Pi Network price has crashed this month as demand and hype surrounding the coin eases. After soaring to an all-time high of $3 last month, it has dropped by over 60% to the current $1.1630. So, what next for the Pi coin in the next few years, and will it become a viable Bitcoin rival?

Why Pi Network price has crashed

Pi Network is a cryptocurrency project that has been around in the last seven years. It was in its development phase for the most part of this period. In it, over 60 million pioneers actively mined it, with the goal of converting their winnings into fiat currencies like the US dollar.

Pi Network launched its mainnet in February, making it possible for pioneers to sell their tokens. As was widely expected, the Pi coin fell immediately after being listed in several exchanges like OKX and MEXC. This crash happened as these pioneers sold their tokens.

Pi Network price then bounced back immediately after that and reached an all-time high of $. This rebound happened as the hype surrounding the Pi coin jumped.

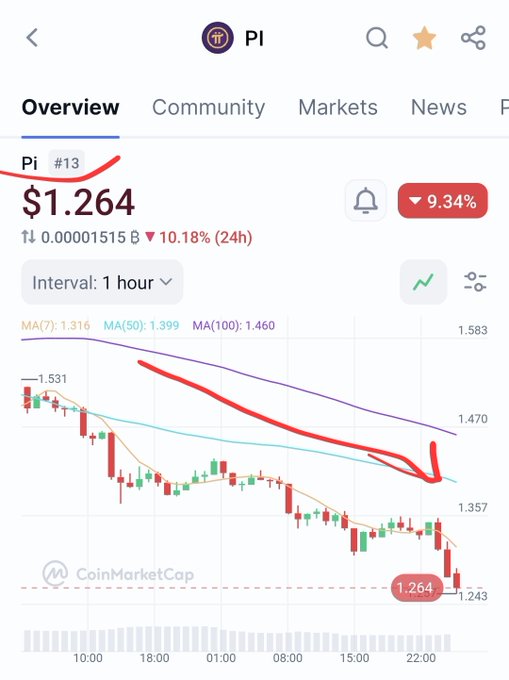

Recently, however, Pi coin has crashed, and is now hovering near its lowest level since February 22.

There are a few reasons why the value of Pi has crashed in the past few weeks. First, the hype surrounding the token has waned, pushing more holders to sell their tokens.

Pi has dropped to #13 in the CMC ranking as its price falls below $1.3. The price drop is directly correlated with public sentiment. The failure to get listed on Binance, despite 86% of the community voting in favor, raises serious concerns about public trust in the project. This…

Second, the much-anticipated Binance listing has not happened yet. Binance ran a poll on whether it should list the Pi Network. While most users voted in favor of listing, the company is yet to confirm when it will happen.

Read more: Pi Network price prediction 2025 – 2030 after the mainnet launch

Third, there are concerns about the future dilution of the Pi Network token. Data by CoinMarketCap shows that Pi Network has a maximum supply of 100 billion tokens, and a circulating one of 6.8 billion. This means that the network will unlock over 93 billion tokens over time.

Some of these tokens or about 1.4 billion tokens, will be unlocked this year, and billions more in the next few years. Unless Pi Network introduces a burn mechanism, there are chances that the supply will become more than demand, which will affect the price.

Potential catalysts for Pi coin

There are a few catalysts that may help to push Pi coin price higher in the long term. First, there are rising recession odds in the US as Donald Trump implements large tariffs on imported goods from countries like China, Canada, and Mexico. A recession would be a good thing for cryptocurrencies like the Pi Network because it will lead to interest rate cuts.

Second, Pi Network has become a large cryptocurrency valued at over $12 billion. It is also one of the most actively traded coins in the market. As such, it is just a matter of time before major companies like Coinbase, UpBit, and Binance list it. They will list it to benefit from the fees that it is generating for other exchanges.

Third, Pi Network is a made-in-USA coin with a valuation of over $12 billion. It is also a proof-of-work token that has higher volumes than other coins like Litecoin, Hedera Hashgraph, Sui, and Polkadot, which have received ETF applications. This means that there are odds that one or more companies will apply for a spot Pi ETF, a move that would lead to more demand.

Pi Coin price analysis

Technicals suggest that the Pi Network price has more downside to go. It has dropped below the 50-period and 25-period moving averages, a sign that bears are in control for now.

Pi Network has also moved below the ascending trendline that connects the lowest swings since February 25. This price was the lower side of the head and shoulders chart pattern, a popular bearish continuation sign.

Therefore, the short-term outlook for the Pi coin prIce is bearish, with the next target to watch being at $0.61, the lowest swing on February 25. In the long-term, however, the Pi Network price will likely bounce back and retest the resistance at $5 as the catalysts above happen.

The post Pi Network price prediction: is it safe to buy the Pi coin dip? appeared first on Invezz