DES MOINES, Iowa, June 4, 2024 (SEND2PRESS NEWSWIRE) — iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the availability of its 2024–2026 U.S. Mortgage Origination Forecast. Updated to reflect preliminary 2023 Home Mortgage Disclosure Act (HMDA) data released by the Federal Financial Institutions Examination Council in March, iEmergent’s latest projections call for modest growth in purchase originations and a gradual increase in refinance loan units and dollars as a percentage of total originations.

According to iEmergent Chief of Forecasting Mark Watson, persistent economic trends – including inflation, real GDP growth, a strong labor market and tight Federal Reserve monetary policy – will continue to dampen the mortgage origination market for the next three years:

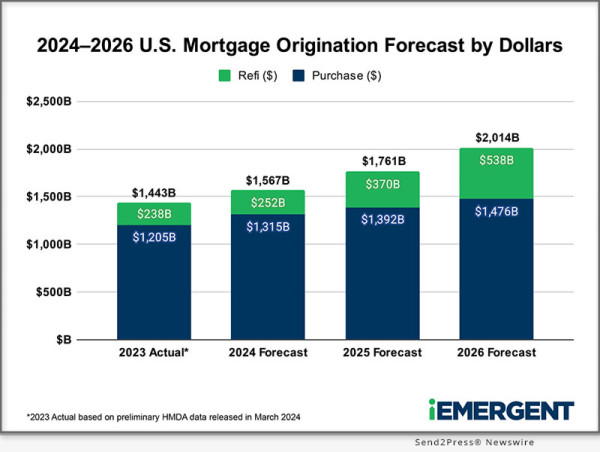

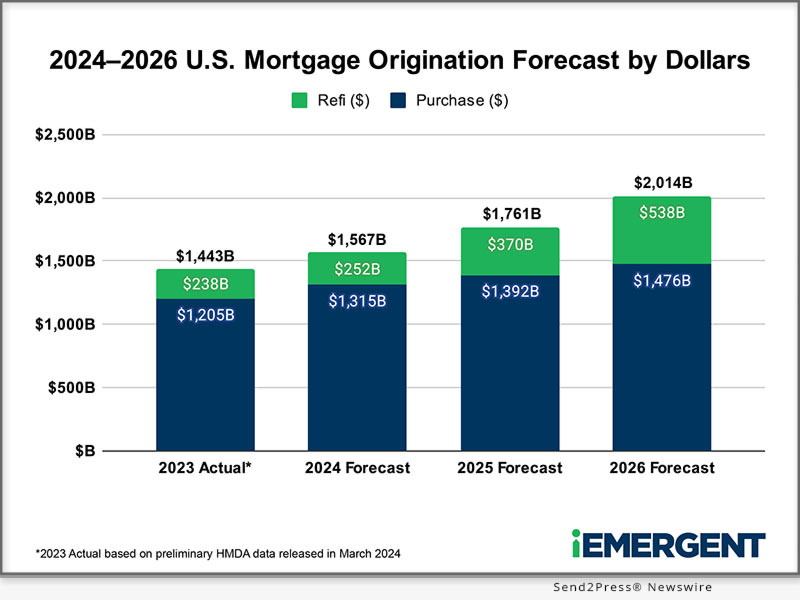

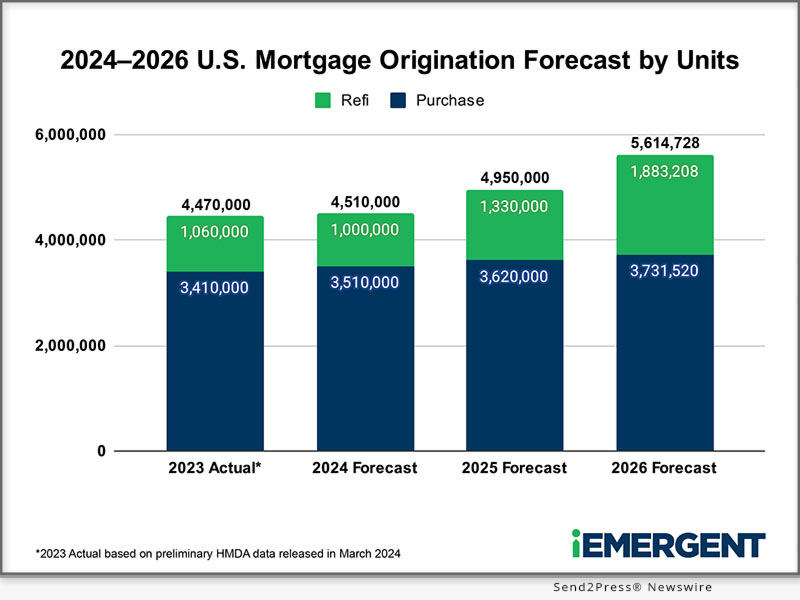

- 2024: Although purchase dollar volume is expected to increase by about 9% in 2024, most of the volume gain will be attributable to larger average loan sizes rather than significant growth in loan count. Refinances are forecast to reach 18% of total mortgage originations, only slightly more than their record low of 17% in 2023.

- 2025: By 2025, deceleration and, ultimately, a mild decline in GDP growth should help reduce long-term interest rates and soften home prices, leading to slightly higher mortgage origination levels. Refi units are anticipated to grow 33% (albeit from historically low levels) on a year-over-year basis.

- 2026: By 2026, total U.S. mortgage origination volume is expected to exceed the $2 trillion mark for the first time since 2022 as refinances continue to recover share in both loan units and dollars.

Image caption 1: Bar graph showing iEmergent’s 3-year U.S. Mortgage Origination Forecast for 2024-2-26 by dollar volume.

Image caption 2: Bar graph showing iEmergent’s 3-year U.S. Mortgage Origination Forecast for 2024-2-26 by loan count/units.

“The American economy has proven surprisingly resilient, and that very resiliency has kept interest rates higher than anticipated for longer than expected. When you factor in an affordability crisis and an acute housing shortage, it’s no wonder origination volumes continue to suffer,” said iEmergent CEO Laird Nossuli. “As economic growth slows over the next couple of years, we could finally see some improvement, provided inventory scarcity is addressed. As markets recover, origination opportunities will be unevenly distributed, making our census-level forecasts a critical tool for shaping lenders’ growth strategies.”

The 2024–2026 forecast is available now in iEmergent’s Mortgage MarketSmart platform, where users can map future lending opportunities at the census tract level and overlay them with historical loan production data, real estate agent and property listing intelligence, household demographic and income insights, community points of interest and more.

Read Mark Watson’s latest blog for more detailed analysis and commentary on the forecast.

Methodology

For more than two decades, iEmergent has been predicting mortgage market trends with a level of precision that surpasses even the industry’s most trusted forecasts from the Mortgage Bankers Association, Freddie Mac and Fannie Mae. In fact, in more than half of the nation’s 73,057 census tracts, iEmergent’s U.S. Mortgage Origination Forecast has proven accurate to within 10 loans.

iEmergent’s proprietary forecasting method is a hybrid of several traditional demand forecast models. Many variables go into these forecasts, but there are two fundamental elements: first, the Purchase Mortgage Generation Rate (PMGR), which is the rate at which an individual market produces purchase mortgages. Second, the homebuyer pool: the number of households that are ready, willing, and able to buy a home. By evaluating the relationship between each census tract’s homebuyer pool and PMGR, probability theory can be applied to estimate the number of purchase mortgage loans and dollars that will be originated in that market.

Read more about iEmergent’s approach to forecasting here.

About iEmergent

Founded in 2000, iEmergent provides mortgage lending forecasts and analytics to the lending, housing and real estate industries. The company offers an extensive variety of forecast and market intelligence products, including Mortgage MarketSmart, a visualization tool that helps lenders quantify how mortgage markets will change. For more information, visit https://www.iemergent.com/.

X/Twitter: @iemergent #housingfinance #housingequity #housingeconomy #mortgage #HMDA #fairlending

News Source: IEmergent

To view the original post, visit: https://www.send2press.com/wire/iemergents-2024-2026-u-s-mortgage-origination-forecast-is-now-available-in-mortgage-marketsmart/.

This press release was issued by Send2Press® Newswire on behalf of the news source, who is solely responsible for its accuracy. www.send2press.com.