Today is the first Friday of the month, meaning that the July Non-Farm Payrolls (NFP) report is due. The report shows the change in the number of workers in the US economy and is viewed as an indicator that moves financial markets the most.

As such, financial markets are very slow ahead of the NFP release. Because no one wants to take a chance before the report, most traders and investors prefer to wait for the report to be released and then react.

The report is essential because of the change in the number of workers and because it contains all kinds of data, such as the unemployment rate, average hourly earnings, and labor participation rate.

As the US economy is the largest in the world, the changes in the job market are closely monitored by everyone because the Federal Reserve might change its monetary policy based on the job market evolution.

Also, the US dollar‘s volatility increases dramatically during the NFP day, bringing opportunities and challenges to currency traders. The US Dollar Index (DXY) is one way to track the greenback, as it reflects the dollar’s relative strength.

What is the US Dollar Index?

The US Dollar Index helps interpret the dollar’s value against a basket of other currencies. Introduced in 1973 by the Federal Reserve, it has been calculated and maintained by the Intercontinental Exchange (ICE) since 1985.

Initially, the index included 10 currencies, but in 1999, following the introduction of the euro, the number of currencies was reduced. Six currencies are currently part of the US Dollar Index: EUR, JPY, GBP, CAD, SEK, CHF. The euro has the biggest weight in the US Dollar Index’s calculation, with 57.6%, followed by the Japanese yen with 13.6%.

The index reached the highest value in 1985 (163.83) and the lowest in 2008 (71.58). When introduced, the initial value was 100.

What are the expectations for the July NFP report?

Economists expect the US economy to add 205k new jobs in July, following a 209k increase a month earlier. Also, the unemployment rate is expected to remain stable at 3.6%.

However, the bias is that the report will show a more robust labor market.

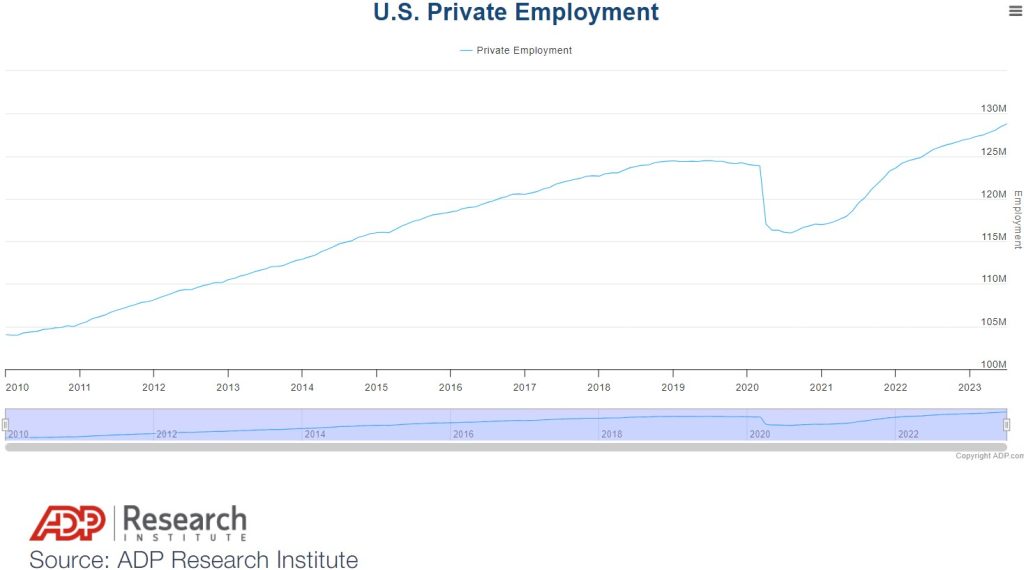

Two days earlier, on Wednesday, the US private employment for July showed that private employers added 324k new jobs, with leisure and hospitality sectors driving growth.

US Dollar Index price forecast

The index found support at the 100 level, following a steady decline since its recent peak in the second half of last year. Interestingly, the index formed a possible reversal pattern on its way down from last year’s highs – a falling wedge.

Falling wedges reflect reversal conditions. When the upper edge of the pattern is broken, the market usually travels at least half the distance of the entire pattern, without making a new lower low.

Hence, the bias ahead of the July NFP report is bullish on the dollar. If the DXY closes the week above the upper edge of the pattern, it should continue to rally in the following weeks.

The post US Dollar Index (DXY) forecast ahead of the July NFP report appeared first on Invezz.