Highlights

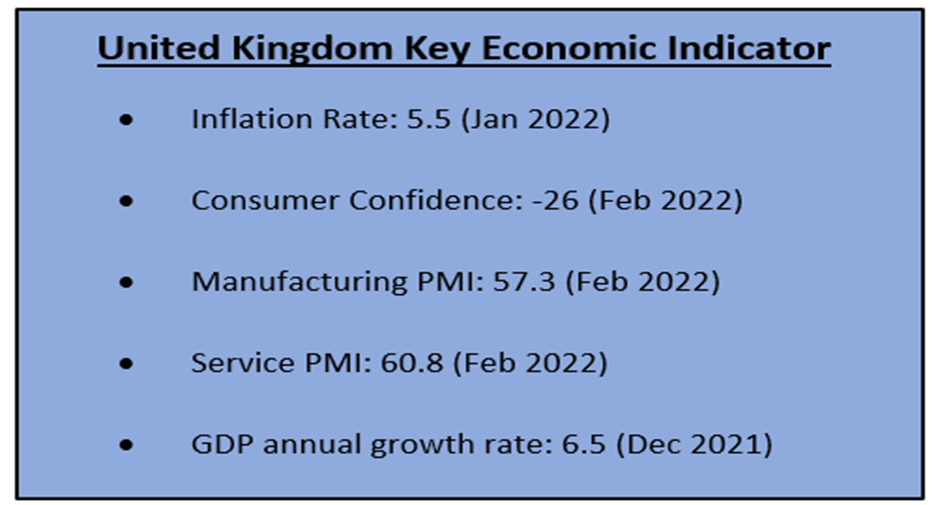

- Consumer confidence in the United Kingdom declined to the lowest level since January 2021.

- According to the latest monthly survey conducted by GfK, consumer confidence dipped by seven points to -26 compared to the previous month’s survey.

In the latest survey conducted by GfK, consumer confidence in the United Kingdom declined to the lowest level since January 2021.

Consumer confidence is a key monthly economic indicator to measure the degree of optimism amongst consumers, which helps get an overall understanding of the economy’s state. According to the survey conducted by GfK, consumer confidence dipped by seven points to -26 compared to the previous month’s survey.

The ease in Covid-19 related restrictions by the UK government failed to lift the public mood as people seemed to be more worried about price rise due to higher inflation in the country. The latest survey was conducted during the first 15 days of February 2022 with over 2,000 people.

The inflation rate in the UK rose to 5.5% in January 2022, reaching nearly 30 years high, adversely impacting the household budget. The current rise in crude oil prices due to the Russia-Ukraine conflict coupled with higher food prices could further accelerate inflation leading to lower consumer confidence in upcoming months.

When consumer confidence is low in an economy, consumers tend to spend less and save more, impacting several sectors, including low sales in the consumer retail segment.

Let us look at 3 FTSE listed retail segment stocks that might get impacted due to lower consumer confidence numbers:

Frasers Group Plc (LON: FRAS)

FTSE250 listed company operates premium retail outlets that sell sportswear, footwear, and other sports equipment and accessories. It has operations in the UK and Europe.

For the 26 weeks ended 24 October 2021, the company reported total revenue of £2,339.8 million, while its reported profit after tax was £143.7 million. The company has presented a positive outlook for the second half of the financial year. However, certain macroeconomic factors like squeezes on consumer spending, supply chain issues, and cost increases might impact the sales.

Frasers Group Plc’s last close was at GBX 621 with a market cap of £3,118 million as of 24 February 2022.

Next Plc (LON: NXT)

The company is engaged in retailing clothes and home products through its retail stores and online retail website. It has operations in over 35 countries.

For the year ended 25 December 2021, the company reported an upbeat sales number, with full-price sales moving up by 13% due to consumers’ pent-up demand. The company has already indicated that it will increase the cost of its goods in 2022 to mitigate higher freight costs and wage inflation.

Next Plc’s last close was at GBX 6,752 with a market cap of £8,930 million as of 24 February 2022.

Marks And Spencer Group Plc (LON: MKS)

The retail segment company operates various stores that sell clothes, food, and grocery. It also offers financial products like credit cards and insurance.

The company reported higher clothes and food sales during the last Christmas. Its total UK sales were at £2,999 million, up by 18.6%.

Marks And Spencer Group Plc’s last close was at GBX 172.55 with a market cap of £3,379 million as of 24 February 2022.