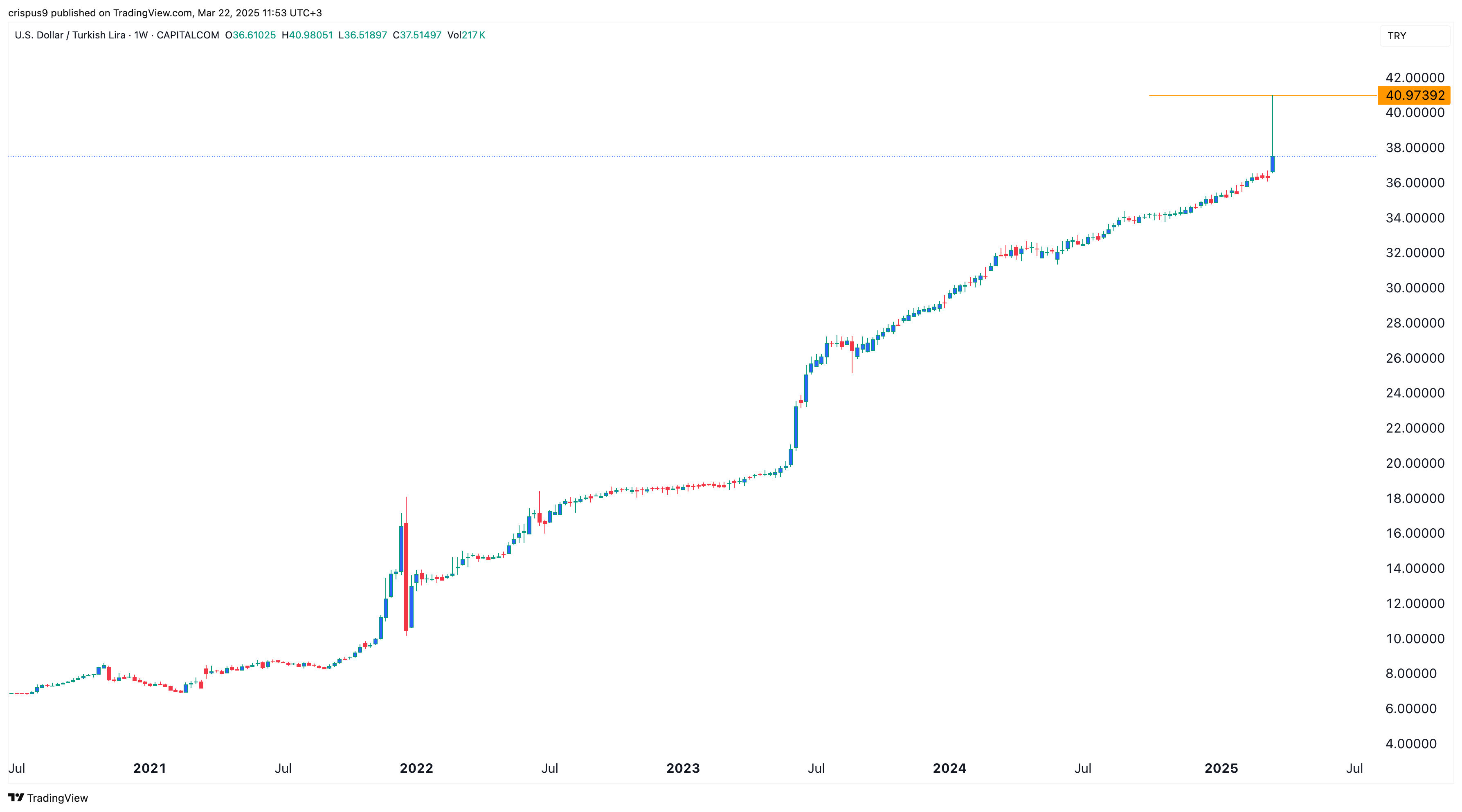

The Turkish lira has surged in the past few days even as political risks in the country soared. The USD/TRY exchange rate initially soared to a record high of 40.97 on Wednesday but ended the week at 37.50. It has soared by almost 9% in the past few days as the Central Bank of the Republic of Turkey (CBRT) intervened.

CBRT interventions lift the Turkish lira

Local and global investors initially dumped the Turkish lira when the Recep Erdogan administration arrested a prominent opposition leader. At its lowest point on Wednesday, the lira had plunged by 18% from its highest level this year.

This sell-off eased when the CBRT intervened in the forex market by spending almost $12 billion. It spent about $11.5 billion on Wednesday, four times bigger than the previous forex intervention in the country. The interventions continued on Thursday and Friday.

On top of this, the CBRT monetary policy committee held an emergency meeting and hiked interest rates for the first time in months. This rate hike was a major reversal since the bank has delivered several rate cuts in the past few months.

The bank hopes that the rate hikes will help draw more Turkish investors to the lira instead of rotating to foreign currencies. It is working as hedge funds have boosted the USD and TRY carry trade has jumped to $35 billion. A carry trade is a situation where investors borrow a lower-yielding currency and invest in a higher-yielding one.

Read more: USD/TRY forecast: ING experts see Turkish lira falling to 43

CBRT independence

The USD/TRY has been in a constant uptrend in decades as Erdogan has moved to strip the central bank its independence. Unlike in other countries where the president cannot fire a governor at will, Erdogan can hire and fire governors at will. He has done that several times in the past few years.

Erdogan’s policies have made the Turkish lira one of the worst-performing currencies globally as it moved from 3 to 37 against the US dollar. In real times, which includes interest rates, it has been one of the top performers recently as its crash decelerated.

The plunging lira has contributed to a surge in inflation over the years, although this trend has reversed lately. The most recent data showed that the Turkish consumer price index dropped to 39% in February from a high of 76 last year.

USD/TRY technical analysis

The weekly chart shows that the USDTRY exchange rate has been in a strong uptrend for a long time. It rose to a high of 40.97 for the first time on record this year in line with our previous USDTRY forecast. It remains above all moving averages, a sign that bulls are in control for now.

However, the weekly chart shows that it has formed a shooting star candlestick pattern, a popular reversal sign. Therefore, there is a likelihood that it will drop for a while as the market reflects on the recent actions by the Turkish central bank. Such a move may see it drop to the key psychological point at 35.

The post USD/TRY: The $12 billion reason why the Turkish lira is surging appeared first on Invezz