The Schwab US Dividend Equity (SCHD) and the Schwab US Large-Cap ETF (SCHX) ETFs are the biggest funds by Charles Schwab by assets. SCHD has over $70 billion in assets, while SCHX has over $50.5 billion. So, which is a better Schwab ETF to buy and hold for value investors?

What is the SCHX ETF?

The SCHX ETF is a top US exchange-traded fund that tracks the Dow Jones US Large-Cap Total Stock Market Index.

This is a top index that gives investors access to about 750 of the biggest companies in the United States. As such, it is often seen as an expanded version of the S&P 500 index and a smaller version of the Russell 1000 index.

The index has a small expense ratio of just 0.03%, and a price-to-earnings ratio of 26.90, making it more expensive than the S&P 500 index with a multiple of 20. Its price to cash flow is 18, while the return on equity is 28%.

By tracking the biggest companies in the US by market cap, the index is mostly made up of technology company, which make up about 32% of the total fund. The other large segments in the industry are financials, consumer discretionary, healthcare, and communication services.

The fund’s biggest companies are Apple, NVIDIA, Microsoft, Amazon, Meta Platforms, Alphabet, and Berkshire Hathaway.

What is the SCHD ETF?

The SCHD ETF is a popular fund that tracks the Dow Jones US Dividend 100 index.

This fund tracks 100 companies that have companies that have a long history of paying dividends to their shareholders. It also focuses on companies that have fundamental relative strengths compared to their peers.

The SCHD ETF is less overvalued than the SCHX ETF as it has a PE ratio of 17, which is smaller than that of the S&P 500 and the SCHX fund. Its return on equity is about 28%, while the price-to-free cash flow was 28%.

The biggest companies in the SCHD ETF are in industries like financials, healthcare, consumer staples, industrials, energy, and consumer discretionary. Some of the top companies in the fund are companies like Abbvie, Amgen, Coca-Cola, Verizon, Pfizer, and Cisco Systems.

All these are top blue-chip companies with a large market share in their respective industries.

Read more: SCHD outlook for 2025: blue chip dividend ETF faces turbulence

SCHD vs SCHX ETF: Which is a better buy?

The SCHD and SCHX ETFs seek to achieve different goals for their investors.

SCHD aims to provide regular dividends to its investors. It has a dividend yield of about 3.60%, higher than the S&P 500 average of 2.3%.

The SCHX, on the other hand, focuses mostly on growth because of its emphasis on technology companies.

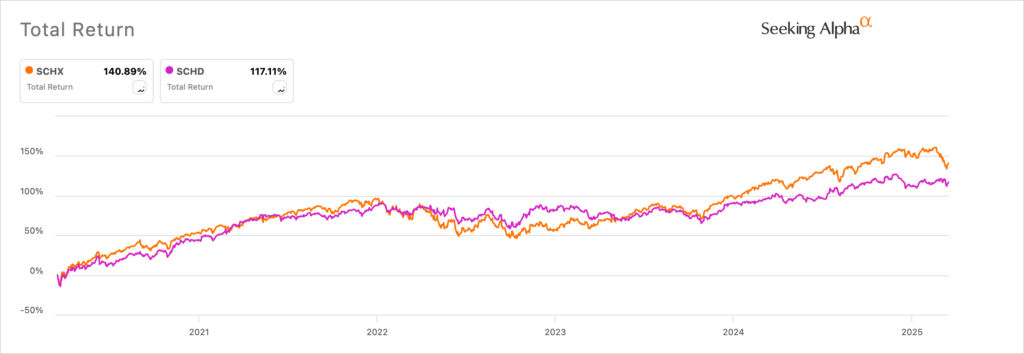

This divergence has made the SCHX ETF a better performer than the SCHD. Its total return in the past five years stood at 140%, higher than the SCHD’s 117%.

The same performance has happened in the last 12 months as the SCHX has returned 11.5%, compared to SCHD’s 10.5%.

Therefore, while the SCHX is a better fund than the SCHD, analysts recommend having the two funds in a portfolio. In this case, SCHD will be a value fund that will provide regular dividends, while the SCHX will provide growth by having access to quality technology companies like Apple, Microsoft, and NVIDIA.

The SCHX ETF will likely do better than the SCHD in case of a recession in the US since it will push the Federal Reserve to cut interest rates earlier on.

Read more: Best all-weather SCHD ETF stocks to buy and hold in 2025

The post SCHD vs SCHX: Which is a better Schwab ETF to buy? appeared first on Invezz