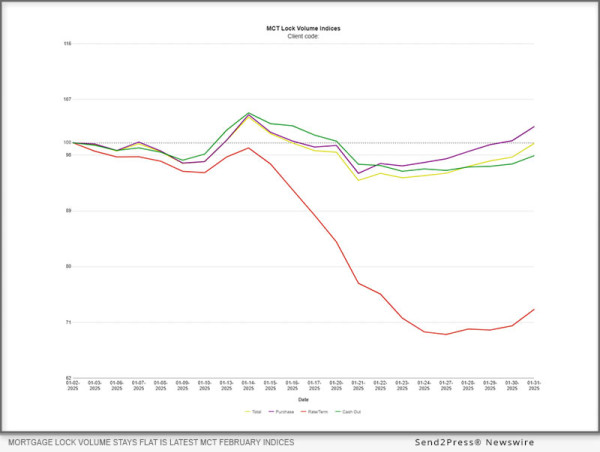

Image caption: Mortgage Lock Volume Stays Flat in Latest MCT February Indices.

Despite the drop in refinance volume, purchase volume has remained steady, resulting in relatively no change in overall production volume month-over-month. The stability in purchase volume continues to support market activity while the industry awaits potential shifts in interest rates.

MCT’s data did show an increase in refinance production in the latter half of January. However, this uptick is likely attributable to the seasonal lull of the holiday period when compared to the end of December.

The outlook for the upcoming Federal Reserve meeting remains uncertain, as additional data is required to refine market predictions. “Tariffs, if or when implemented, may have an impact on inflation which will have influence over the next Fed decision,” said Andrew Rhodes, Senior Director and Head of Trading at MCT. “This, along with upcoming Nonfarm payroll and Consumer Price Index (CPI) reports, will help determine the outlook for mortgage rates heading into the Spring season.”

MCT’s latest report offers an in-depth analysis of these factors, providing valuable insights to lenders, investors, and industry stakeholders as they navigate the shifting mortgage landscape. To access the full report and learn more about MCT’s innovative solutions, visit MCT’s website.

MCT’s Lock Volume Indices present a snapshot of rate lock volume activity in the residential mortgage industry broken out by lock type (purchase, rate/term refinance, and cash out refinance) across a broad diversity of lenders (e.g., sizes, products/services offered, business models) from MCT’s national footprint.

Download the report: https://mct-trading.com/press-release/mortgage-lock-volume-flat-latest-february-indices/

About MCT:

For over two decades, MCT has been a leading source of innovation for the mortgage secondary market. Melding deep subject matter expertise with a passion for emerging technologies and clients, MCT is the de facto leader in innovative mortgage capital markets technology. From architecting modern best execution loan sales to launching the most successful and advanced marketplace for mortgage-related assets, lenders, investors, and network partners all benefit from MCT’s stewardship. MCT’s technology and know-how continue to revolutionize how mortgage assets are priced, locked, hedged, traded, and valued – offering clients the tools to perform under any market condition.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

IMAGE link for media: https://mct-trading.com/wp-content/uploads/2025/02/mct-lock-volume-indices-43.png

MEDIA CONTACT:

Ian Miller

Chief Marketing Officer

Mortgage Capital Trading

619-618-7855

[email protected]

News Source: Mortgage Capital Trading Inc.

To view the original post, visit: https://www.send2press.com/wire/mortgage-lock-volume-stays-flat-in-latest-mct-february-indices/.

This press release was issued by Send2Press® Newswire on behalf of the news source, who is solely responsible for its accuracy. www.send2press.com.