Crypto prices have started the year on a strong note, with Bitcoin surging to over $87,500 and Ethereum rising to $1,340. The total market cap of all cryptocurrencies tracked by CoinMarketCap jumped to $2.76 trillion. This article provides a forecast for top tokens like Stellar Lumens (XLM), Decentraland (MANA), and Stacks (STX).

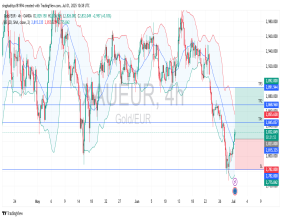

Stellar price technical analysis

Stellar is one of the top players in the crypto market. It is often seen as Ripple’s cousin because it was established by Jed McCaleb, one of Ripple Labs founders. Like Ripple, it is also in the cross-border payment industry.

The Stellar price often follows that of XRP, meaning it may track its performance. As we wrote earlier, there is a likelihood that the XRP token will jump by as much as 50% in the coming weeks.

Stellar price has formed a falling wedge pattern on the daily chart. As shown above, the upper side of this pattern connects the highest swings since January 16. Its lower side links the lowest swings since December 20th last year.

These two lines are now about to intersect, as the XLM price has risen above the upper boundary. Oscillators like the Relative Strength Index (RSI) and the Stochastic Oscillator have all pointed upwards.

Therefore, the token will likely continue rising, with the next point to watch being at $0.4041. To get this target, we measured the widest part of the falling wedge pattern, and then the same distance from the wedge’s upper side. This performance will be confirmed if the price moves above the 50-day moving average at $0.2670.

A drop below the lower side of the wedge at $0.1974 will invalidate the bullish forecast and point to more downside, potentially to $0.10.

Decentraland price analysis

Decentraland is one of the most popular players in the gaming and metaverse industry. MANA, its token has bounced back in the past few weeks, moving from a low of $0.1898 earlier this month to the current $0.3361.

The token formed a giant double-bottom pattern at $0.2115, its lowest swing in August last year and April. A double bottom is one of the most bullish patterns in technical analysis.

The token has moved above the 50-day moving average, while the Relative Strength Index (RSI) has pointed upwards. It also formed an inverse head-and-shoulders chart pattern, a popular bullish reversal sign.

Therefore, the coin is likely to continue rising as bulls target the next key psychological point at $0.50, which is approximately 60% higher than the current level. A drop below the psychological point at $0.25 will invalidate the bullish outlook.

Stacks price analysis

Stacks, a popular Bitcoin sidechain, has performed well over the past few days, with its token showing signs of stabilizing at $0.5850. It has risen slightly in the past four straight days, as the total value locked (TVL) in the network rising by 25% in the last seven days to $167 million.

The STX token has formed a bullish divergence pattern as the Relative Strength Index (RSI) and the MACD indicators rising. It has also formed a double-bottom pattern at $0.5650.

Therefore, the token will likely keep soaring as bulls target the next key resistance level at $1, which is about 45% above the current level. A drop below the key support at $0.5650 will invalidate the bullish view.

Other crypto coins to watch

There are other crypto tokens showing strong potential this week. Some of these ones are The Sandbox (SAND), Injective (INJ), NEAR Protocol (NEAR), Fartcoin, and Algorand.

The post Crypto price predictions: Stellar (XLM), Decentraland (MANA), Stacks (STX) appeared first on Invezz