The Stellantis (STLA) stock price has moved into a deep bear market as doubts about the company’s future remains. Its American shares plunged to a low of $13.40 on Wednesday, its lowest point since January 2023, and down by over 51% from its highest point this year.

Stellantis has severely underperformed other large automakers. It has dropped by almost 40% this year, while Ford has fallen by almost 10% this year while Renault and General Motors have risen by 34% and 9.52%, respectively.

Stellantis business is struggling

Stellantis is not a popular name, yet it is one of the biggest companies in the auto industry. It owns some of the most popular brands, especially in Europe and North America.

It was formed through the merger of Fiat Chrysler with PSA, a French company known for its Peugeot brand.

Before that, Fiat acquired Chrysler, the smallest of the large Detroit automakers from bankruptcy.

Some of the other popular brands in the Stellantis umbrella are Alpha Romeo, Dodge, Jeep, and RAM.

Stellantis’ business has gone through a rollercoaster in the past few years. Its revenue surged from $149 billion in 2021 to $179 billion and $189 billion in the next two years. This revenue growth translated to more robust profits, with the net income jumping from $14.2 billion in 2021 to $18.59 billion last year.

This profitability has made Carlos Tavares one of the best-paid executive in the auto industry, making $39 million in 2023. His salary was higher than Jim Farley’s (Ford) $26 million and Mary Barra’s (GM) $27.8 million.

Tavares also made more money than Luca de Meo, Renault’s CEO who earned about $6.33 million.

The challenge, however, is that many of Stellantis brands are not doing well, partly because of many years of underinvestment. Just recently, Kevin Farrish, the head of the US National Dealer Council wrote a scathing letter, saying:

“We did not create this problem, the federal government did not create this problem, the UAW did not create this problem, and your employees did not create this problem — you created this problem.”

Read more: Stellantis stock can only go up after US sales decline: here’s why

Stellantis top brands are not doing well

In a recent article on Stellantis, I warned that some of its brands risked going extinct, especially in the United States.

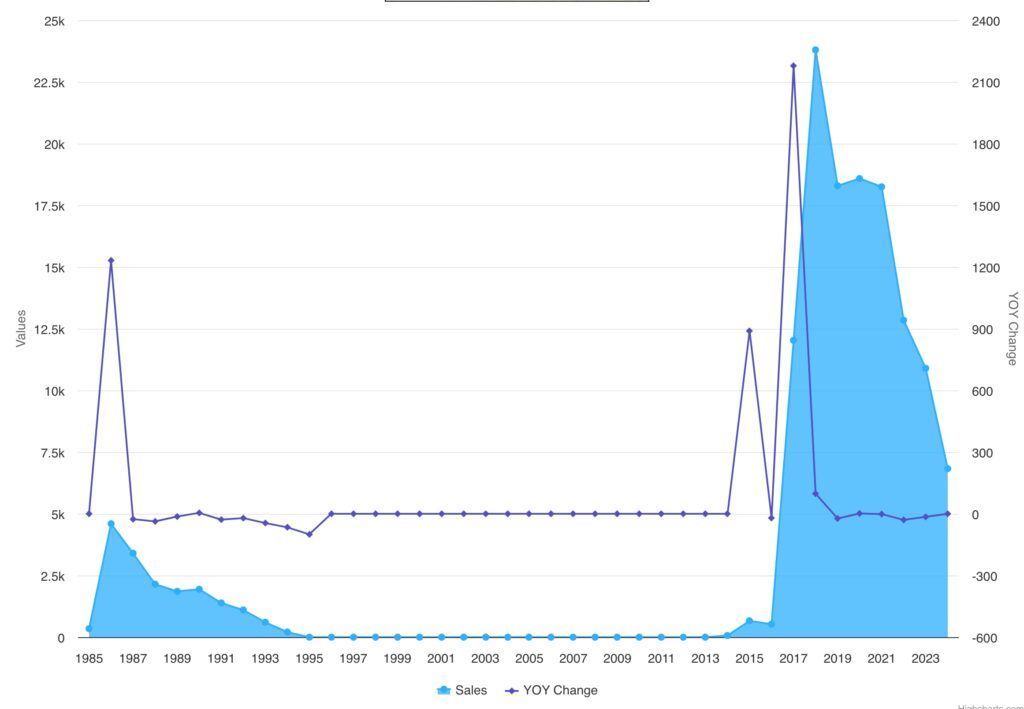

First, there is Alfa Romeo, a brand whose closest competitors are the likes of BMW, Audi, and Lexus. Over the years, the brand has not done well and is not the first car that most people think about when buying a vehicle. As the chart below shows, total sales in the US have tanked in the past few years.

The other notable brand is Maserati, a luxury brand that competes with the likes of Ferrari, McLaren, Aston Martin, and Porsche. Like with Alfa Romeo, very few people think of Maserati when doing their luxury car shopping. For example, data shows that the brand sold 6,500 cars in the first quarter of the year, down from 15,300 in the same period last year.

RAM, one of the best pickup trucks in the US, is also losing market share. Its sales plunged by about 20% in the first half of the year. Its sales have trailed those from Toyota, GM, and Ford. This is a notable development because the US is one of the most important markets for Stellantis.

Other brands that have seen substantial weakness are Jeep, Chrysler, and Dodge. For example, Jeep sales in the US dropped by 34% from the record high.

At the same time, the company is bracing for more competition from quality and affordable Chinese brands, especially in the European market.

Stellantis stock dropped after weak earnings

Analysts believe that Stellantis needs more measures than those announced yet, which have included layoffs.

The most important one is that the company needs to invest in its core brands to grow its market share. To some extent, the company should consider strategic alternatives for some of its top underperforming brands.

The most recent results show that Stellantis combined shipments dropped from over 3.3 million in the first half of the year in 2023 to $2.9 million.

Its net revenue dropped from 98 billion to €85 billion in that period, while its basic earnings per share fell to €1.87.

Stellantis stock price analysis

STLA chart by TradingView

The weekly chart shows that the STLA share price peaked at $27.7 in March 2024, and has plunged to $13.40.

It has dropped to the 61.8% Fibonacci Retracement level. Also, it has dropped below the 50-week and 200-week Exponential Moving Averages (EMA), meaning that bears are in control.

Also, the MACD and the Relative Strength Index (RSI) have continued falling. Therefore, the path of the least resistance for the Stellantis share price is bearish, with the next point to watch being at $9, the 78.6% retracement point.

The post Stellantis stock is down 51% from YTD high: buying the dip is risky appeared first on Invezz