The GraniteShares 2x Long NVDA Daily ETF (NVDL) and the YieldMax NVDA Option Income Strategy ETF (NVDY) ETFs will be in the spotlight this week as NVIDIA publishes its financial results on Wednesday. This article explains whether NVDY and NVDL are good investments ahead of the earnings.

What are NVDL and NVDY ETFs?

The NVDL ETL is a leveraged fund that aims to achieve an amplified performance of the NVDIA stock. In this case, the fund rises 2x whenever NVIDIA stock rises, and vice versa. For example, the NVDL stock dropped by 4% on Friday as the NVDA stock dumped by 2%. It has $4.6 billion in assets and an expense ratio of 1.06%.

The NVDY ETF, on the other hand, is a covered call fund that aims to generate regular payouts to investors. It does that by investing in NVIDIA shares and then selling call options, a move that gives it an instant premium that it distributes to its shareholders. It has over $1.5 billion in assets and an expense ratio of 1.01%.

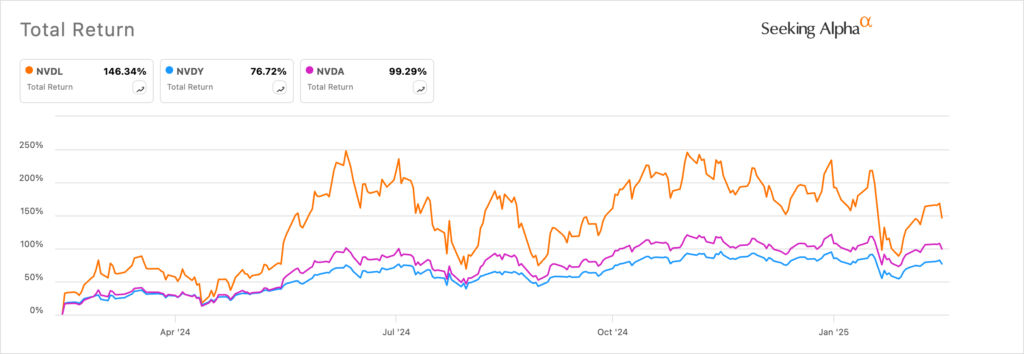

NVDY’s stock return is often lower than that of NVIDIA, but it then compensates it with the dividend payouts. For example, while the stock has crashed by about 14% in the last 12 months, the total return was about 76% in that period. NVDY has a dividend yield of 98%, a figure that often wavers.

Read more: Nvidia Q3 earnings surpass expectations as AI demand drives record revenue

NVIDIA earnings preview

The key catalyst for the NVDY and NVDL stock prices will be the upcoming NVDIA earnings, which will provide more color on its performance.

NVDIA has been one of the best-performing companies in the US as its sales have surged amid the ongoing semiconductor demand. Companies like Microsoft, Amazon, Xai, and Google are expected to spend over $320 billion in chips for their data centers this year.

NVIDIA’s business has had a spectacular growth rate in the past few years as its annual revenue surged from $10.9 billion in 2020 to $60.9 billion in 2023. It has made over $113 billion in the trailing twelve months (TTM).

Analysts are optimistic about NVIDIA’s earnings this week. The average estimate is that its revenue will be $38.15 billion, a 72% annual increase from the previous quarter. This revenue will bring the total figure for 2024 to $129,28 billion. Its 2024 revenue will be a 112% growth from a year earlier.

Analysts believe that NVIDIA’s revenue will then decelerate to $195 billion this year. This deceleration is understandable since the AI industry growth will start to mature. Also, companies will have more choices, especially now that AMD and Intel have launched their AI chips.

NVDA has become a highly profitable company, with its earnings per share expected to move to 85 cents from the 52 cents it made a year earlier.The annual EPS is expected to move from 1.3 cents to 2.9 cents.

Implication on NVDL and NVDY stocks

NVDA vs NVDL vs NVDY performance

So, how will the financial results affect the NVDY and NVDL stocks? These ETFs react differently to NVDA’s stocks. NVDL stock rises two times based on the NVDA’s daily performance.

NVDL stock performance also mirrors that of NVDA, but it has some limitations because of the call option element.

There are odds that the NVDA stock price will jump after earnings and push the two ETFs higher. In addition to beating analysts estimates, the company may demonstrate that its business is doing well despite the DeepSeek AI threat in China.

However, there is a risk that the company will issue a softer guidance as it faces the reality that AI spending may slow this year. The key support and resistance levels to watch for the NVDA stock will be $112 (3rd Feb high) and $152 (2024 high)

The post NVDY, NVDL ETFs analysis ahead of the NVIDIA earnings appeared first on Invezz