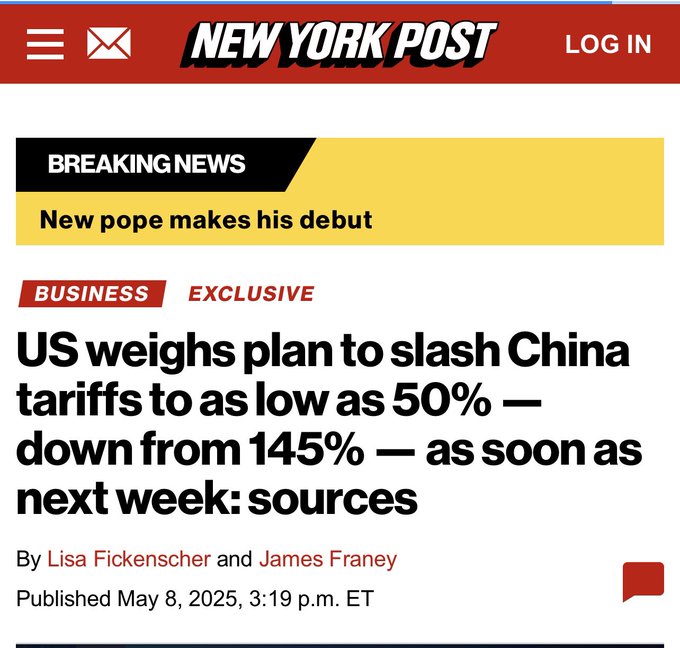

The United States is considering a major rollback of tariffs on Chinese imports, with plans underway to cut the current 145% levy to as low as 50%, according to a report by the New York Post.

The potential move signals a significant shift in the Trump administration’s trade strategy as high-level negotiations between US and Chinese officials are expected to resume in Switzerland next week.

Sources familiar with the matter told The Post that US officials are actively discussing reducing the steep tariffs imposed on Chinese goods to a range between 50% and 54%.

The aim is to ease trade tensions and open the door to a broader agreement between the two economic superpowers.

New York Post is now reporting that U.S. is planning to cut Chinese tariffs from 145% to 50%. 50% is the point where large businesses can absorb the tariffs via price hikes and layoffs (to protect profit margins), but most small businesses can’t. It’s a much better scenario

At the same time, tariffs on imports from other South and Southeast Asian countries could be lowered to around 25%, a step seen as part of a wider recalibration of American trade policy in the Indo-Pacific region.

“They are going to be bringing it down to 50% while the negotiations are ongoing,” one source was quoted as saying by the Post.

The push to reduce tariffs follows President Donald Trump’s recent comments in the Oval Office, where he unveiled a US-UK trade deal and acknowledged that China tariffs “can only come down.”

“It’s at 145%, so we know it’s coming down,” Trump told reporters, adding optimism about improving trade relations with Beijing.

The expected tariff adjustment aligns with comments from Treasury Secretary Scott Bessent, who earlier this week remarked at the Milken Institute Global Conference that the current triple-digit tariffs were “not sustainable.”

The administration’s internal discussions reportedly gained momentum following a White House meeting in April with top US retail CEOs — Doug McMillon (Walmart), Brian Cornell (Target), and Ted Decker (Home Depot) — who described the talks as “constructive.”

Retailers are already preparing for possible changes.

Jay Foreman, CEO of toymaker Basic Fun (maker of Care Bears, Tonka Trucks, and My Little Pony), told The Post that buyers are asking vendors to price goods based on various potential tariff rates, ranging from 10% to 54%.

“The signals we are getting is that the dam will break by the end of this week or next,” Foreman said.

Although White House spokesperson Kush Desai stated that official tariff decisions will come directly from the President and dismissed speculation, market watchers and industry insiders remain optimistic that a deal is in the works.

“People are realizing that deals are going to be made,” a source said.

The development could have a broad impact on global trade flows, consumer prices, and inflation — especially in the retail and manufacturing sectors that rely heavily on Chinese and Southeast Asian imports.

The post Trump may slash China tariffs to 50% as US-China trade talks heat up: report appeared first on Invezz