Summary

- Zanaga Iron Ore Company Limited is having an interest in the Zanaga project in the Republic of Congo

- The Zanaga project is located in the south of Republic of Congo bordering Gabon and is one of the largest known iron ore reserves in the world

- In order to keep the project cost low and maximise the return on capital, the project will be developed in a phased manner

Zanaga Iron Ore Company Limited is a London listed (AIM: ZIOC) iron ore mining development company, having an interest in the Zanaga project in the Republic of Congo, through investment in its associate company Jumelles Limited. The company’s partner in the project is mining major Glencore, which holds 50 per cent plus one share ownership. The Zanaga Iron Ore company holds 50 per cent ownership less one share stake in the project.

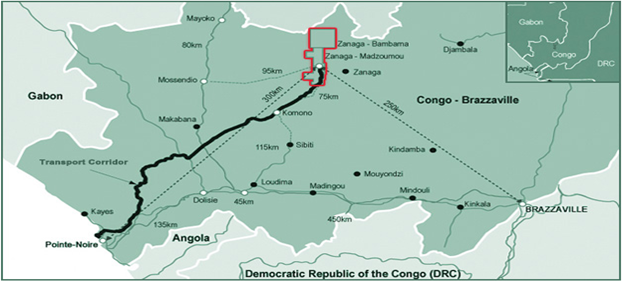

The Zanaga project is located in the south of Republic of Congo bordering Gabon and is one of the largest known iron ore reserves in the world.

Zanaga Project Location

(Image Source - Company Website)

The project holds total ore reserves of 2.07 billion tons of iron ore, out of which 770 million tons are already proven reserves and 1.29 billion tons are probable reserves. The iron ore mine will have a 30-year life and will produce a very high-quality iron ore product grading 66-68.5% Fe with very low impurities, in line with China’s drive to secure higher-grade material with lower environmental impact. This grade of product trades at a significant premium to benchmark iron ore prices.

In order to keep the project cost low and maximise the return on capital, the project will be developed in a phased manner. In the first phase, the development would consist of 12Mtpa of operations, while another 18Mtpa will be added in the second phase, taking the total iron ore to be mined to 30Mtpa. The mined ore will be transported to the ports via a slurry pipeline in both stages to keep the transportation cost at the minimum.

The project has already received its mining licence and an environmental permit from the Republic of Congo, and a mining convention has also been agreed with the government.

The shares of the company are listed on Alternative Investment Market (AIM) segment of London Stock Exchange and are traded under the ticker name ZIOC.

Project’s Current status

- The project is still in its development phase and has not yet started production. The company is currently working with several equipment vendors and support services providers to develop infrastructure for the project.

- On 25 June 2020, the company entered into a share subscription agreement with Shard Merchant Capital Ltd (SMC), an institutional investor for the sale of 21 million shares in no par value, in three trenches of 7 million each. SMC has agreed that it will make all reasonable efforts to place those shares and pay 95 per cent of the proceeds to ZIOC.

- Earlier, in December 2019, the company entered into an agreement with China Overseas Infrastructure Development and Investment Corporation Limited (COIDIC) to bring in necessary funding and technical expertise into the project. COIDIC is a strategic Chinese government backed entity funded by China Development Bank and a number of large Chinese infrastructure development companies.

- The scope of the agreement included both funding and infrastructure development as well as taping into other future opportunities that might arise from the project. The company had expressed its intention to use the funding raised to finance the development of the first stage of the project and finance the second phase of the project with the accrued earnings from the sale of iron ore from the first phase.

What makes Zanaga Iron Ore company a standout

- The company has an interest in one of the largest Iron ore reserves in the world. The mine life is estimated at 30 years, as per the current assessment of the iron ore content in the mine. It is highly probable that over a period of time when mining commences more reserves could be discovered.

- The partner of the company on this project is Glencore. The association with Glencore will give Zanaga Iron Ore company access to the largest customers of iron ore in the world and also access to a strong management base coupled with high profile investors.

- A strong mining ecosystem in the Republic of Congo. Most of the land acquisition done in the country be it the acquisition of mines, land for infrastructure or pipeline were all procured from the government with less hassle and no private owner negotiations.

Iron Ore markets in the Long term

- The long-term prospect for iron ore is very promising. The high growth rates being witnessed in several of the African and Asian Countries will translate into increased demand for iron ore.

- China is actively intensifying its drive to secure natural resource supply and reduce its reliance on Australian and Brazilian iron ore. Numerous government institutions have recently stated that China will now look to strategically invest in African iron ore projects, making Zanaga a primary target as it is one of the largest and highest quality iron ore projects in Africa.

- The company intends to produce a very high-grade iron ore pellet feed product, which will be used to make iron ore pellets. This aligns with China’s strategy to build extensive pelletisation capacity and lower its environmental footprint.

The share price movement of Zanaga Iron Ore Company Ltd on the London Stock Exchange

On 29 July 2020 at the time of writing (15:09 PM GMT) the shares of ZIOC were trading at GBX 6.20. The 52-week high/low of the stock was reported at GBX 12.93 and GBX 3.21, respectively. The current market capitalisation of the company stood at £19.98 million.

Conclusion

The current management of the company consists of highly experienced professionals who have decades of experience in world-class mining and exploration companies like Anglo American Plc, De Beers and BHP Billiton. Apart from this, the company also enjoys the management supervision of its majority partner in the project Glencore, which gives it a strong base to explore future high growth and value creation opportunities. COIDIC and Jumelles (the joint venture company between ZIOC and Glencore) intend to explore solutions regarding the Zanaga Project and its related infrastructure projects. The company has also got the advantage of association with “Yantai Port” (an experienced Chinese operator in Africa), which has been introduced to the Zanaga Project as per the Framework Agreement with COIDIC. Overall, the company has been progressing well in unlocking the logistical challenges associated with both the 30Mtpa project and the EPP Project, and further value enhancement can be expected in the second half of the fiscal year.