Highlights

- An ongoing lorry driver shortage has impacted the UK’s fuel supplies and other related sectors.

- The retail sector has warned that if the shortage is not addressed in the next 10 days Christmas may be impacted.

The UK has simultaneously been grappling with a petrol supply crisis caused by an acute lorry driver shortage and surging gas prices. Moreover, the surge in gas prices is further expected to impact fuel prices.

The lorry driver shortage has been due to a wider supply chain issue, which has been impacting other sectors as well.

The British retail sector recently raised concern and warned the UK government that unless the driver shortage issue is addressed within the next ten days, the sector will face significant disruption ahead of Christmas.

The government stated that the army is highly likely to begin assisting with fuel deliveries this week after the Ministry of Defence approved the official request. Despite the approval, the UK’s business secretary Kwasi Kwarteng stated that the government cannot guarantee if Christmas will not be affected but did say the situation is stabilising.

The next 10 days are critical for the retail sector as the industry usually increases stockpiles and their supplies in the month of October to ensure sufficient inventories for the Christmas season.

UK citizens had resorted to panic-induced stockpiling of petrol last weekend due to the fuel supply crisis.

Let us take a look at 2 AIM listed stocks in the retail sector and how they are performing:

- Boohoo Group PLC (LON: BOO)

FTSE AIM 100 index listed Boohoo is an online fashion retailer. The company released its publication of the international factory list on Monday in order to meet its pledge of ensuring complete transparency of its entire supply chain.

The list contains a total of 1,100 factories in Bangladesh, India, China and several other countries.

Boohoo had pledged to release more information and commit to higher transparency within a year of an independent review.

Also, the company is set to report its interim results on 30 September.

Boohoo’s shares were trading at GBX 267.00, up by 2.65 per cent, on 29 September at 11:32 AM BST. The FTSE AIM 100 index was trading at 6,200.16, up by 0.34 per cent.

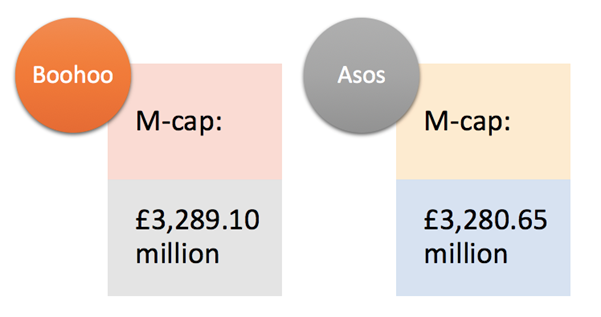

The company’s market cap was at £3,289.10 million as of 29 September 2021.

© 2021 Kalkine Media

- Asos PLC (LON: ASC)

FTSE AIM UK 50 index constituent Asos is UK based online fashion and cosmetic retailer.

The company is planning to set up a new tech hub in Belfast, which will be its permanent base. The company is expected to create 184 jobs over the next three years in Belfast with the latest initiative.

Of the 184 jobs, 52 jobs are expected to be in place in the first year itself. The company plans to invest up to £14 million for the new hub, which is expected to start its operations in 2022.

Asos’ shares were trading at GBX 3,290.00, up by 0.12 per cent, on 29 September at 11:54 AM BST. The FTSE AIM UK 50 index was trading at 6,723.54, up by 0.37 per cent.

The company’s market cap was at £3,280.65 million as of Wednesday.

Bottom Line

The UK trucking body Road Haulage Association (RHA) said that there is a shortage of around 100,000 lorry drivers, especially after 25,000 drivers went back to their home countries post Brexit.

The RHA has called on the government to increase the number of qualifying tests for lorry drivers to meet the driver shortfall.

.jpg)