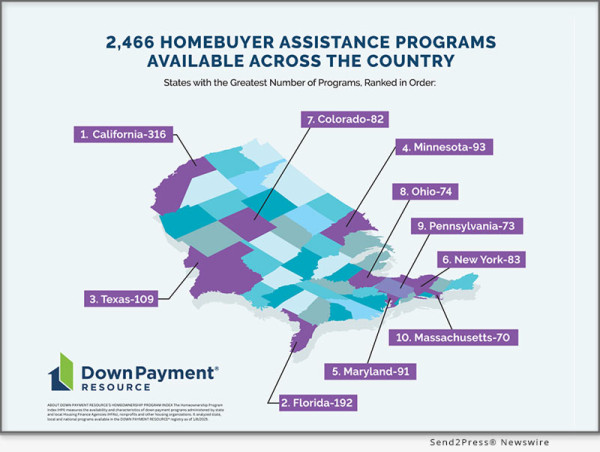

ATLANTA, Ga., Jan. 21, 2025 (SEND2PRESS NEWSWIRE) — Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q4 2024 Homeownership Program Index (HPI) report. The report saw the number of homebuyer assistance programs increase by 172 and the number of entities offering them increase by 75 year-over-year (YoY), bringing the total number of available programs to 2,466.

Image caption: Down Payment Resource’s Q4 2024 HPI Report.

“We are pleased to see state and local agencies adapting to the current and ongoing housing affordability crisis by adding new programs and expanding their criteria to allow for the purchase of multi-family and manufactured housing,” said Rob Chrane, founder and CEO of DPR. “We’re also seeing more flexibility in how funds can be used — a down payment, closing costs or buying down their interest rate. In a market with few homes for sale and escalating prices, down payment assistance has become vital for many buyers in helping them to become homeowners and start building wealth through equity.”

KEY HPI REPORT FINDINGS

An examination of the existing 2,466 homebuyer assistance programs on January 8, 2025, resulted in the following key findings:

- The number of U.S. homebuyer assistance programs increased by 22 over the past quarter. This represents a 1% increase over the previous quarter, and a 7% YoY increase.

- Grants accounted for the largest share of program gains YoY. The most substantial YoY gains were seen in grant programs (50), combined assistance programs (49), and below-market-rate (BMR)/resale-restricted programs (21).

- Local housing finance agencies added the most programs in 2024. Local housing finance agencies introduced 72 programs in Q4 2024, a 60% YoY increase. Nonprofits added 50 programs, and municipalities added 46 programs during this period.

- Rise in multi-family and manufactured housing programs continues: Programs supporting multi-family purchases increased by 17% YoY, rising from 686 in Q4 2023 to 805 in Q4 2024. Similarly, programs for manufactured housing grew by 14% YoY, from 804 in Q4 2023 to 914 in Q4 2024.

- 2024 concluded with 196 programs offering incentives for special groups. 68 programs offer special funding for educators, 54 programs for protectors, 49 programs for military Veterans, 47 programs for firefighters, 44 programs for healthcare workers, and 47 for Native Americans.

A more detailed analysis of the Q4 2024 HPI findings, including infographics and examples of the programs described in this release, can be found on DPR’s website at https://downpaymentresource.com/professional-resource/2025-kicks-off-with-record-number-of-homebuyer-assistance-programs/.

For a complete list of homebuyer assistance programs by state, visit https://downpaymentresource.com/wp-content/uploads/2025/01/HPI-state-by-state-data.Q42024-1.pdf.

METHODOLOGY

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,300 program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates (MCCs) and affordable first mortgages, in the DOWN PAYMENT RESOURCE® database.

About Down Payment Resource:

Down Payment Resource (DPR) is the housing industry authority on homebuyer assistance program data and solutions. With a database that tracks more than 2,400 programs and toolsets for mortgage lenders, multiple listing services (MLSs) and API users, DPR helps housing professionals connect homebuyers with the assistance they need. DPR frequently lends its expertise to nonprofits, housing finance agencies, policymakers, government-sponsored enterprises and trade organizations seeking to improve housing affordability. Its technology is used by seven of the top 25 mortgage lenders, the three largest real estate listing websites and 600,000 real estate agents. For more information, visit https://downpaymentresource.com/.

X: @DwnPmtResource #downpaymentassistance #affordabilitycrisis #housingaffordability #mortgage #housingequity #downpayment

News Source: Down Payment Resource

To view the original post, visit: https://www.send2press.com/wire/172-new-homebuyer-assistance-programs-and-75-new-program-providers-emerged-in-2024-to-tackle-homeownership-affordability/.

This press release was issued by Send2Press® Newswire on behalf of the news source, who is solely responsible for its accuracy. www.send2press.com.