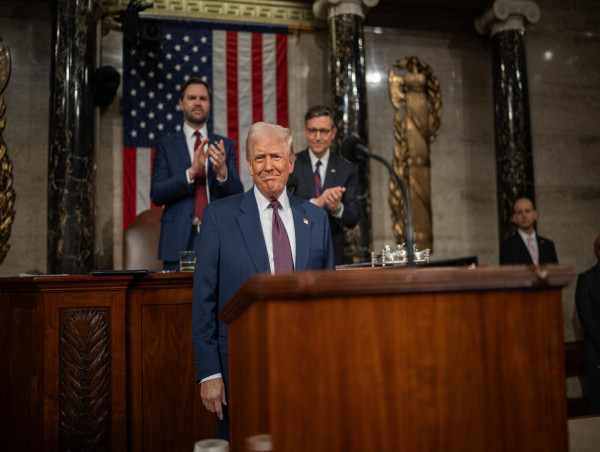

Top oil executives will meet with US President Donald Trump at the White House on Wednesday to discuss strategies for increasing domestic energy production amid falling crude prices and potential trade wars.

This meeting will be Trump’s first with oil and gas leaders since he began his second term as president in January.

The closed-door event will include members of the American Petroleum Institute’s (API) executive committee, according to a Reuters report.

API, a prominent trade group representing the interests of the oil and gas industry, boasts a powerful and influential executive committee.

This committee comprises top leaders from some of the biggest names in the industry.

Notable figures include Darren Woods, the CEO of ExxonMobil; Mike Wirth, the CEO of Chevron; Ryan Lance, the CEO of ConocoPhillips; Mark Lashier, the CEO of Phillips 66; and Maryann Mannen, the CEO of Marathon Petroleum.

These executives, through their leadership roles within API, play a significant part in shaping the policy direction and advocacy efforts of the organisation.

Their collective influence extends to a broad range of issues affecting the oil and gas sector, including environmental regulations, energy policy, and market dynamics.

Dual purpose meeting

The upcoming meeting will serve a dual purpose. On one hand, it will be an opportunity to celebrate President Trump’s early and unwavering support for the oil industry, acknowledging his role in its successes.

This “victory lap” will allow industry leaders to express their gratitude and highlight the positive impacts of the President’s policies.

However, the meeting will not solely be celebratory.

Industry executives are also expected to raise concerns about the potential negative consequences of Trump’s trade wars.

They will likely argue that these trade wars could disrupt global markets and create instability, ultimately harming the oil industry.

Furthermore, the executives are expected to emphasize the necessity of higher oil prices.

Higher prices are essential to incentivise investment in domestic oil production and to achieve Trump’s stated goal of increasing domestic energy independence.

They may suggest that current price levels are insufficient to support the level of investment needed to significantly expand domestic production.

Need for higher oil prices

The Trump administration entered office promising to increase US oil production, which was already at a record high, by up to 3 million barrels per day.

They aimed to lower energy prices for Americans impacted by inflation by easing environmental regulations and accelerating the permitting process.

“The best way to maintain oil production and energy independence is to support a higher oil price,” Ed Hirs, an energy economist at the University of Houston was quoted in the Reuters report.

Drill-baby-drill is not the way forward. And so I think they’re going to try and make that point to him tactfully.

Due to US tariff policies and OPEC+ plans to increase production, benchmark Brent oil prices are projected to average $73 per barrel in 2025.

This forecast by Wood Mackenzie represents a $7 per barrel decrease from the 2024 average.

Oil prices have fallen sharply since January as concerns about an oversupply in the market, coupled with tariff concerns have spooked investors.

API’s opposition

The API has publicly opposed Trump’s pursuit of a trade war with allies Mexico and Canada, partly because the two US neighbors are its top sources of imported crude oil.

Producers who can prove compliance with the United States-Mexico-Canada Agreement (USMCA) are exempt from the tariffs Trump imposed on imported crude from Canada and Mexico.

Last month, in response to the tariffs, API CEO Mike Sommers said:

Energy markets are highly integrated, and free and fair trade across our borders is critical for delivering affordable, reliable energy to U.S. consumers.

Previously, the API had also released a five-point energy plan for Trump and Congress.

The plan includes permit reform, increased offshore oil leasing, tax credits for carbon capture and hydrogen production, and a rollback of subsidies for electric vehicles.

The post Trump to meet oil executives as crude prices slide, raising economic concerns appeared first on Invezz