The World Gold Council expects bar and coin demand in China to stay strong even as high gold prices may negatively impact gold jewelry sales, despite consumer spending remaining relatively stable.

In the long run, a pilot program that permits Chinese insurers to purchase physical gold should further bolster investment demand, the council said in its latest update.

The surging consumer attention towards gold indicates that wholesale demand, primarily driven by investment, may remain stable in the near term.

However, this demand is likely to cool down as the second quarter of 2025 approaches, which is historically an off-season for gold consumption in China.

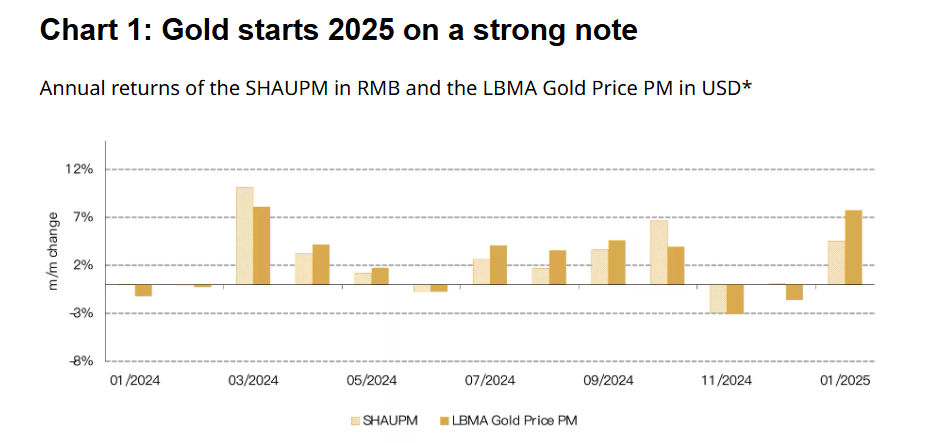

The LBMA gold price PM increased by 8% during the first month of 2025, while the SHAUPM in RMB rose by 5%, demonstrating a surge in gold prices.

The RMB gold price underperformed in comparison due to a stronger local currency and fewer trading days as a result of the Chinese New Year holiday between January 28 and February 4, WGC said.

“Our analysis shows that heightened geopolitical risks – such as the Trump administration’s tariff policies – improving gold ETF inflows and rekindling inflation concerns were main contributors to the record-shattering gold price in January,” said Ray Jia, research head, China, WGC.

Wholesale demand

Gold shipments from the Shanghai Gold Exchange (SGE) rose 3% month-over-month to 125 tons in the month of the Chinese New Year (CNY).

This increase was primarily driven by seasonal stock replenishment from jewellery retailers, banks and other market participants ahead of the CNY holiday, which is traditionally a peak season for gold consumption in China.

“But our pre-holiday field research in Shenzhen, the hub of China’s gold jewellery wholesaling and manufacturing, indicates weaker-than-usual sentiment among gold jewellery retailers,” Jia said.

Due to the rising gold prices and the potential for sustained weaknesses in demand, gold jewellery retailers stocked up less than previous years and lowered their expectations for the holiday sales.

The 54% year-over-year decline in January’s wholesale gold demand reflects this.

However, it’s crucial to remember that 2024 had the highest January demand ever, even though it was 37% below the ten-year average, WGC said.

China ETFs and gold holdings

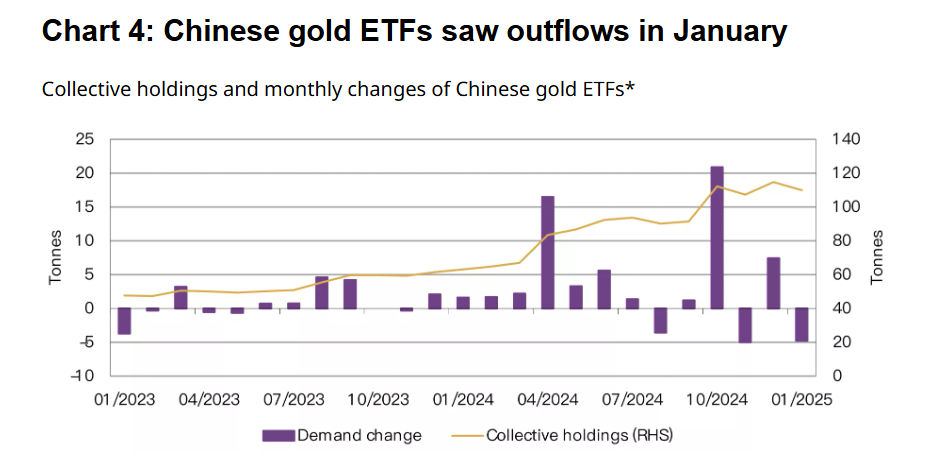

In January, Chinese gold ETFs experienced a decline of RMB 2.8 billion ($399 million) in holdings, which translates to a reduction of 4.7 tons.

China’s total assets under management (AUM) decreased to RMB 70 billion (US$9.8bn) after the month’s outflow, and their collective holdings reached 110 tons.

“We believe the outflow can be mainly attributed to profit-taking activities ahead of the CNY holiday to avoid additional volatilities from international markets while the local market is closed,” Jia said.

At the start of 2025, China’s official gold holdings rose to 2,285 tons, representing 5.9% of total foreign reserves, following a 5 ton increase.

China’s gold purchases totaled 44 tons in 2024, according to WGC’s latest Gold Demand Trends report, despite a six-month pause in the middle of the year.

Looking ahead

The resurgence in consumption was evident during the CNY holiday between late January and early February.

Both consumer spending on dining and travel and box office revenues experienced a significant increase compared to the same period in 2024, with the latter reaching a historical high, WGC said.

The surge in gold prices led Chinese consumers towards lighter products, even as gold consumption and jewellery store activity boomed during the holiday period, it said.

The investment narrative for gold is increasingly compelling due to several factors.

The soaring price of gold, ongoing announcements of central bank purchases, and fluctuations in local currencies have all contributed to heightened investor interest.

“Our conversations with market participants indicate that gold bar sales maintained their stunning pace seen in 2024, even leading to inventory shortages for some,” Jia said.

We believe the current trend may continue.

While demand for gold jewelry may remain low, demand for gold bars and coins is expected to stay strong.

Any adjustment in gold prices could be seen as a buying opportunity.

“Lastly, we believe a recent announcement of policy changes that allows ten Chinese insurers to buy up to 1% of each company’s total assets in physical gold, as a pilot run, should provide longer-term support for local investment gold demand,” Jia said.

The post Why WGC expects China's gold bar and coin demand to remain strong? appeared first on Invezz