The Rolls-Royce share price continued its strong bullish momentum this month as investors cheered its strong earnings and its progress towards achieving its targets earlier. RR stock has jumped in the last eight consecutive months, breaking a record. Its previous streak was a six-month gain in 2014.

Why the Rolls-Royce share price is soaring

The Rolls-Royce stock price has done well and is up by over 40% this year. Its surge intensified this year as the company published strong financial results that showed that it achieved its mid-year targets earlier than expected.

The most recent results showed that Rolls-Royce Group made over £17.84 billion in 2024, much higher than the £15.4 billion it made a year earlier.

Its operating profit jumped from £1.59 billion in 2023 to over £2.4 billion, while the free cash flow rose to over £2.42 billion.

This growth happened as the company continued its transformation journey. It continued to test its UltraFan engine as it positions itself as a major player in the narrow and widebody aircraft industry.

Rolls-Royce is also benefiting from the ongoing Small Modular Reactors (SMR) industry that is growing because of the data center demand. It was also selected by the Czech Republic to build small modular reactors, a business that is expected to see strong growth.

Rolls-Royce Holdings has also exited some of its businesses. For example, it sold its direct air capture assets as it worked to slash costs.

Read more: What next for the soaring Rolls-Royce share price?

RR growth is continuing

Rolls-Royce share price has surged as the company published strong financial results, which showed that all its segments were doing well.

Its civil aerospace, the most important business in its business, made over £9 billion, up by about 24% a year earlier. The gross profit and free cash flow jumped by 44% and 224%. Most of this revenue came from large engines, followed by business aviation.

The defence business did well in 2024. Its revenue rose by 13% to £4.5 billion, a trend that may continue this year, as demand for submarines rose. This division is expected to do well as European countries boost their defense spending.

Rolls-Royce share price has also surged after demand jumped. Its revenue rose by 11% to £4.2 billion, helped by the power generation business.

This growth has pushed the company has pushed the firm to reinstate its dividends and repurchase its shares.

Analysts anticipate that the company’s growth will continue doing well this year since its valuation is still reasonable. It has a forward P/E ratio of about 37 and a trailing multiple of 37.

Rolls-Royce stock price forecast

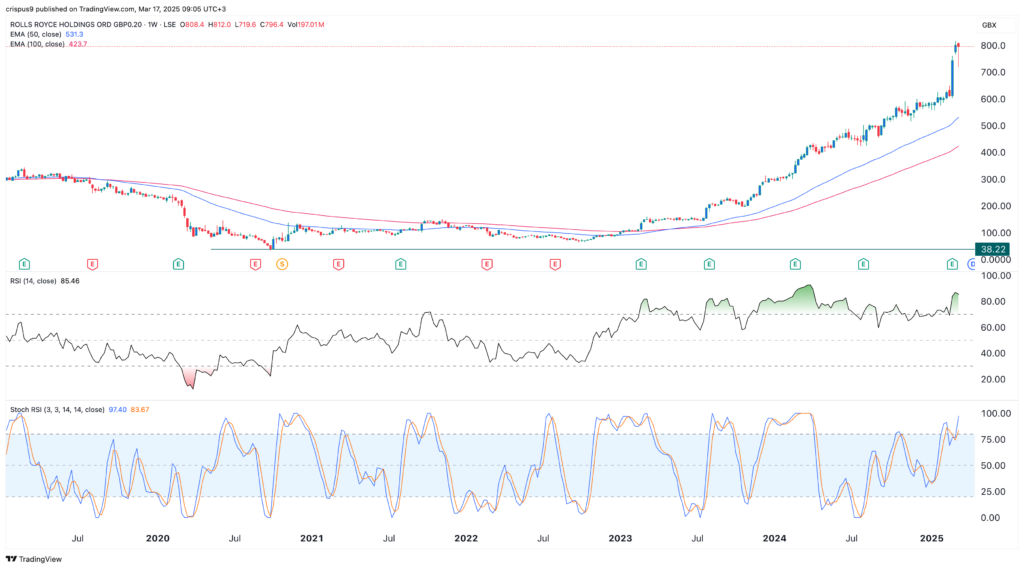

RR chart by TradingView

The weekly chart shows that the RR stock price has been in a strong bull run in the past few years. It jumped from a low of 38.22p in 2021 to a high of 800p, making it one of the best-performing companies in the FTSE 100 index. This surge is in line with our recent forecast.

The stock has remained above the 50-week and 100-week Exponential Moving Averages (EMA). It is about 50% above the current level.

The Relative Strength Index (RSI) and the Stochastic Oscillator have moved to their overbought level.

Therefore, the momentum will likely continue rising as bulls target the key resistance at 1,000p, which is about 25% above the current level.

The risk, however, is that it may go through mean reversion, where it will retreat and retest the moving averages.

The post Will the surging Rolls-Royce share price 1,000p in 2025? appeared first on Invezz