Ethereum price surged on Tuesday morning as expectations that the Securities and Exchange Commission (SEC) will approve ETH ETFs jumped. The token has soared to over $3,700 and is quickly nearing its year-to-date high of $4,090.

Ethereum balances are tumbling

Most analysts believe that the SEC will approve Ethereum ETFs by companies like Ark Invest, Blackrock, Franklin Templeton, and Invesco.

Such a move will likely lead to more Ethereum demand as we saw with Bitcoin earlier this year. The iShares Bitcoin Trust (IBIT) is the fastest-growing ETFs globally as it added over $18 billion in assets within five months. All spot Bitcoin ETFs have over $50 billion in assets.

Ethereum will likely have the same performance because it is the second-biggest cryptocurrency in the world. And unlike Bitcoin, Ethereum ETFs, if approved, will distribute staking rewards to investors each month.

Staking, where Ethereum holders delegate their tokens to support the network, is one reason why the SEC may reject the applications. In past statements, SEC’s Gary Gensler has argued that staking makes Ethereum an unregistered security.

If it approves the Ethereum ETF, it means that the agency will likely accept future applications for tokens like Solana, Polkadot, and Cardano.

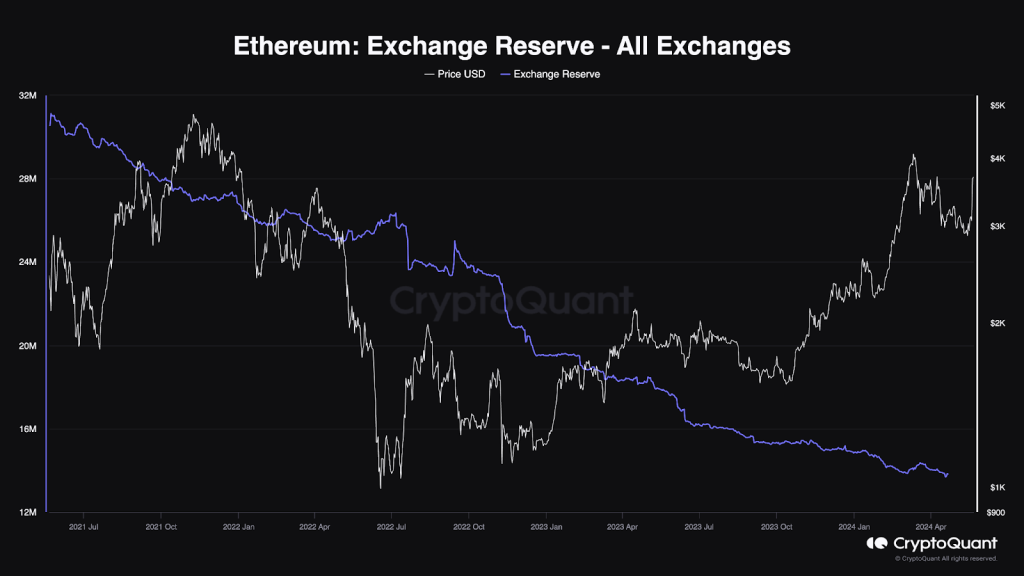

Meanwhile, the world is running out of Ethereum coins. Data shows that Ether balances in exchanges like Binance, Coinbase, and Bybit has plunged to its lowest level in months. There are now about 13.8 million ETH exchange reserves, down from almost 32 million in 2021.

Ethereum balances in exchanges

The exchange reserves have dropped as more people have moved their tokens to wallets like MetaMask and OKX Wallet. Other tokens have been staked, with data showing that the total staked market cap has jumped to over $120 billion.

Fundamentally, Ethereum still has a leading market share in key industries like DeFi and tokenisation. However, it is also facing substantial competition from Solana, which has become the go-to blockchain among most new developers.

Ethereum price forecast

Turning to the daily chart, we see that the ETH token has made a bullish breakout in the past two days. This breakout happened after the token formed a falling wedge pattern, a popular bullish signs.

ETH has jumped above the upper side of the wedge and has constantly remained above the 200-day Exponential Moving Averages (EMA) It has also jumped above the Ichimoku cloud. It has also jumped above the first resistance of the Woodie pivot point.

Therefore, the outlook for the token is bullish, with the next target to watch being at $4,090. A breach above that level will increase the possibility of the token surging to $5,000.

The post Ethereum price prediction as supply in exchanges plummets appeared first on Invezz