Investing in quality blue-chip ETFs can be a great way to ensuring a rich retirement. Analysts recommend investing in ETFs that combine growth, value, and regular dividends. This article looks at some of the best SWAN blue-chip ETFs to buy and hold for a rich retirement. SWAN stands for sleep well at night.

Grayscale Mini Bitcoin Trust (BTC)

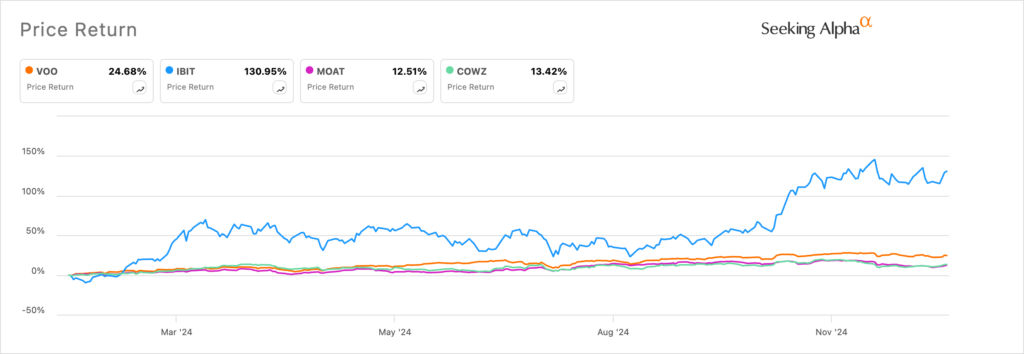

The Grayscale Mini Bitcoin Trust is one of the best blue-chip ETFs to buy and hold for a rich retirement. That’s because Bitcoin has some of the best features in that it is in a high demand while its supply is in a freefall. There will only be 21 million Bitcoins, most of which have been mined and held by investors.

Bitcoin also has a long record of doing well and beating American equities. It has jumped from near zero in 2009 to over $100,000, and this trend may go on for a long time. Some analysts anticipate that the price will surge to over $1 million in the next decade.

Buying and holding Bitcoin in a private wallet is one of the best ways to invest in the coin because it will not cost you any money. If you have to buy a Bitcoin ETF, Grayscale’s mini fund, which has $3.9 billion in assets is the best fund to buy.

The BTC fund has an expense ratio of 0.15%, making it the cheapest ETF in the industry. It is much cheaper than the iShares Bitcoin Trust (IBIT), which charges a 0.25% fee. A $100,000 investment in BTC will cost $150, while a similar allocation in IBIT will cost $250 annually. Why pay more for a similar investment?

iShares S&P 500 (IVV) or Vanguard S&P 500 (VOO)

The other best blue-chip ETF to buy and hold for a SWAN retirement is either the IVV or the VOO. These popular funds track the S&P 500 index and charge the same expense ratio of 0.03%. The ETF is slightly cheaper than the SPDR S&P 500 ETF (SPY), which charges about 0.09%.

The S&P 500 index tracks the biggest companies in the United States, including popular brands like NVIDIA, Microsoft, and Alphabet. These are all some of the most important companies globally because of their services.

The S&P 500 index has a long track record of performance and beating other American exchange-traded funds. While the fund regularly drops, such as during the dot com bubble and the Global Housing Crisis, it always bounces back.

IVV and VOO ETF investors might also consider allocating cash in funds tracking the Nasdaq 100 index.

Pacer US Cash Cows 100 ETF (COWZ)

The Pacer US Cash Cows 100 ETF is another blue-chip ETF to consider because of what it does. It is a fund that invests in 100 companies that have a record of growing their free cash flows, one of the most important metrics in a company’s books.

It is a fairly balanced fund made up of companies from most sectors. Energy companies account for 24% of the fund, followed by companies in the technology, consumer discretionary, and healthcare industries. The biggest names in the fund are names like EOG Resources, Valero Energy, Chevron, ConocoPhillips, and Haliburton.

VanEck Morningstar Wide Moat ETF (MOAT)

The other blue-chip ETF to consider is the MOAT ETF, which comprises companies with large industry moats. In other words, it looks at companies that have a large competitive advantage against their peers.

Most of these companies are in the health care, industrials, technology, and consumer staples industry. Some of the most notable members of the portfolio are names like Alphabet, Disney, Bristol-Myers Squibb, Gilead Sciences, and Teradyne.

The benefit of investing in this fund is that it often beats the S&P 500 index and is uncorrelated with it.

The post Best blue-chip ETFs to buy for a SWAN and rich retirement appeared first on Invezz