The iShares 20+ Year Treasury Bond ETF (TLT) and the Vanguard Long-Term Treasury Index Fund ETF (VGLT) ETFs have pulled back in the past few weeks as investors assess the next actions of the Federal Reserve and a potential black swan event in the US.

The more popular TLT ETF retreated to $94.45, down by 7.05% from its highest point this year. Similarly, the VGLT fund has retreated by 6.12% to $59. The two three-star rated funds have had positive total returns this year, rising by over 13%.

Federal Reserve actions

The TLT and VGLT funds are some of the biggest bond funds in Wall Street with over $58 billion and $19 billion, respectively.

TLT tracks the ICE U.S. Treasury 20+ Years Bond Index while the VGLT invests in government bonds with a maturity of between 10 and 25 years.

These funds are affected by the movement in long-term interest rates in the United States, which is in turn, influenced by the Federal Reserve’s actions.

The most recent data shows that the benchmark 30-year Treasury Yield was trading at 4.34%, up from the year-to-date low of 3.8%. Shorter-term yields have also bounced back, with the two-year rising from 3.5% to 4%.

These yields have jumped because of the changing view about the Federal Reserve. A few weeks ago, the consensus view among analysts was that the Fed would deliver several jumbo rate cuts to put a check on the labor market.

That happened after a series of weaker jobs reports. For example, the Bureau of Labor Statistics (BLS) revised downwards the number of jobs created in the 12 months to March this year by over 800k.

More data showed that the unemployment rate crawled back from a low of 3.5% this year to 4.3%, while wage growth slowed.

All this happened at a time when the country’s inflation was moving downwards. After peaking at a 40-year high of 9.1% in 2022, the headline Consumer Price Index (CPI) has retreated to 2.5%.

The closely watched personal consumption expenditure (PCE) has also retreated from 6.8% to 2.2%, meaning that these figures are approaching the Fed’s 2.0% target.

The next key catalyst for the TLT and VGLT ETFs will be the upcoming US inflation data, which will likely have little impact on the next Federal Reserve actions. Analysts expect the data to show that the headline CPI retreated from 2.5% in August to 2.3% in September.

Black swan event ahead

The biggest risk for US long-term bonds and ETFs like TLT and VGLT is that the economy faces a major black swan event after the upcoming general election.

The swan event to watch is the public debt, which has entered beast mode in the past few years. Data shows that the total public debt has risen from about $10 trillion to $33.5 trillion today, and is adding $1 trillion after every three months. Granted, the GDP has risen from $14.7 trillion to $28.1 trillion in the same period.

This debt increase has happened when Democrats and Republicans were in power. Donald Trump, a Republican, added public debt by over $8 trillion, in part because of tax cuts and his pandemic response.

However, the challenge is that the current trajectory is not good, and the situation could worsen after the next election.

A report by a non-partisan agency estimated that Trump’s actions will boost the budget deficit by $7.5 trillion in the next decade. His plan to extend his tax cuts and implement additional ones will influence this deficit.

Kamala Harris is also expected to boost the deficit in her tenure because of her welfare spending, which will be influenced by her tax increases. Her spending will boost the deficit by $3.5 trillion.

Therefore, the black swan event is where the US loses the last Triple-A credit from Moody’s. S&P downgraded the US to AA+ in 2011, while Fitch did the same in 2023. Moody’s has warned that the ongoing unconstrained spending could push it to slash its rating.

As such, there is a risk that the US could go through what the UK went through during the mini-budget crisis in 2022.

VGLT vs TLT: which is a better buy?

The VGLT and TLT ETFs are risky funds to invest in because of the elevated US public debt risks. However, if I had to recommend – and I am not – I believe that the smaller VGLT is a better one to invest in.

VGLT has a dividend yield of 3.86% while the TLT fund yields 3.85%. Its four-year average yield is 2.75% while TLT is 2.48%.

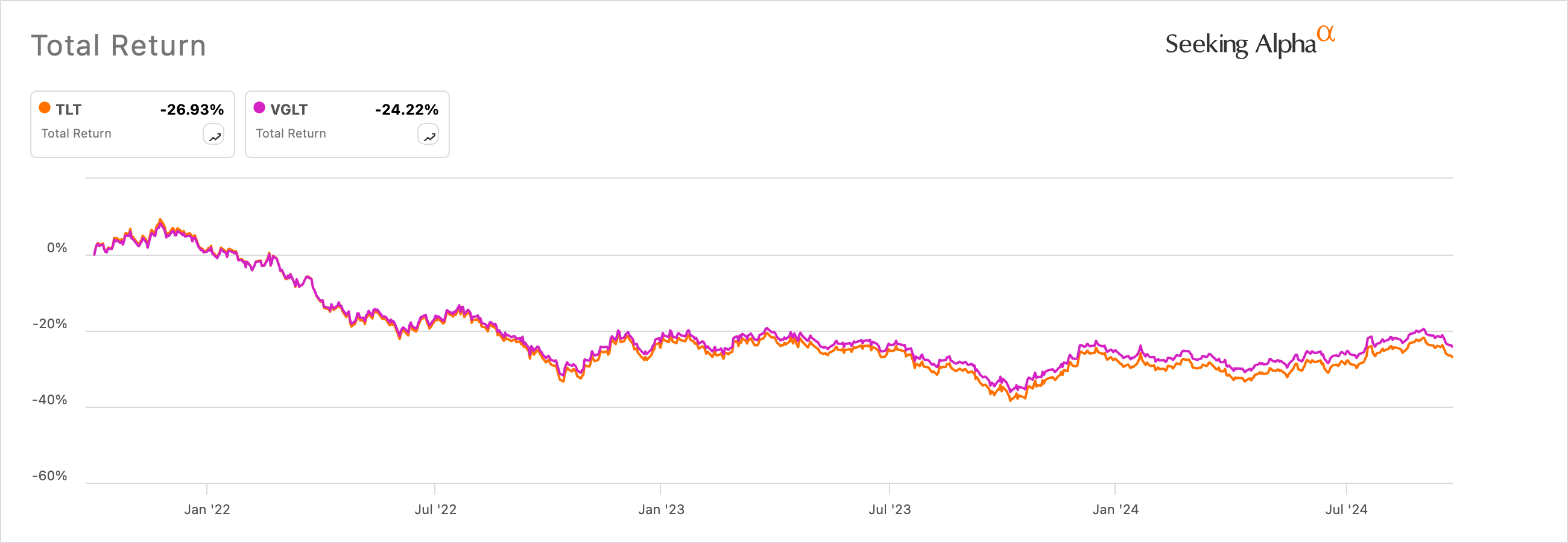

Another important data is that VGLT is a cheaper fund to invest in because of its 0.04% expense ratio compared to TLT’s 0.15%. These factors explain why the VGLT has done better than the TLT in the last few years.

The post VGLT and TLT ETFs retreat; concerns of a black swan event rise appeared first on Invezz